Answered step by step

Verified Expert Solution

Question

1 Approved Answer

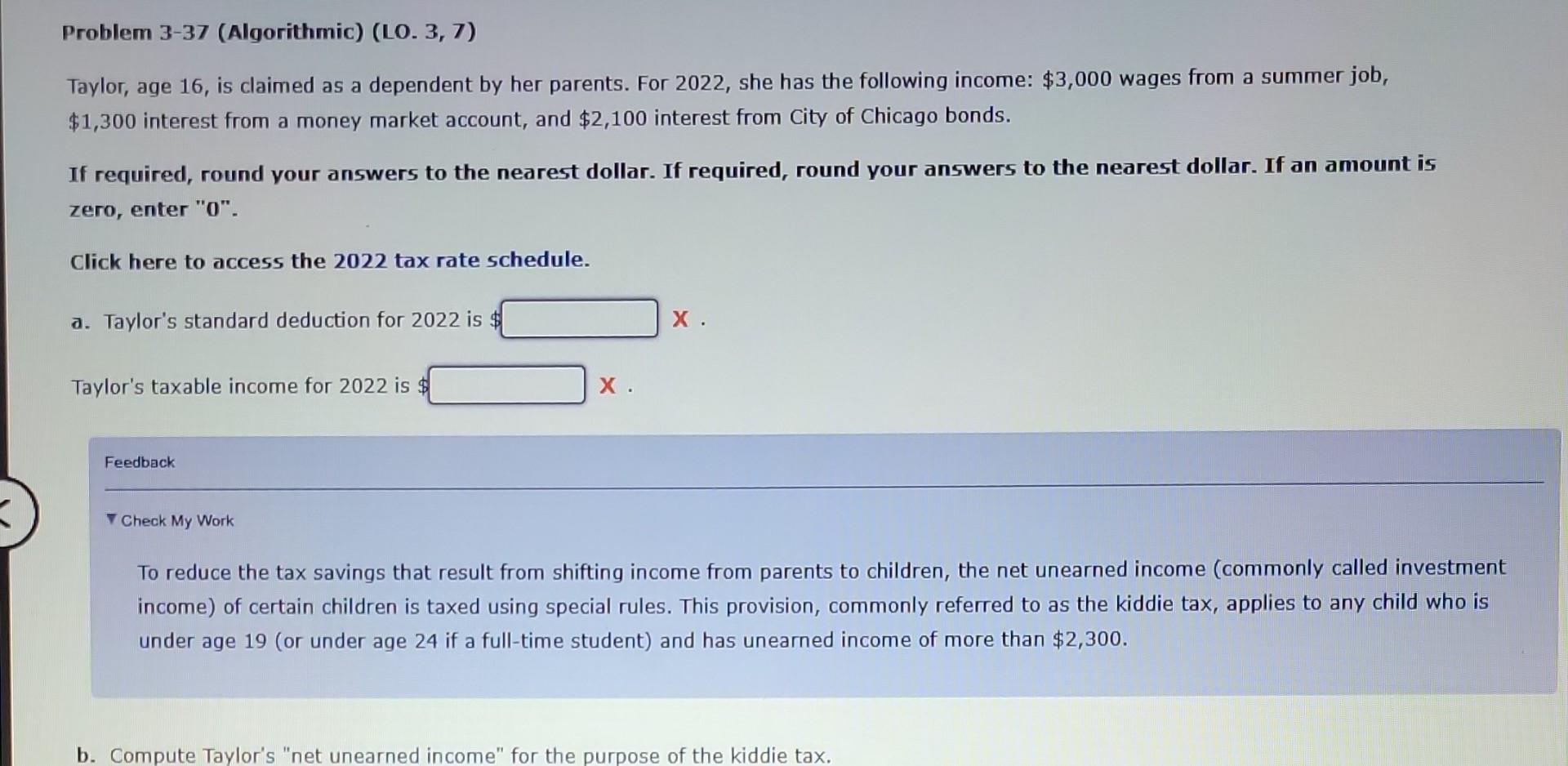

Problem 3-37 (Algorithmic) (LO. 3, 7) Taylor, age 16, is claimed as a dependent by her parents. For 2022, she has the following income:

