Answered step by step

Verified Expert Solution

Question

1 Approved Answer

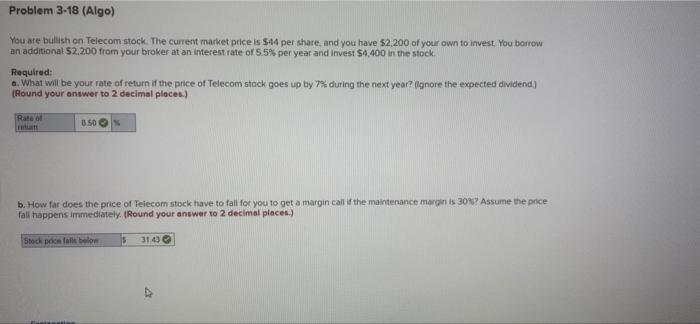

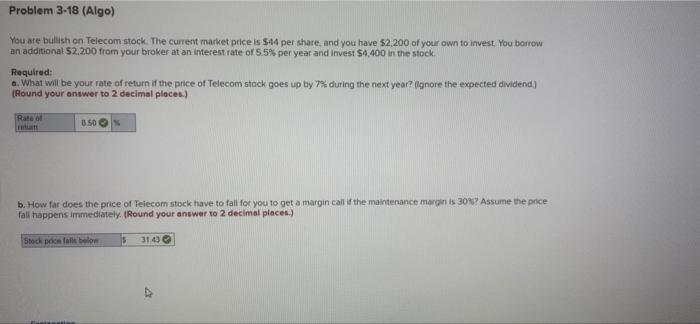

Problem 3-18 (Algo) You are bullish on Telecom stock. The current market price is 544 per share, and you have $2,200 of your own to

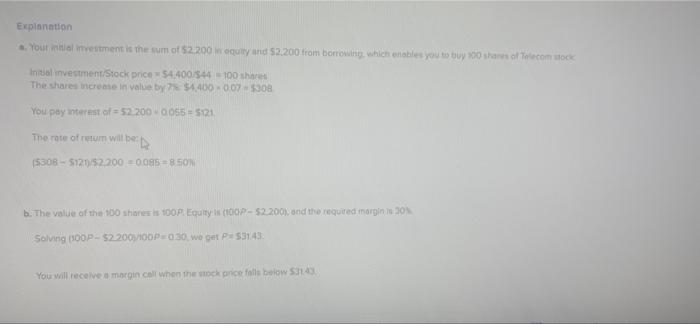

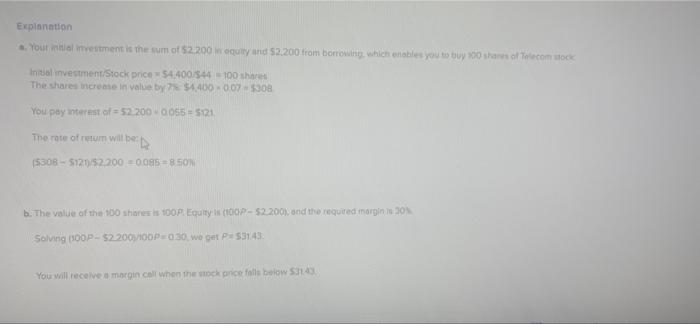

Problem 3-18 (Algo) You are bullish on Telecom stock. The current market price is 544 per share, and you have $2,200 of your own to invest. You borrow an additional $2.200 from your broker at an interest rate of 5.5% per year and invest $4,400 in the stock Required: What will be your rate of return if the price of Telecom stock goes up by 7% during the next year? (ignore the expected dividend) (Round your answer to 2 decimal places.) Rate of 3.50 b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance marginis 301 Assume the price fall happens immediately. (Round your answer to 2 decimal places.) Stock pocetale bolo 33140 Explanation .. Your livestment is the sum of 52 200 qarty and $2.200 from borrowing, which enables you to buy shares of Telecom dock Initial investment/Stock price 54.400/544 =100 h The shares income in value by $4.4000075308 You pay interest of = 52 2000055 = 5121 The rate of return will be 15308 - 512052200 = 0095=8 SOM b. The value of the 100 shares is oor Equity OP-52 2001, and the required marginin 30 Solving (100P - $22001/P=030, we get P-53143 You will receive a marginal when the rock falls below Sh14

Problem 3-18 (Algo) You are bullish on Telecom stock. The current market price is 544 per share, and you have $2,200 of your own to invest. You borrow an additional $2.200 from your broker at an interest rate of 5.5% per year and invest $4,400 in the stock Required: What will be your rate of return if the price of Telecom stock goes up by 7% during the next year? (ignore the expected dividend) (Round your answer to 2 decimal places.) Rate of 3.50 b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance marginis 301 Assume the price fall happens immediately. (Round your answer to 2 decimal places.) Stock pocetale bolo 33140 Explanation .. Your livestment is the sum of 52 200 qarty and $2.200 from borrowing, which enables you to buy shares of Telecom dock Initial investment/Stock price 54.400/544 =100 h The shares income in value by $4.4000075308 You pay interest of = 52 2000055 = 5121 The rate of return will be 15308 - 512052200 = 0095=8 SOM b. The value of the 100 shares is oor Equity OP-52 2001, and the required marginin 30 Solving (100P - $22001/P=030, we get P-53143 You will receive a marginal when the rock falls below Sh14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started