Answered step by step

Verified Expert Solution

Question

1 Approved Answer

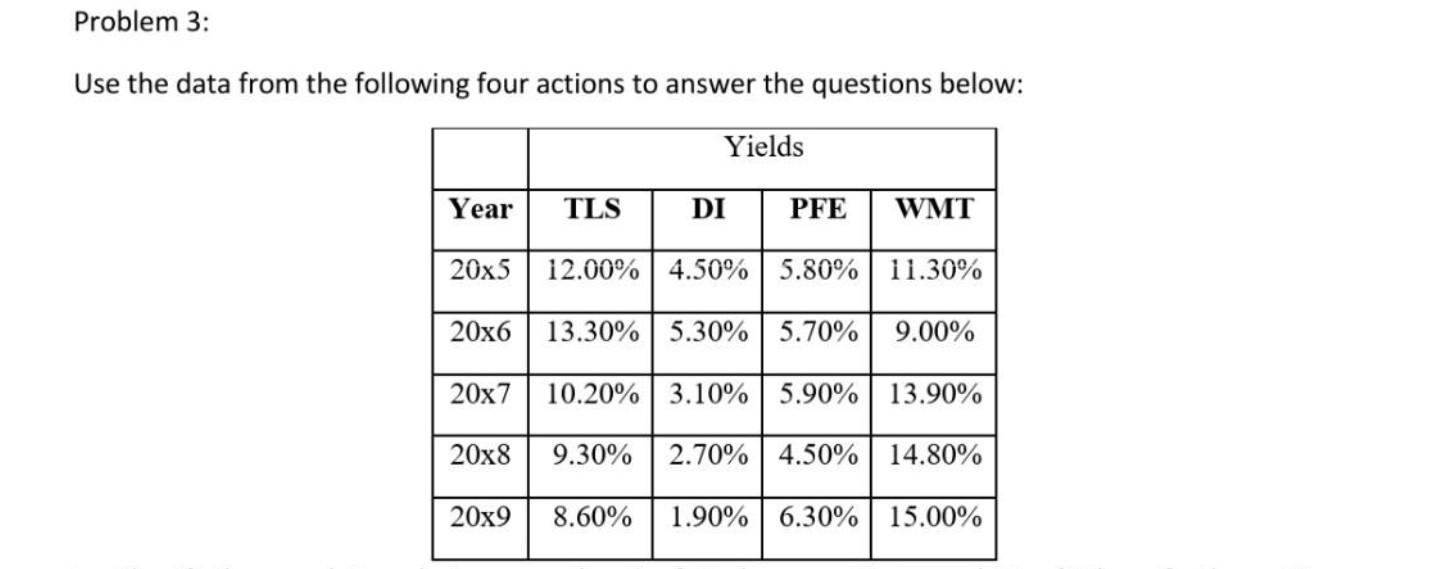

Problem 3: Use the data from the following four actions to answer the questions below: Yields Year TLS DI PFE WMT 20x5 12.00% 4.50% 5.80%

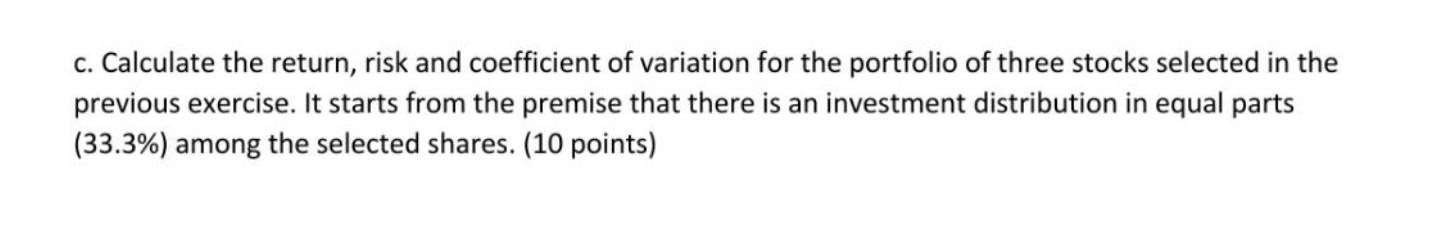

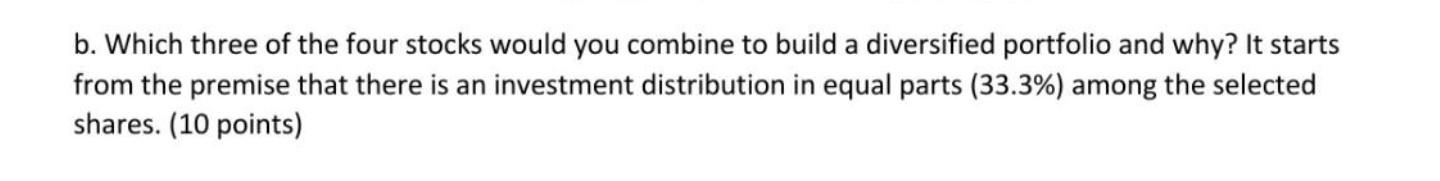

Problem 3: Use the data from the following four actions to answer the questions below: Yields Year TLS DI PFE WMT 20x5 12.00% 4.50% 5.80% 11.30% 20x613.30% 5.30% 5.70% 9.00% 20x7 10.20% 3.10% 5.90% 13.90% 20x8 9.30% 2.70% 4.50% | 14.80% 20x9 8.60% 1.90% 6.30% 15.00% c. Calculate the return, risk and coefficient of variation for the portfolio of three stocks selected in the previous exercise. It starts from the premise that there is an investment distribution in equal parts (33.3%) among the selected shares. (10 points) b. Which three of the four stocks would you combine to build a diversified portfolio and why? It starts from the premise that there is an investment distribution in equal parts (33.3%) among the selected shares. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started