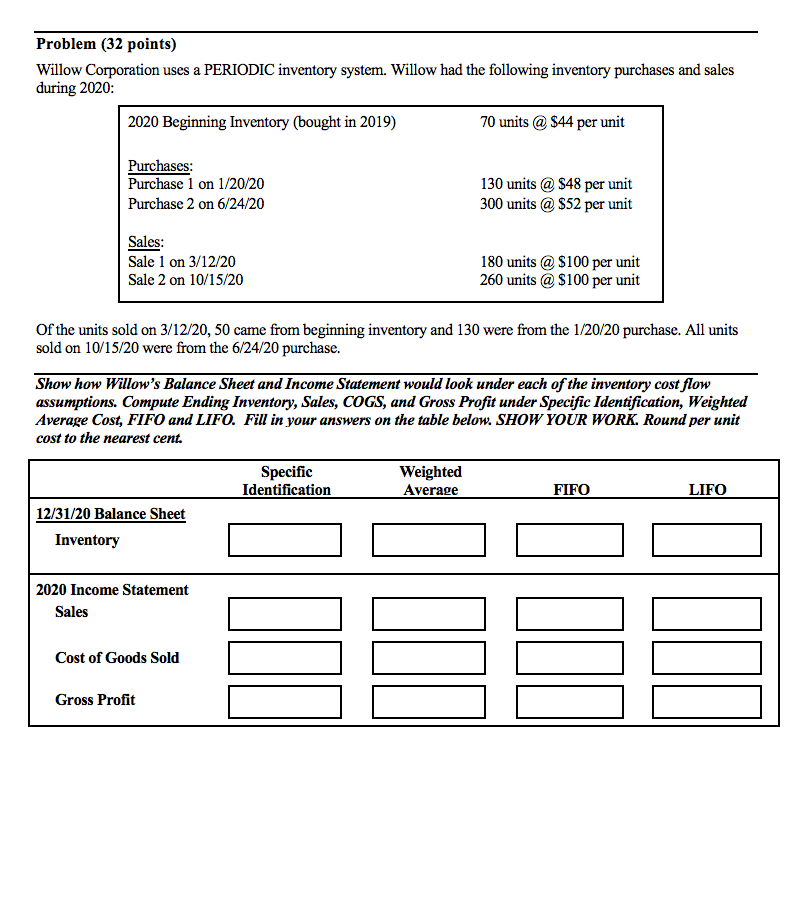

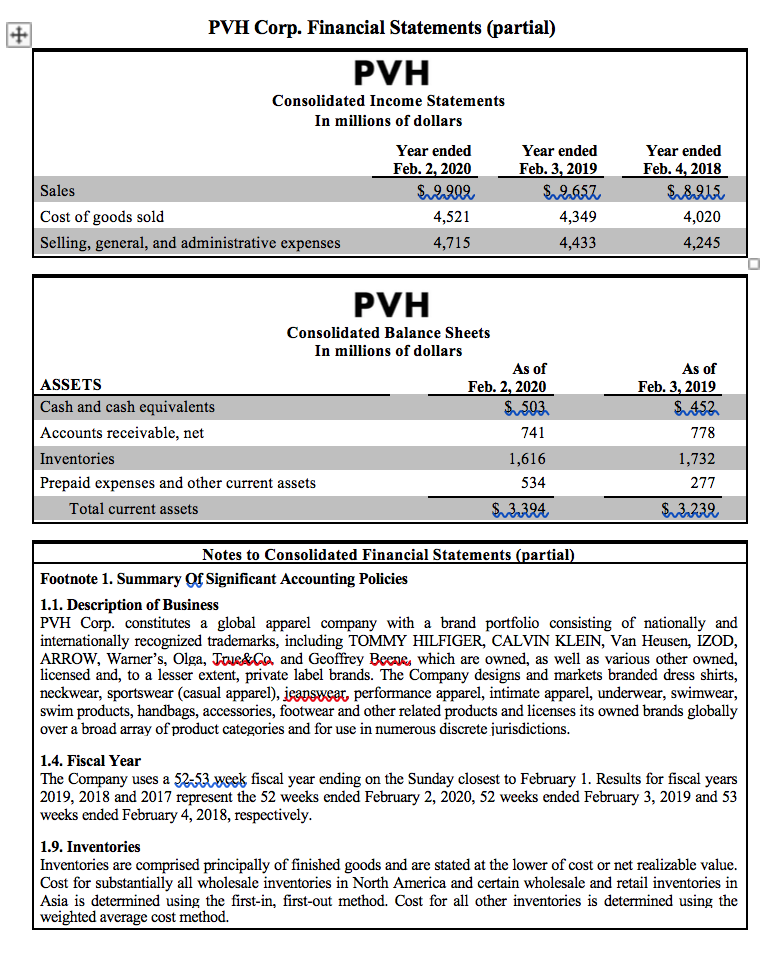

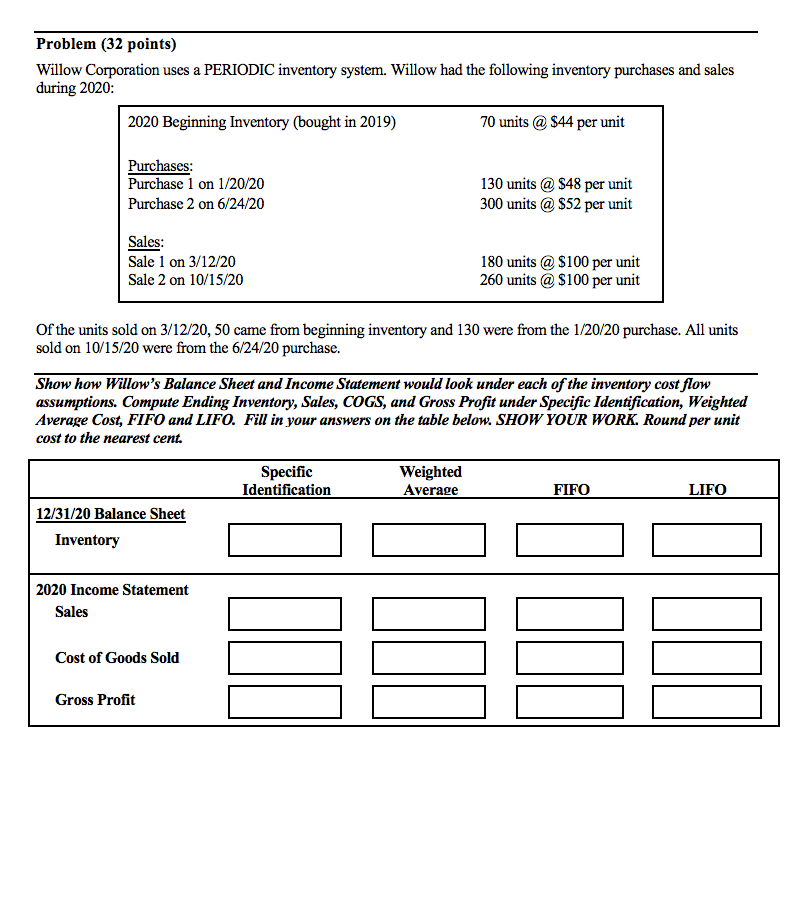

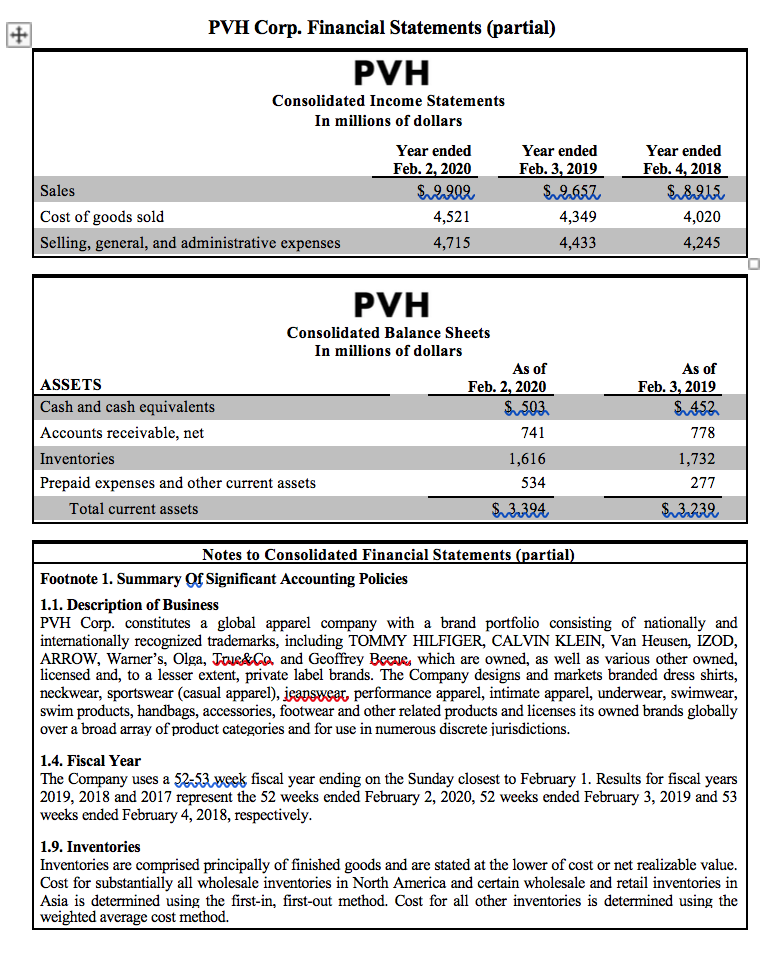

Problem (32 points) Willow Corporation uses a PERIODIC inventory system. Willow had the following inventory purchases and sales during 2020: 2020 Beginning Inventory (bought in 2019) 70 units @ $44 per unit Purchases: Purchase 1 on 1/20/20 Purchase 2 on 6/24/20 130 units @ $48 per unit 300 units @ $52 per unit Sales: Sale 1 on 3/12/20 Sale 2 on 10/15/20 180 units @ $100 per unit 260 units @ $100 per unit of the units sold on 3/12/20,50 came from beginning inventory and 130 were from the 1/20/20 purchase. All units sold on 10/15/20 were from the 6/24/20 purchase. Show how Willow's Balance Sheet and Income Statement would look under each of the inventory cost flow assumptions. Compute Ending Inventory, Sales, COGS, and Gross Profit under Specific Identification, Weighted Average Cost, FIFO and LIFO. Fill in your answers on the table below. SHOW YOUR WORK. Round per unit cost to the nearest cent. Specific Weighted Identification