problem 3-17

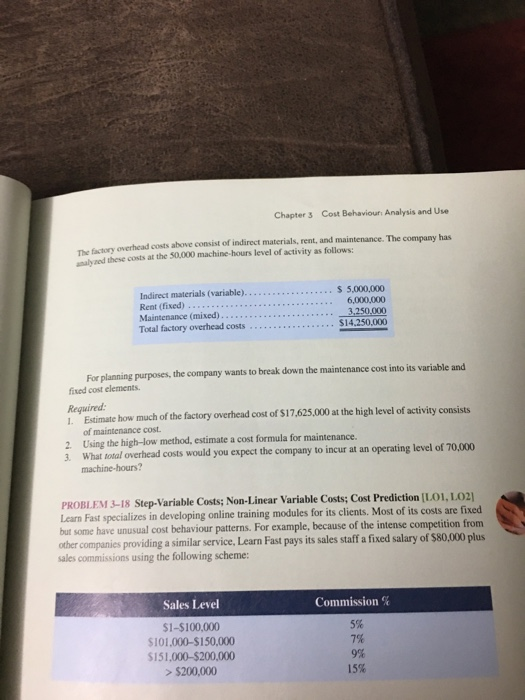

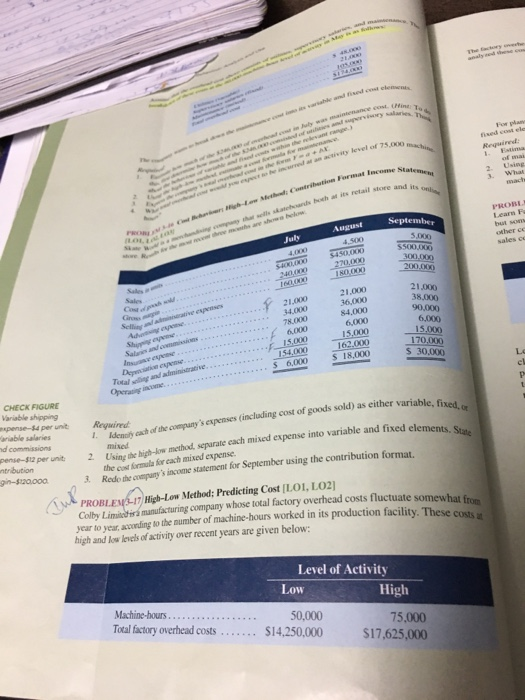

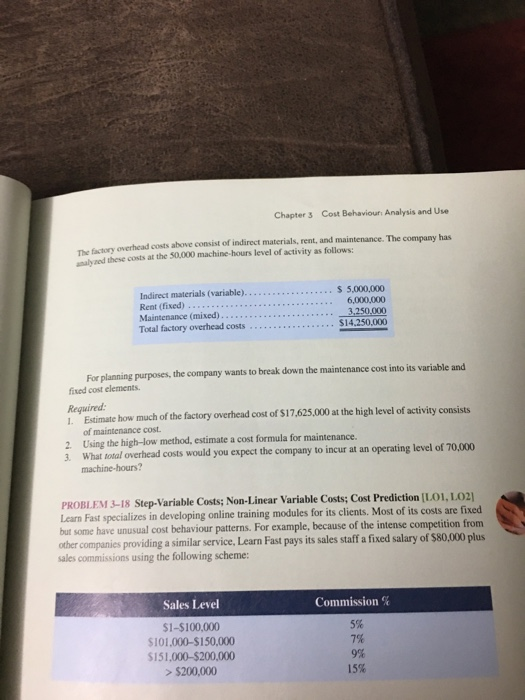

. w d ele level of 75 .AL at ww w w Income Stateme retail store and its PRON September LOL July others sales 4.500 SESOCO 2700 S500 300.000 200.000 CERTO 21.000) 38.000 90.000 6.000 15.000 170,000 $ 30,000 21.000 36.000 84.000 6.000 15.000 162.00 S 18.000 Selling Shi Sala $ 6,000 Tiada variable, fixed. Required fixed elements. Stue CHECK FIGURE Variable shipping pense- per unit penses (including cost of goods sold) as either variable ariable salaries death of the company expenses (includ nd commissions mixed pense-512 per unit 2 Using the high- method. separate cach mixed expense into variable and fixed elemen tribution the cost formule for each mixed expense. gin-$120.000 3 Rede de c y's income statement for September using the contribution format PROBLEMI High-Low Method: Predicting Cost LOI, LO2 Colby Lim u nufacturing company whose total factory overhead costs fluctuate somewhat year to year wording to the number of machine-hours worked in its production facility. These high and low levels of activity over recent years are given below: its production facility. These costs a Level of Activity Low High Machine-hours.................. 50,000 75,000 Total factory overhead costs ....... $14,250,000 $17,625,000 Chapter 3 Cost Behaviour: Analysis and Use ory overhead costs above consist of indirect materials, rent, and maintenance. The company has ed these costs at the 50.000 machine-hours level of activity as follows: Indirect materials (variable). ............. Rent (fixed) .......... Maintenance (mixed)... Total factory overhead costs .. $ 5,000,000 6,000,000 3,250.000 $14.250.000 For planning purposes, the company wants to break down the maintenance cost into its variable and fined cost elements Required: 1. Estimate how much of the factory overhead cost of $17,625,000 at the high level of activity consists of maintenance cost. 2. Using the high-low method, estimate a cost formula for maintenance. 3 What total overhead costs would you expect the company to incur at an operating level of 70,000 machine-hours? PROBLEM 3-18 Step-Variable Costs: Non-Linear Variable Costs; Cost Prediction [LOI, LO2] Learn Fast specializes in developing online training modules for its clients. Most of its costs are fixed but some have unusual cost behaviour patterns. For example, because of the intense competition from other companies providing a similar service, Learn Fast pays its sales staff a fixed salary of $80,000 plus sales commissions using the following scheme: Commission 5% Sales Level $1-$100,000 S101.000-$150,000 S151,000-$200,000 >$200,000 99% 15%

problem 3-17

problem 3-17