Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 32: Pam and Drix formed a partnership in 20x1 to operate a bookkeeping services. Pam contributed the initial capital while Drix managed the

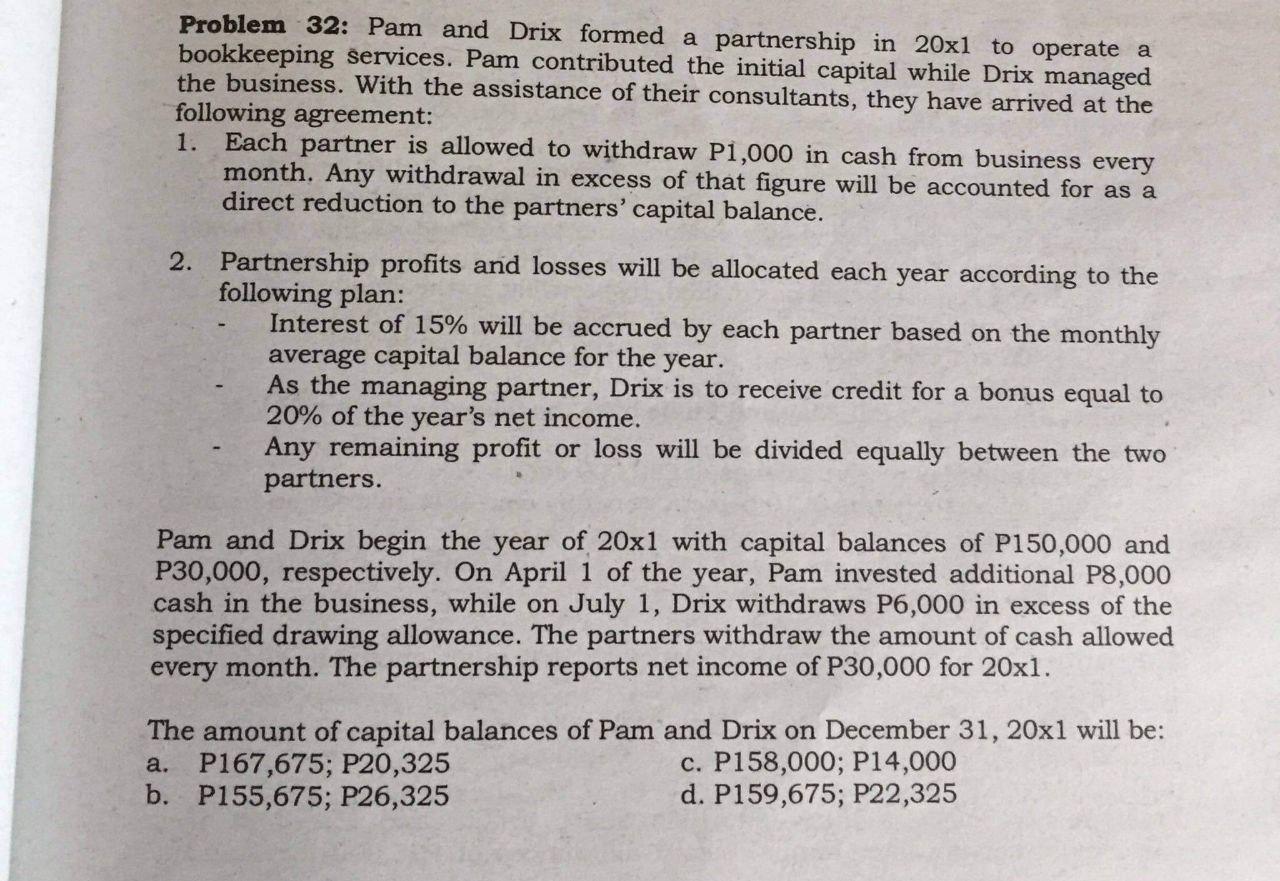

Problem 32: Pam and Drix formed a partnership in 20x1 to operate a bookkeeping services. Pam contributed the initial capital while Drix managed the business. With the assistance of their consultants, they have arrived at the following agreement: 1. Each partner is allowed to withdraw P1,000 in cash from business every month. Any withdrawal in excess of that figure will be accounted for as a direct reduction to the partners' capital balance. 2. Partnership profits and losses will be allocated each year according to the following plan: Interest of 15% will be accrued by each partner based on the monthly average capital balance for the year. As the managing partner, Drix is to receive credit for a bonus equal to 20% of the year's net income. Any remaining profit or loss will be divided equally between the two partners. Pam and Drix begin the year of 20x1 with capital balances of P150,000 and P30,000, respectively. On April 1 of the year, Pam invested additional P8,000 cash in the business, while on July 1, Drix withdraws P6,000 in excess of the specified drawing allowance. The partners withdraw the amount of cash allowed every month. The partnership reports net income of P30,000 for 20x1. The amount of capital balances of Pam and Drix on December 31, 20x1 will be: a. P167,675; P20,325 c. P158,000; P14,000 d. P159,675; P22,325 b. P155,675; P26,325

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started