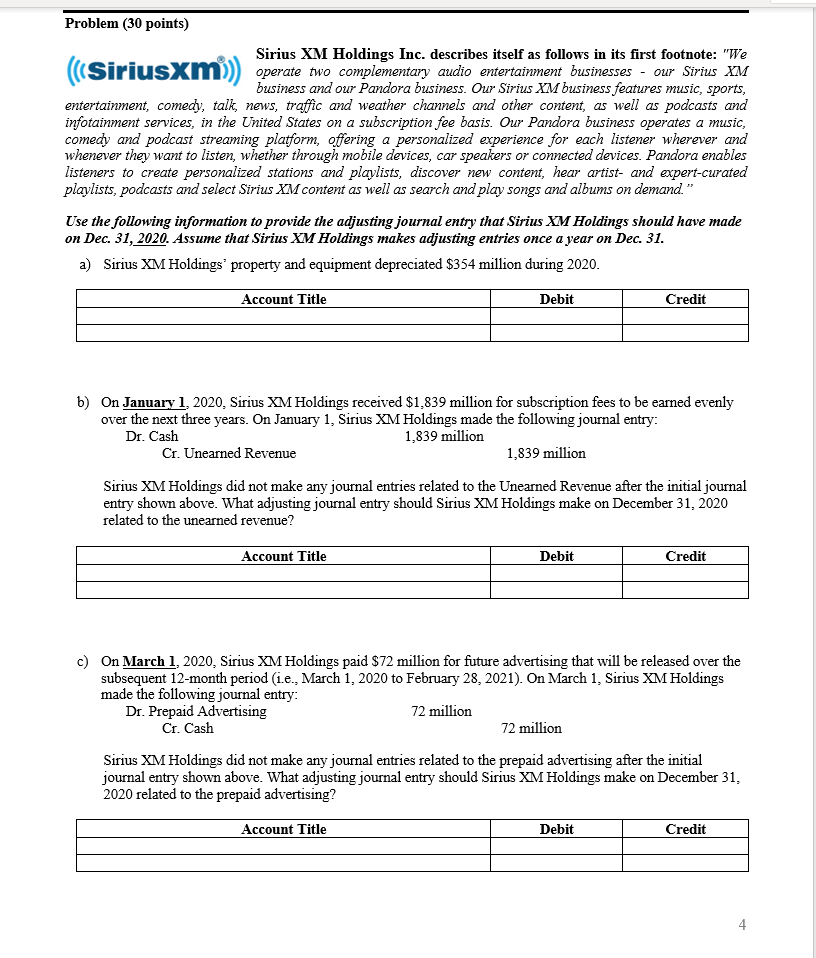

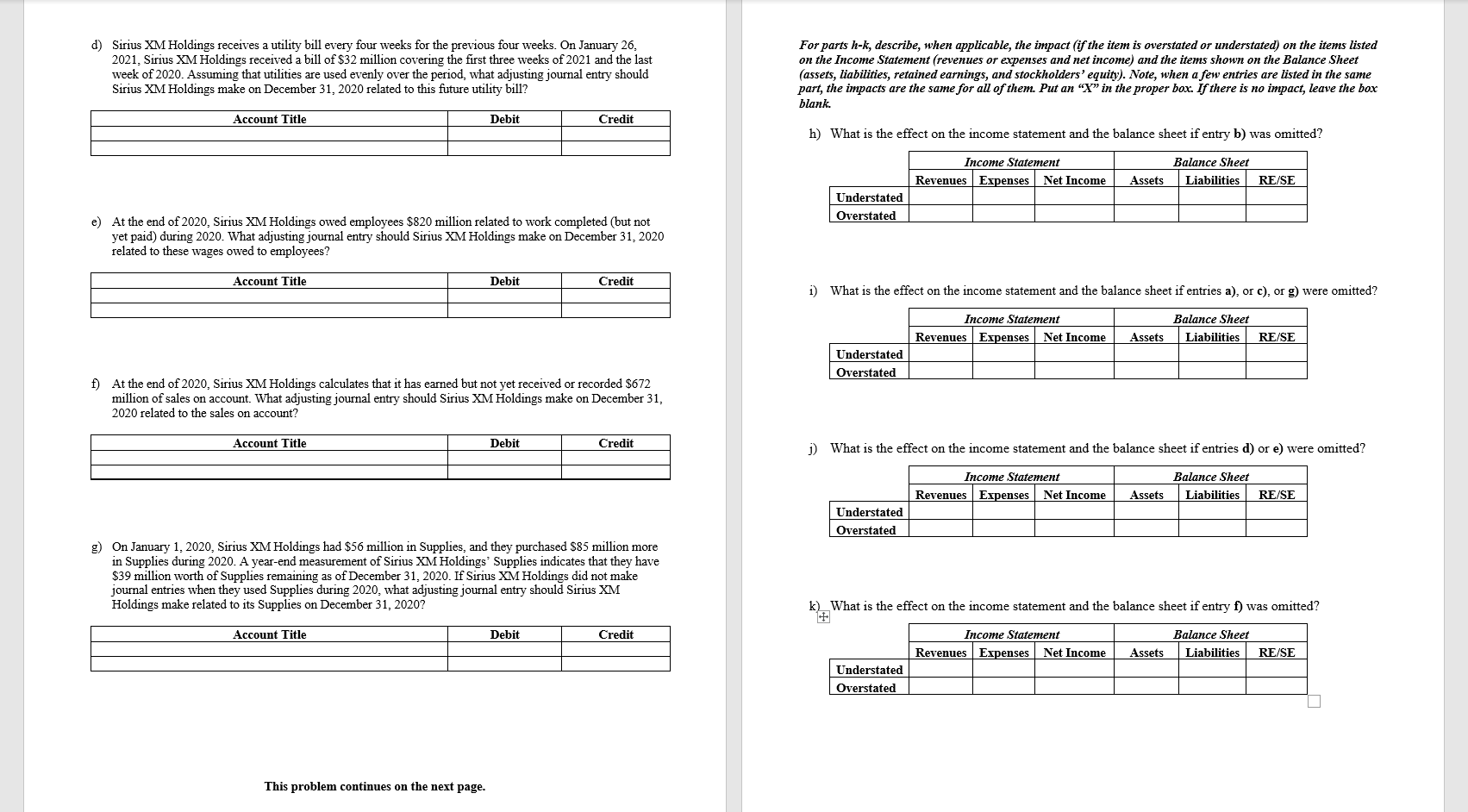

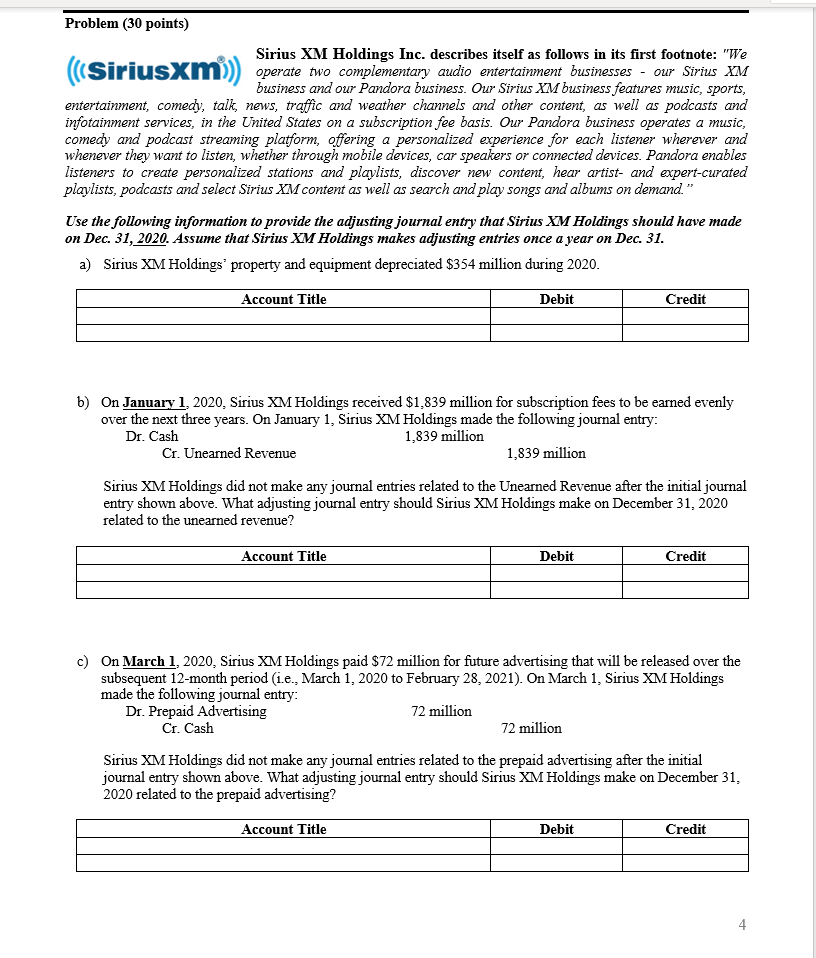

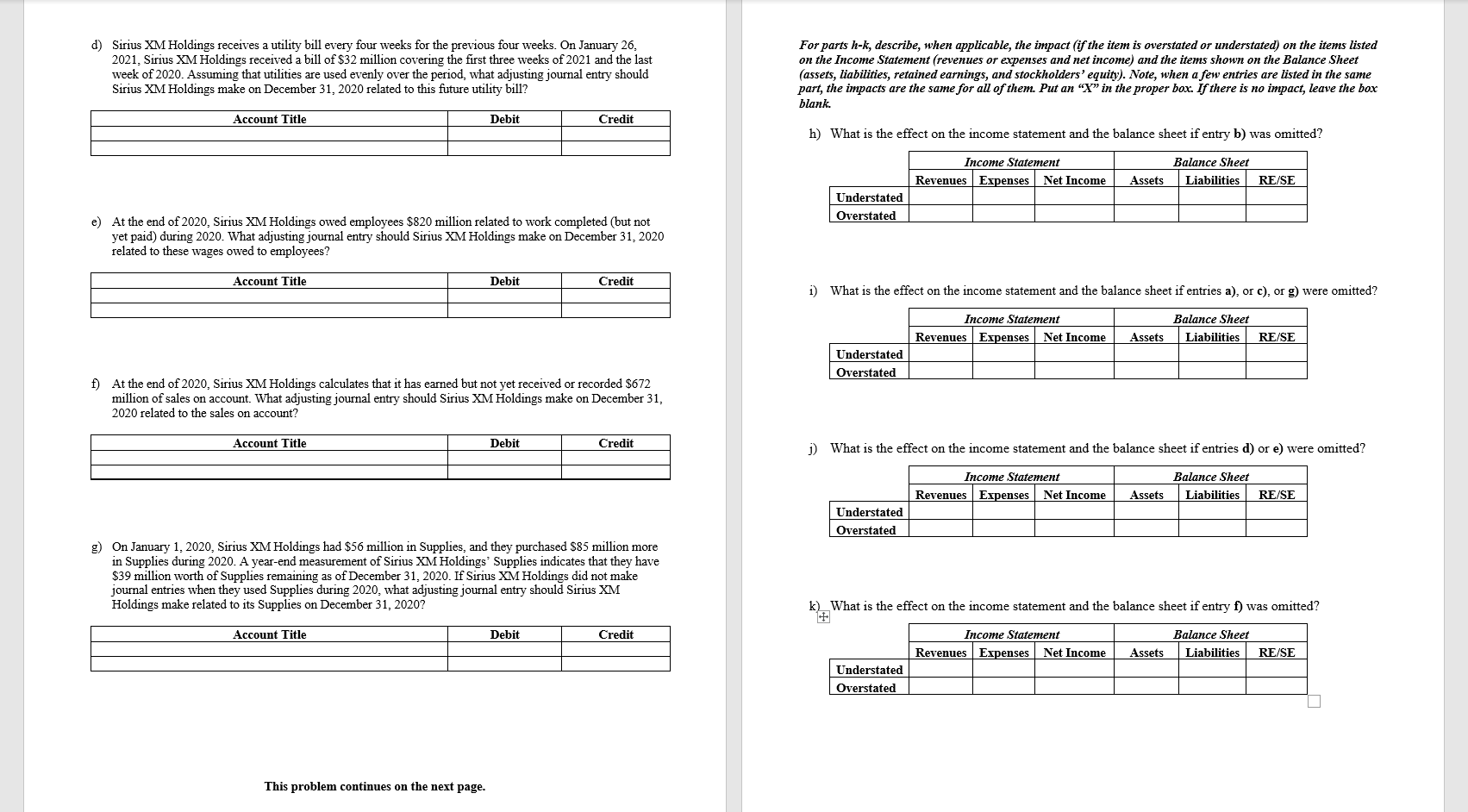

Problem (30 points) "We (((SiriusXm) operate two complementary audio entertainment businesses - our Sirius XM business and our Pandora business. Our Sirius XM business features music, sports, entertainment, comedy, talk, news, traffic and weather channels and other content, as well as podcasts and infotainment services, in the United States on a subscription fee basis. Our Pandora business operates a music, comedy and podcast streaming platform, offering a personalized experience for each listener wherever and whenever they want to listen, whether through mobile devices, car speakers or connected devices. Pandora enables listeners to create personalized stations and playlists, discover new content, hear artist- and expert-curated playlists, podcasts and select Sirius XM content as well as search and play songs and albums on demand." Use the following information to provide the adjusting journal entry that Sirius XM Holdings should have made on Dec. 31, 2020. Assume that Sirius XM Holdings makes adjusting entries once a year on Dec. 31. a) SiriusXM Holdings property and