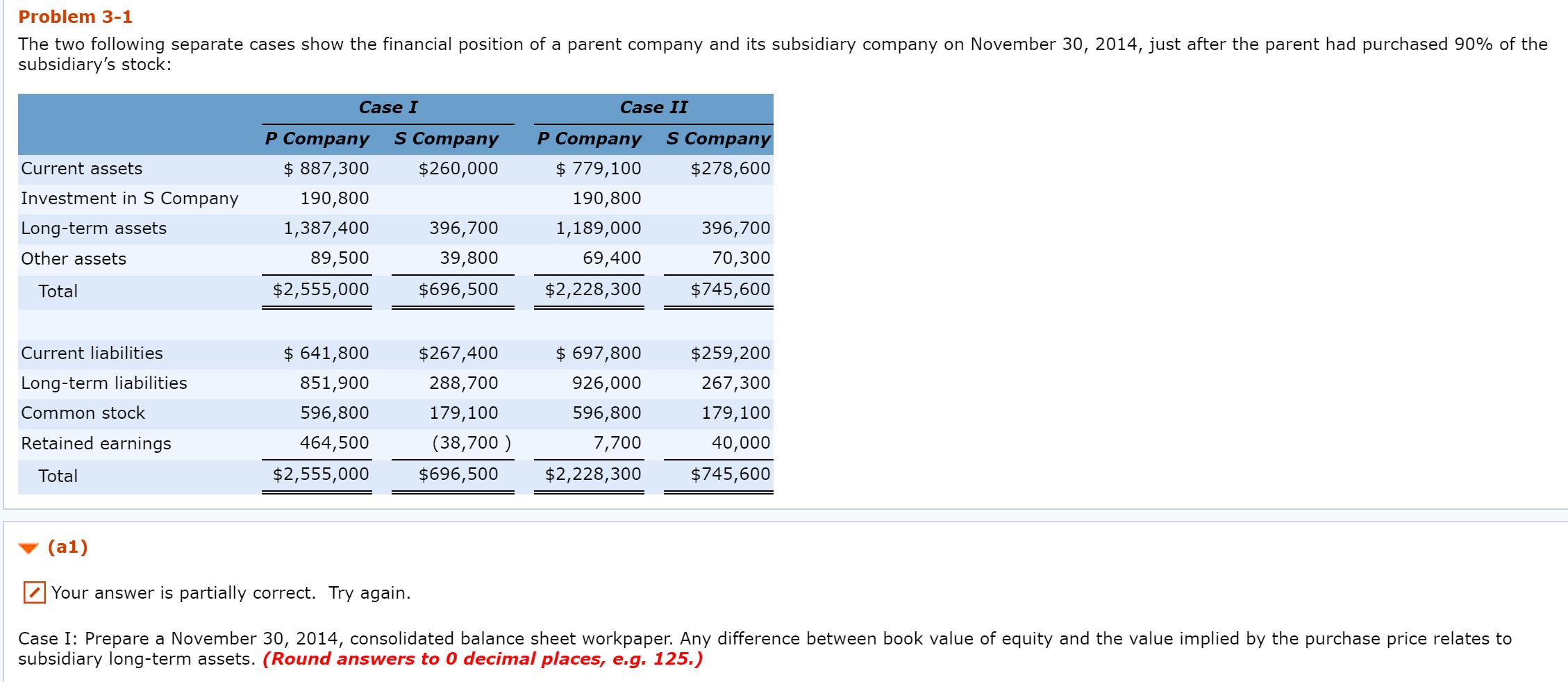

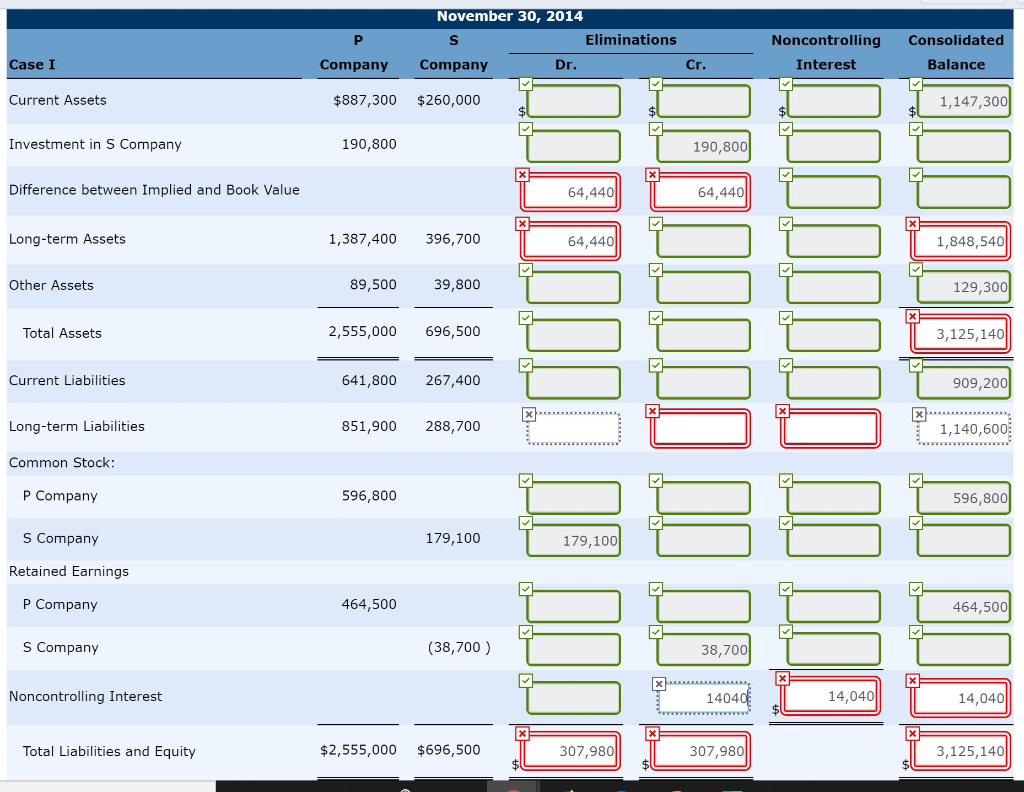

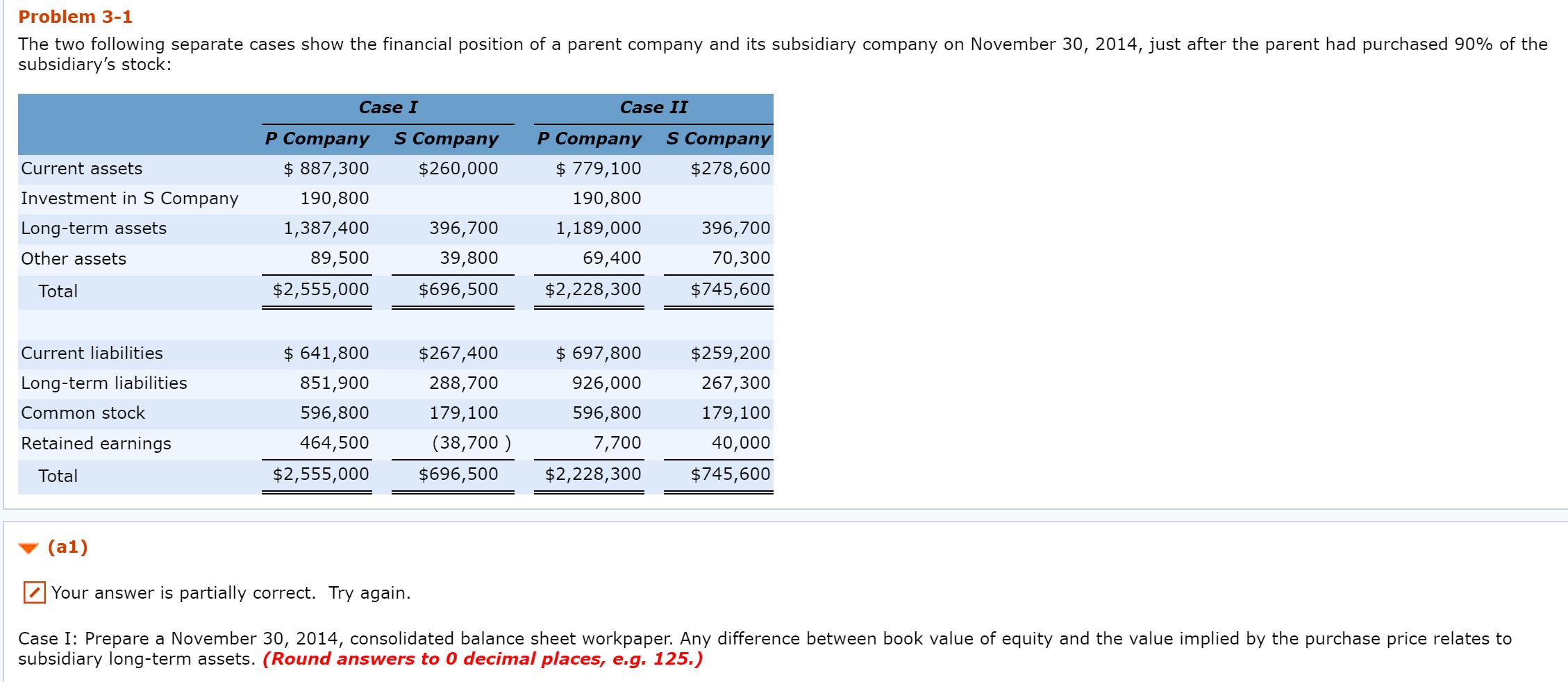

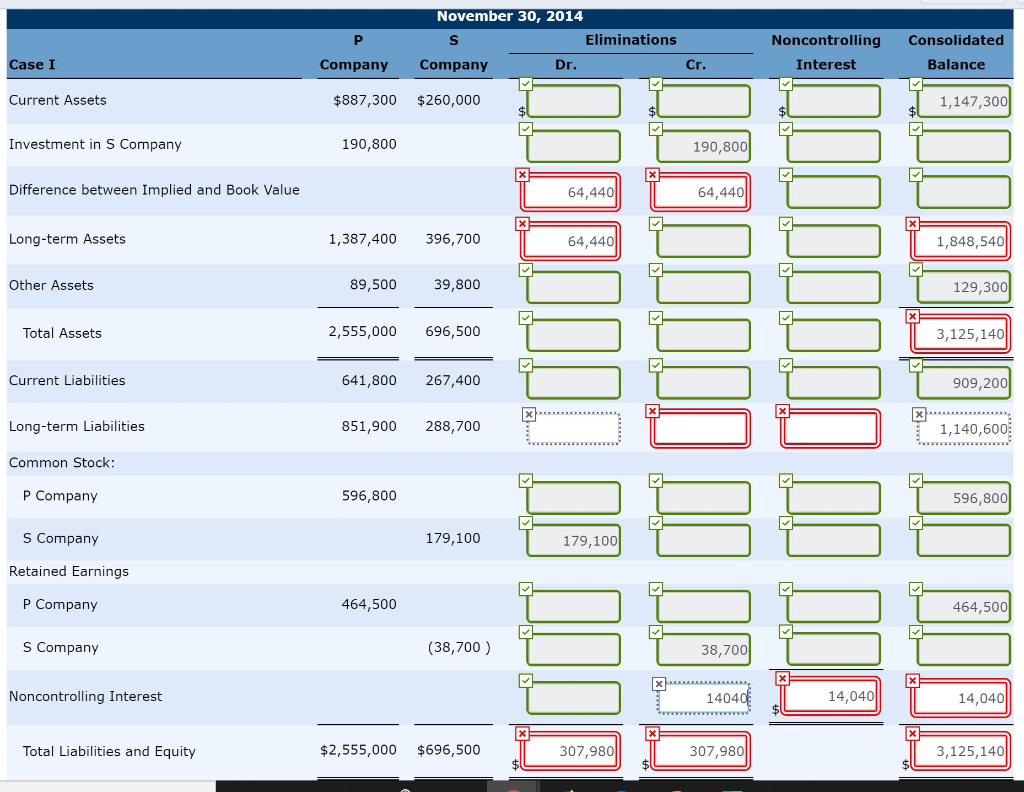

Problem 3-1 The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary's stock: Case I Case II S Company Company S Company P Company $ 887,300 Current assets $260,000 $779,100 $278,600 Investment in S Company 190,800 190,800 1,387,400 Long-term assets 396,700 1,189,000 396,700 Other assets 89,500 39,800 69,400 70,300 $745,600 $2,555,000 $696,500 $2,228,300 Total $ 641,800 $267,400 $697,800 Current liabilities $259,200 851,900 926,000 Long-term liabilities 288,700 267,300 Common stock 596,800 596,800 179,100 179,100 Retained earnings (38,700) 7,700 40,000 464,500 $745,600 $2,555,000 $696,500 $2,228,300 Total (a1) Your answer is partially correct. Try again. Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to 0 decimal places, e.g. 125.) November 30, 2014 Eliminations Noncontrolling Consolidated Case I Company Company Cr. Interest Balance Dr. 1,147,300 Current Assets $887,300 $260,000 Investment in S Company 190,800 190,800 Difference between Implied and Book Value 64,440 64,440 396,700 Long-term Assets 64,440 1,387,400 1,848,540 Other Assets 89,500 39,800 129,300 2,555,000 696,500 3,125,140 Total Assets 267,400 909,200 Current Liabilities 641,800 288,700 Long-term Liabilities 851,900 1,140,600 Common Stock: 596,800 P Company 596,800 S Company 179,100 179,100 Retained Earnings P Company 464,500 464,500 S Company (38,700) 38,700 14040 14,040 14,040 Noncontrolling Interest 307,980 307,980 3,125,140 Total Liabilities and Equity $2,555,000 $696,500 Problem 3-1 The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary's stock: Case I Case II S Company Company S Company P Company $ 887,300 Current assets $260,000 $779,100 $278,600 Investment in S Company 190,800 190,800 1,387,400 Long-term assets 396,700 1,189,000 396,700 Other assets 89,500 39,800 69,400 70,300 $745,600 $2,555,000 $696,500 $2,228,300 Total $ 641,800 $267,400 $697,800 Current liabilities $259,200 851,900 926,000 Long-term liabilities 288,700 267,300 Common stock 596,800 596,800 179,100 179,100 Retained earnings (38,700) 7,700 40,000 464,500 $745,600 $2,555,000 $696,500 $2,228,300 Total (a1) Your answer is partially correct. Try again. Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to 0 decimal places, e.g. 125.) November 30, 2014 Eliminations Noncontrolling Consolidated Case I Company Company Cr. Interest Balance Dr. 1,147,300 Current Assets $887,300 $260,000 Investment in S Company 190,800 190,800 Difference between Implied and Book Value 64,440 64,440 396,700 Long-term Assets 64,440 1,387,400 1,848,540 Other Assets 89,500 39,800 129,300 2,555,000 696,500 3,125,140 Total Assets 267,400 909,200 Current Liabilities 641,800 288,700 Long-term Liabilities 851,900 1,140,600 Common Stock: 596,800 P Company 596,800 S Company 179,100 179,100 Retained Earnings P Company 464,500 464,500 S Company (38,700) 38,700 14040 14,040 14,040 Noncontrolling Interest 307,980 307,980 3,125,140 Total Liabilities and Equity $2,555,000 $696,500