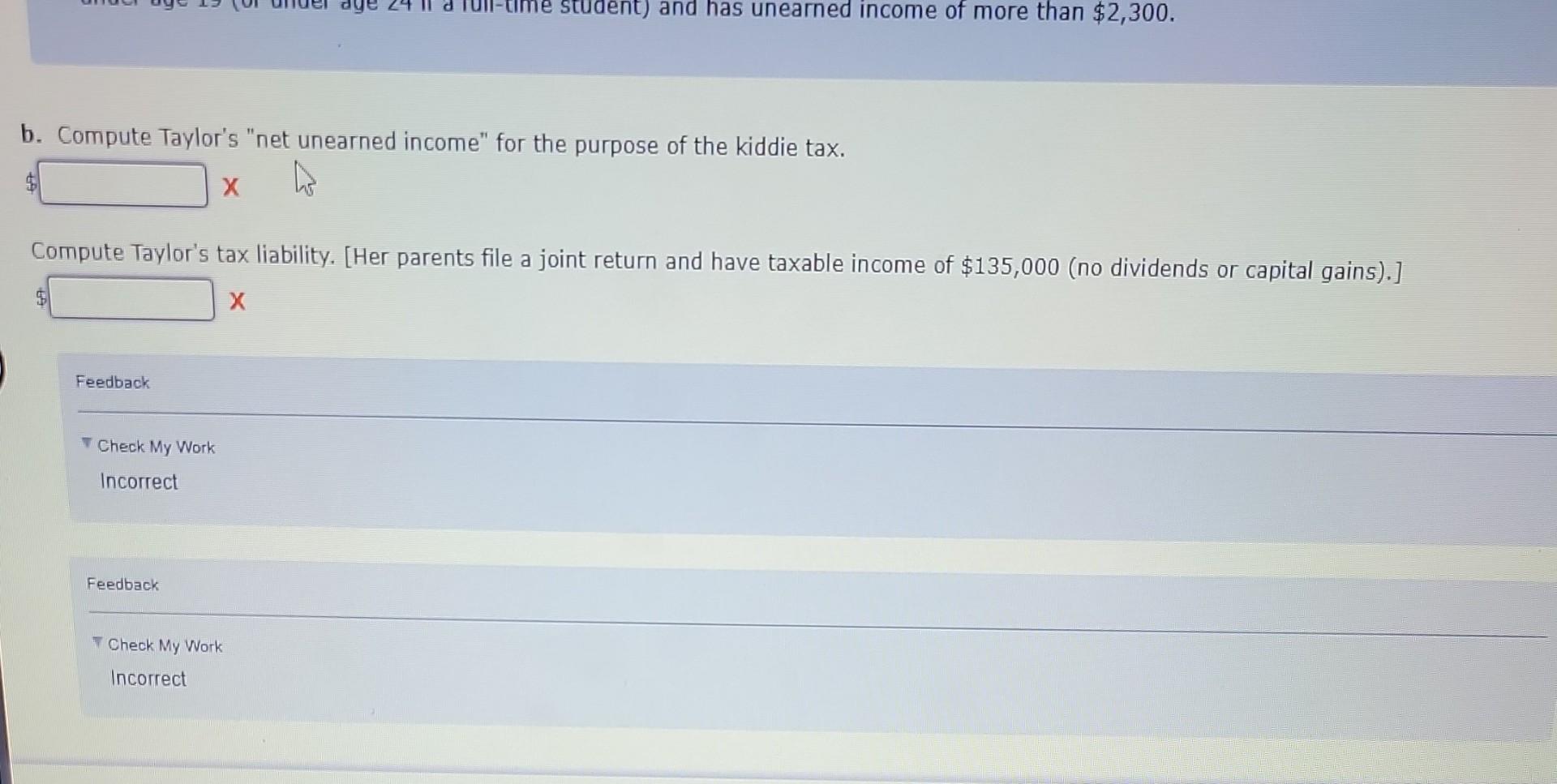

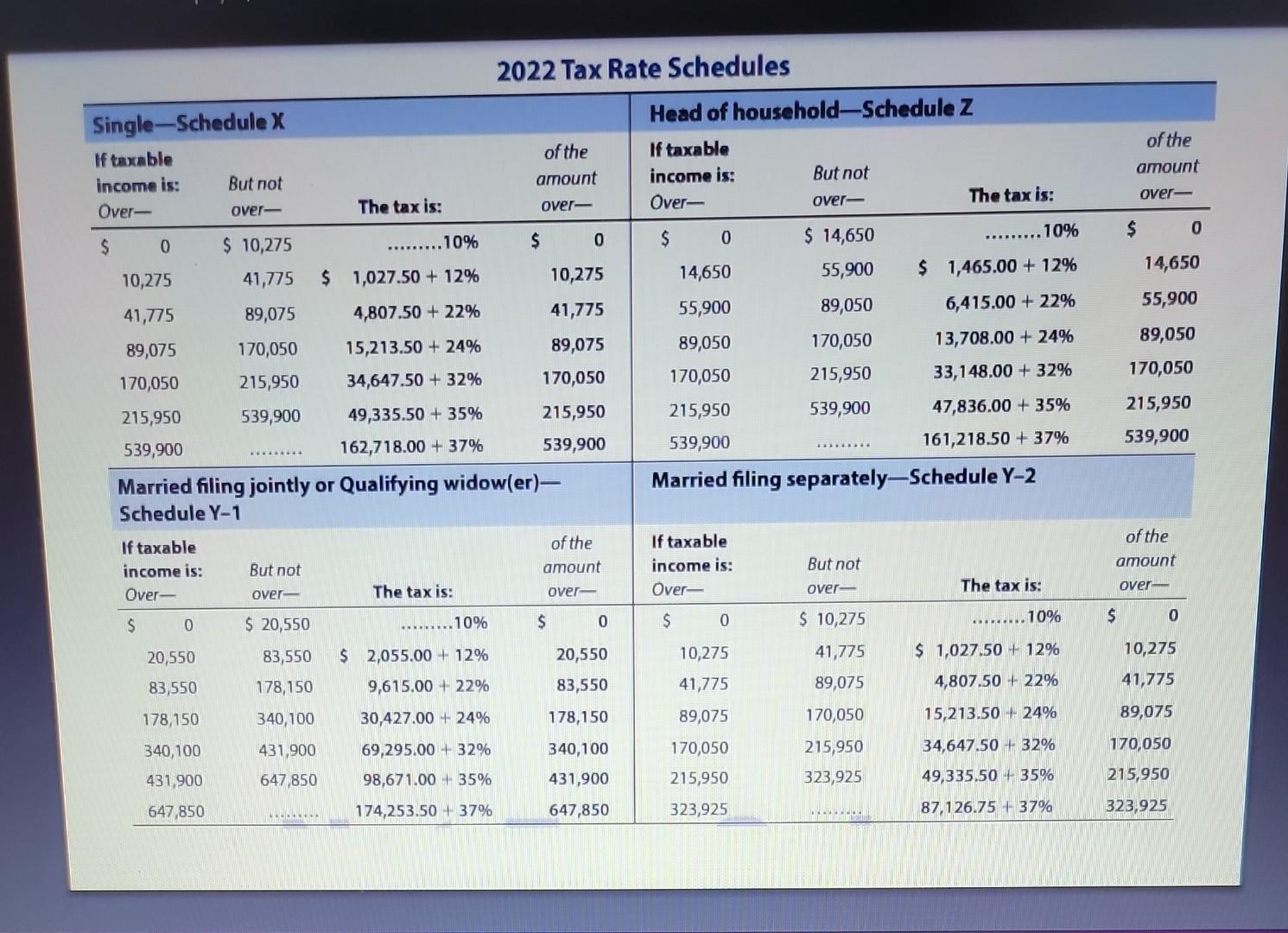

Problem 3-37 (Algorithmic) (LO. 3, 7) Taylor, age 16, is claimed as a dependent by her parents. For 2022, she has the following income: $3,000 wages from a summer job, $1,300 interest from a money market account, and $2,100 interest from City of Chicago bonds. If required, round your answers to the nearest dollar. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". Click here to access the 2022 tax rate schedule. a. Taylor's standard deduction for 2022 is $ Taylor's taxable income for 2022 is $ X. X. Feedback Check My Work To reduce the tax savings that result from shifting income from parents to children, the net unearned income (commonly called investment income) of certain children is taxed using special rules. This provision, commonly referred to as the kiddie tax, applies to any child who is under age 19 (or under age 24 if a full-time student) and has unearned income of more than $2,300. b. Compute Taylor's "net unearned income" for the purpose of the kiddie tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started