equipment depreciated $354 million during 2020. Account Title Debit Credit b) On January 1, 2020, SiriusXM Holdings received $1,839 million for subscription fees to be earned evenly over the next three years. On January 1, Sirius XM Holdings made the following journal entry: Dr. Cash 1,839 million Cr. Unearned Revenue 1,839 million Sirius XM Holdings did not make any journal entries related to the Unearned Revenue after the initial journal entry shown above. What adjusting journal entry should Sirius XM Holdings make on December 31, 2020 related to the unearned revenue? Account Title Debit Credit c) On March 1, 2020, SiriusXM Holdings paid $72 million for future advertising that will be released over the subsequent 12-month period (.e., March 1, 2020 to February 28, 2021). On March 1, Sirius XM Holdings made the following journal entry: Dr. Prepaid Advertising 72 million Cr. Cash 72 million Sirius XM Holdings did not make any journal entries related to the prepaid advertising after the initial journal entry shown above. What adjusting journal entry should Sirius XM Holdings make on December 31, 2020 related to the prepaid advertising? Account Title Debit Credit 4 d) Sirius XM Holdings receives a utility bill every four weeks for the previous four weeks. On January 26, 2021, Sirius XM Holdings received a bill of $32 million covering the first three weeks of 2021 and the last week of 2020. Assuming that utilities are used evenly over the period, what adjusting journal entry should Sirius XM Holdings make on December 31, 2020 related to this future utility bill? For parts h-k, describe, when applicable, the impact (if the item is overstated or understated) on the items listed on the Income Statement (revenues or expenses and net income) and the items shown on the Balance Sheet (assets, liabilities, retained earnings, and stockholders' equity). Note, when a few entries are listed in the same part, the impacts are the same for all of them. Put an "Y" in the proper box. If there is no impact, leave the box blank Account Title Debit Credit h) What is the effect on the income statement and the balance sheet if entry b) was omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated e) At the end of 2020, Sirius XM Holdings owed employees $820 million related to work completed (but not yet paid) during 2020. What adjusting journal entry should Sirius XM Holdings make on December 31, 2020 related to these wages owed to employees? Account Title Debit Credit i) What is the effect on the income statement and the balance sheet if entries a), or c), or g) were omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated f) At the end of 2020, Sirius XM Holdings calculates that it has earned but not yet received or recorded $672 million of sales on account. What adjusting journal entry should Sirius XM Holdings make on December 31, 2020 related to the sales on account? Account Title Debit Credit 1) What is the effect on the income statement and the balance sheet if entries d) or e) were omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated g) On January 1, 2020, SiriusXM Holdings had $56 million in Supplies, and they purchased $85 million more in Supplies during 2020. A year-end measurement of Sirius XM Holdings Supplies indicates that they have $39 million worth of Supplies remaining as of December 31, 2020. If Sirius XM Holdings did not make journal entries when they used Supplies during 2020, what adjusting journal entry should Sirius XM Holdings make related to its Supplies on December 31, 2020? k) What is the effect on the income statement and the balance sheet if entry f) was omitted? Account Title Debit Credit Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated This problem continues on the next page