Average FIFO LIFO 12/31/20 Balance Sheet Inventory 2020 Income Statement Sales Cost of Goods Sold 100 II llo Gross Profit PVH Corp. Financial Statements (partial) PVH Consolidated Income Statements In millions of dollars Sales Cost of goods sold Selling, general, and administrative expenses Year ended Feb. 2. 2020 S4999 4,521 4,715 Year ended Feb. 3, 2019 S2.657 4,349 4,433 Year ended Feb. 4, 2018 S8.2015 4,020 4,245 PVH Consolidated Balance Sheets In millions of dollars As of ASSETS Feb. 2, 2020 Cash and cash equivalents Su 503 Accounts receivable, net 741 Inventories 1,616 Prepaid expenses and other current assets 534 Total current assets $3.394 As of Feb. 3, 2019 S452 778 1,732 277 $3.239 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary Of Significant Accounting Policies 1.1. Description of Business PVH Corp. constitutes a global apparel company with a brand portfolio consisting of nationally and internationally recognized trademarks, including TOMMY HILFIGER, CALVIN KLEIN, Van Heusen, IZOD, ARROW, Warner's, Olga, True&ca and Geoffrey Beene, which are owned, as well as various other owned, licensed and, to a lesser extent, private label brands. The Company designs and markets branded dress shirts, neckwear, sportswear (casual apparel), ieapsweat performance apparel, intimate apparel, underwear, swimwear, swim products, handbags, accessories, footwear and other related products and licenses its owned brands globally over a broad array of product categories and for use in numerous discrete jurisdictions. 1.4. Fiscal Year The Company uses a 52-53 week fiscal year ending on the Sunday closest to February 1. Results for fiscal years 2019, 2018 and 2017 represent the 52 weeks ended February 2, 2020, 52 weeks ended February 3, 2019 and 53 weeks ended February 4, 2018, respectively. 1.9. Inventories Inventories are comprised principally of finished goods and are stated at the lower of cost or net realizable value. Cost for substantially all wholesale inventories in North America and certain wholesale and retail inventories in Asia is determined using the first-in, first-out method. Cost for all other inventories is determined using the weighted average cost method