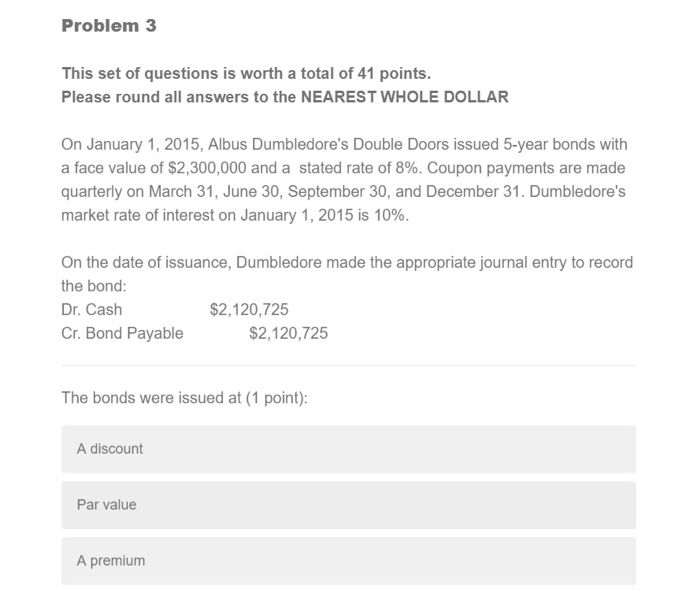

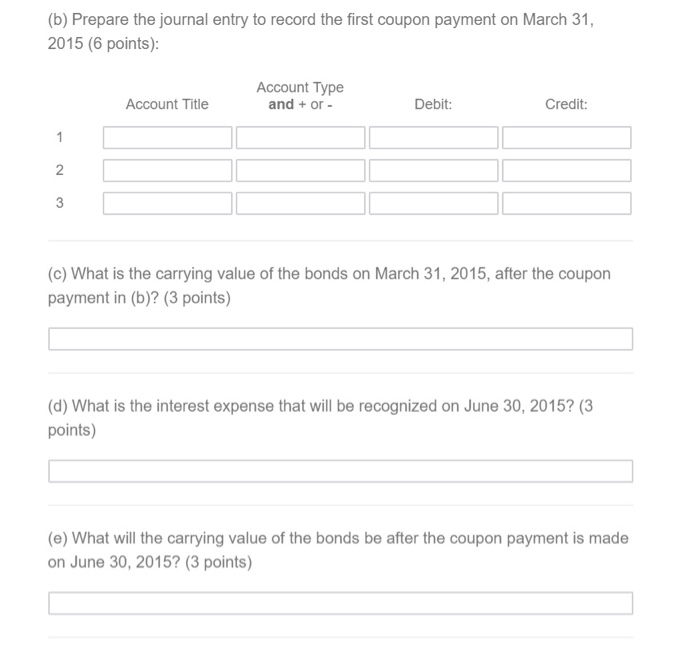

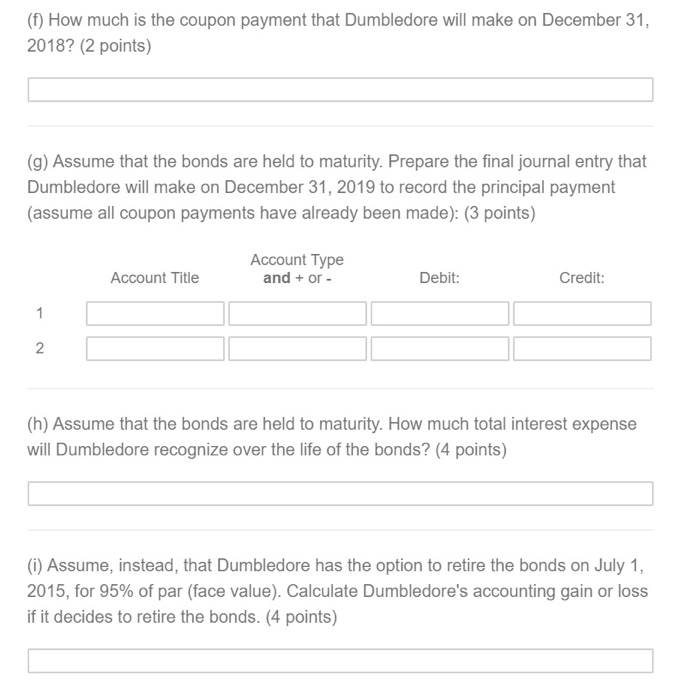

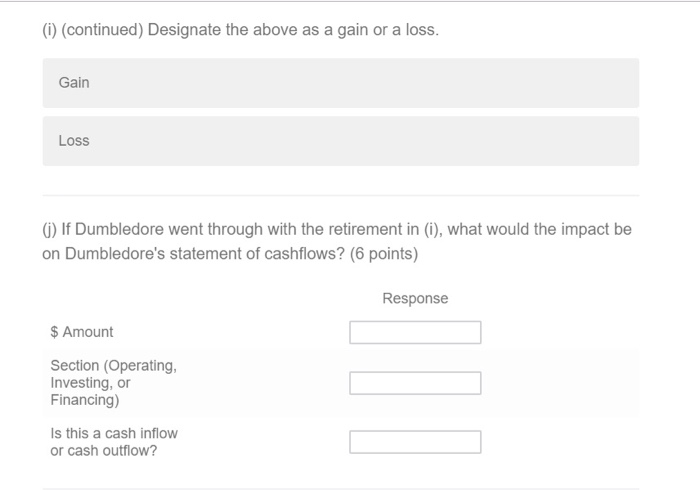

Problem 3 This set of questions is worth a total of 41 points. Please round all answers to the NEAREST WHOLE DOLLAR On January 1, 2015, Albus Dumbledore's Double Doors issued 5-year bonds with a face value of $2,300,000 and a stated rate of 8%. Coupon payments are made quarterly on March 31, June 30, September 30, and December 31. Dumbledore's market rate of interest on January 1, 2015 is 10%. On the date of issuance, Dumbledore made the appropriate journal entry to record the bond: Dr. Cash $2,120,725 Cr. Bond Payable $2,120,725 The bonds were issued at (1 point): A discount Par value A premium (b) Prepare the journal entry to record the first coupon payment on March 31, 2015 (6 points) Account Type and + or - Account Title Debit: Credit: 1 (c) What is the carrying value of the bonds on March 31, 2015, after the coupon payment in (b)? (3 points) (d) What is the interest expense that will be recognized on June 30, 2015? (3 points) (e) What will the carrying value of the bonds be after the coupon payment is made on June 30, 2015? (3 points) (f) How much is the coupon payment that Dumbledore will make on December 31, 2018? (2 points) (g) Assume that the bonds are held to maturity. Prepare the final journal entry that Dumbledore will make on December 31, 2019 to record the principal payment (assume all coupon payments have already been made): (3 points) Account Title Account Type and + or - Debit: Credit: (h) Assume that the bonds are held to maturity. How much total interest expense will Dumbledore recognize over the life of the bonds? (4 points) (i) Assume, instead, that Dumbledore has the option to retire the bonds on July 1, 2015, for 95% of par (face value). Calculate Dumbledore's accounting gain or loss if it decides to retire the bonds. (4 points) (i) (continued) Designate the above as a gain or a loss. Gain Loss () If Dumbledore went through with the retirement in (i), what would the impact be on Dumbledore's statement of cashflows? (6 points) Response $ Amount Section (Operating, Investing, or Financing) Is this a cash inflow or cash outflow