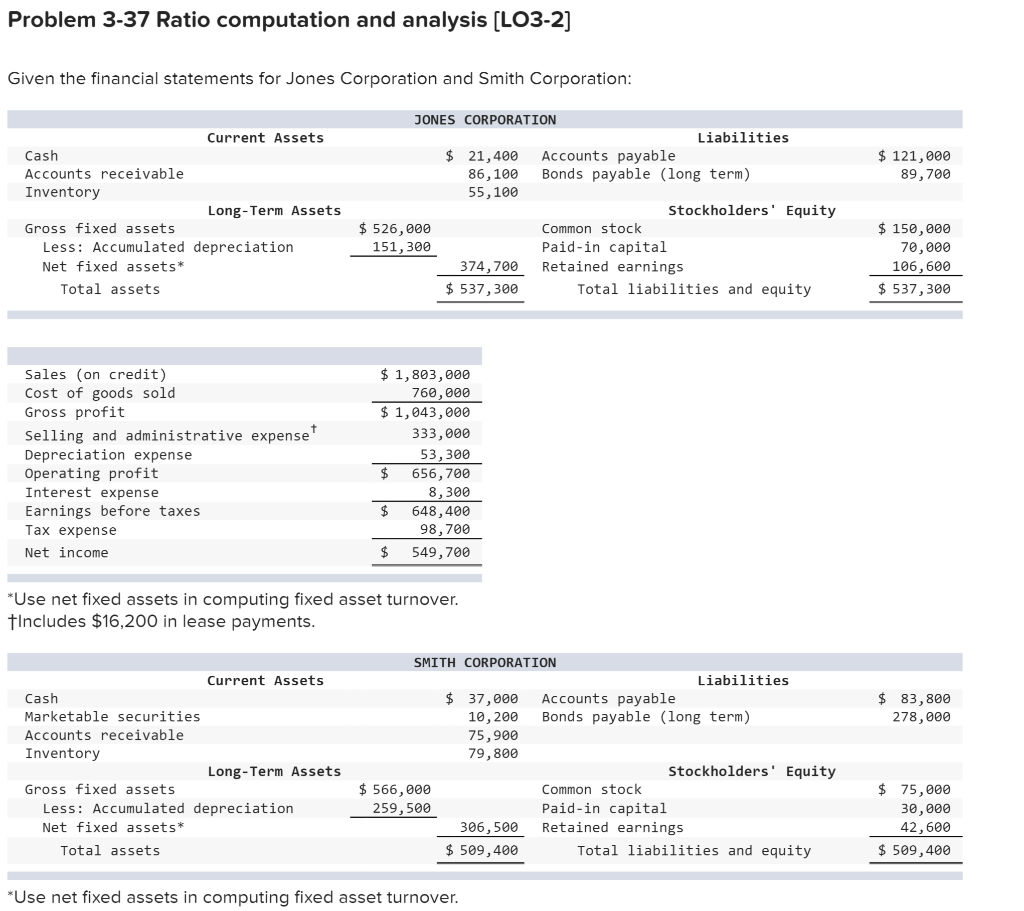

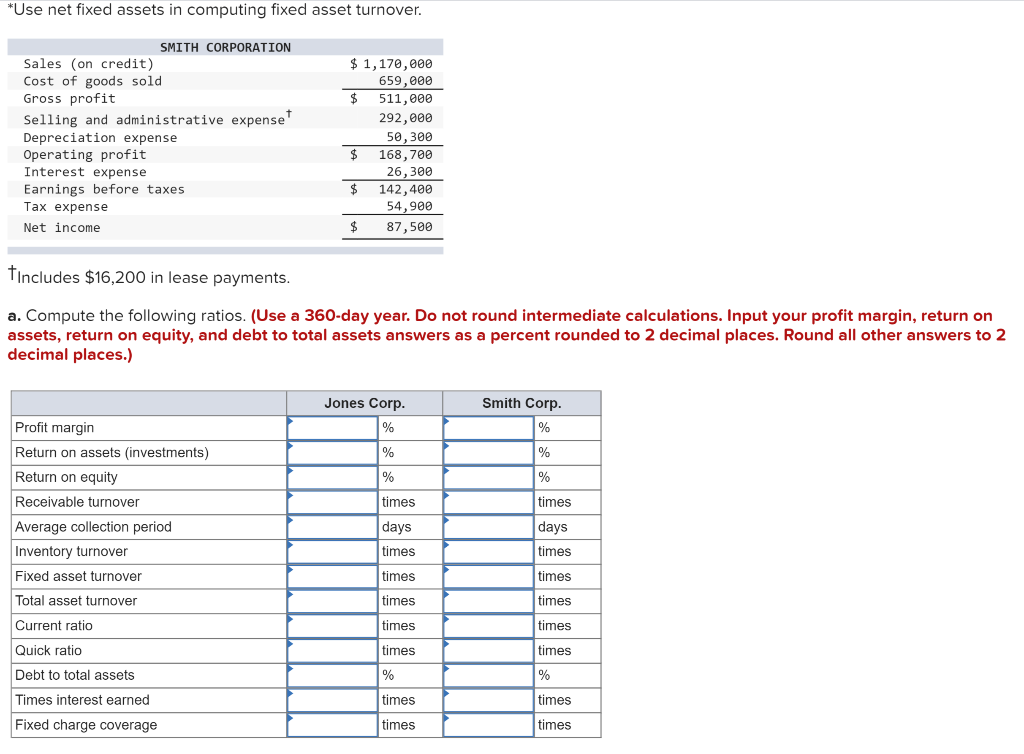

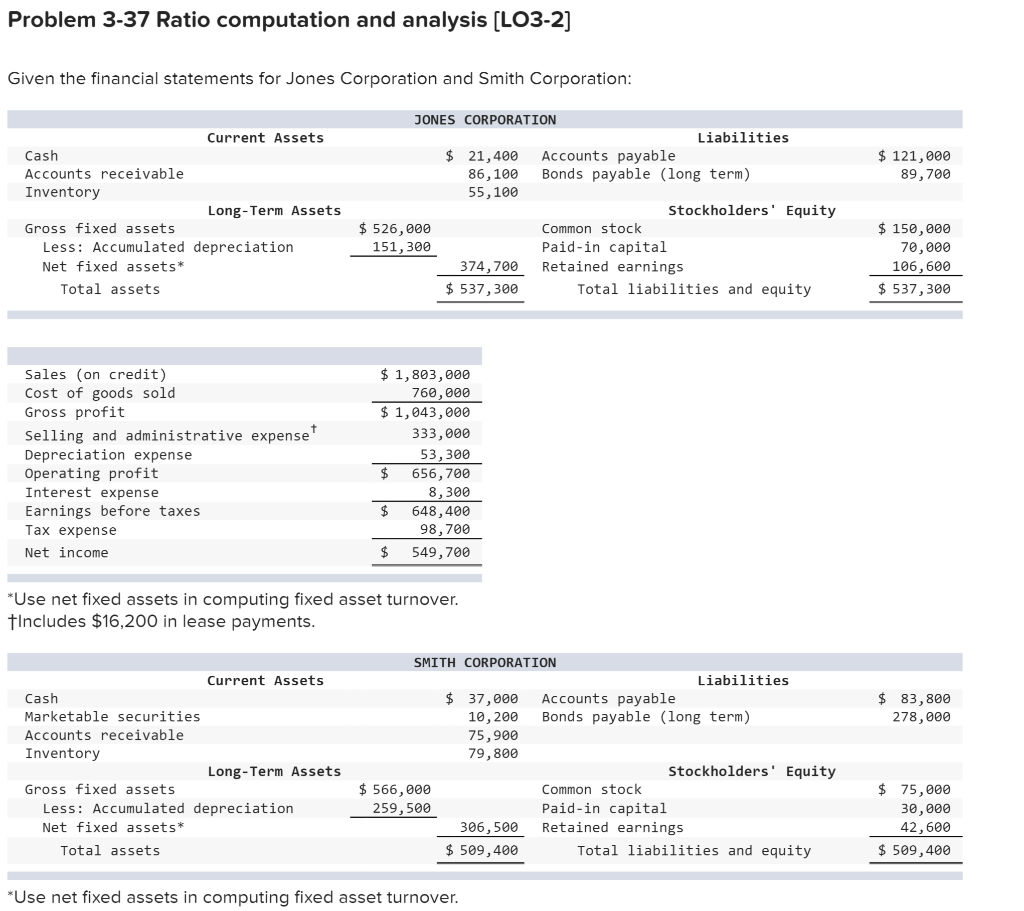

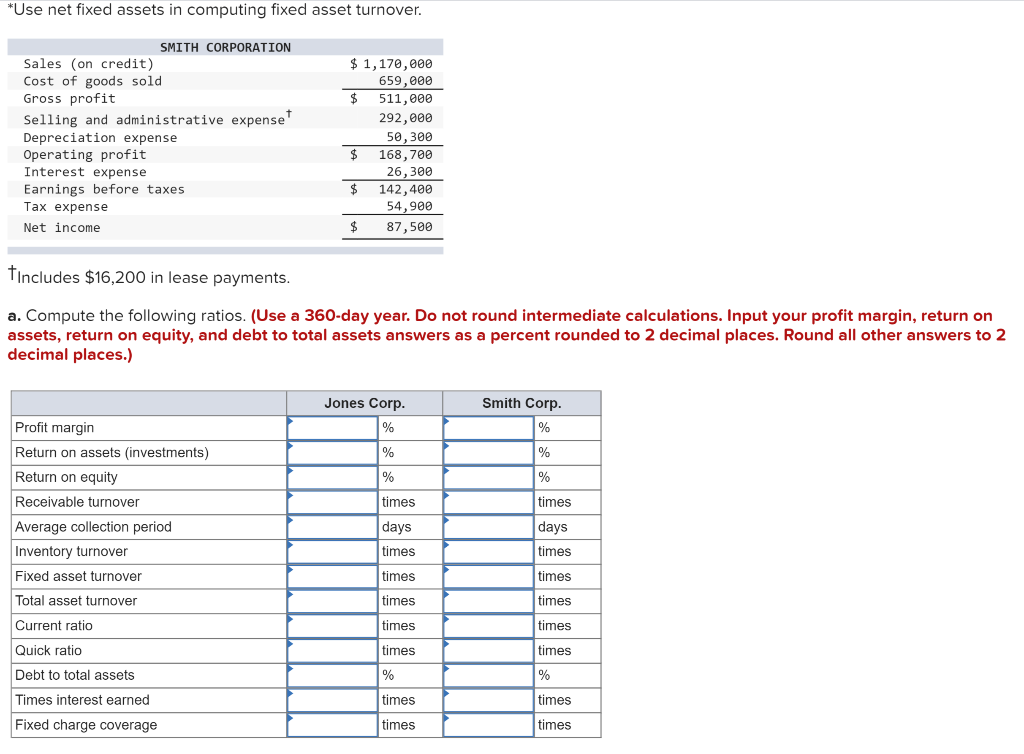

Problem 3-37 Ratio computation and analysis (LO3-2] Given the financial statements for Jones Corporation and Smith Corporation: $ 121,000 89,700 Current Assets Cash Accounts receivable Inventory Long-Term Assets Gross fixed assets Less: Accumulated depreciation Net fixed assets* Total assets JONES CORPORATION Liabilities $ 21,400 Accounts payable 86,100 Bonds payable (long term) 55,100 Stockholders' Equity $ 526,000 Common stock 151,300 Paid-in capital 374,700 Retained earnings $ 537, 300 Total liabilities and equity $ 150,000 70,000 106,600 $ 537,300 Sales (on credit) Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Operating profit Interest expense Earnings before taxes Tax expense Net income $ 1,803,000 760,000 $ 1,043,000 333,000 53,300 656, 700 8,300 648,400 98,700 549,700 *Use net fixed assets in computing fixed asset turnover. Includes $16,200 in lease payments. $ 83,800 278,000 Current Assets Cash Marketable securities Accounts receivable Inventory Long-Term Assets Gross fixed assets Less: Accumulated depreciation Net fixed assets* Total assets SMITH CORPORATION Liabilities $ 37,000 Accounts payable 10,200 Bonds payable (long term) 75,900 79,800 Stockholders' Equity $ 566,000 Common stock 259,500 Paid-in capital 306,500 Retained earnings $ 509,400 Total liabilities and equity $ 75,000 30,000 42,600 $ 509,400 *Use net fixed assets in computing fixed asset turnover. *Use net fixed assets in computing fixed asset turnover. SMITH CORPORATION Sales (on credit) Cost of goods sold Gross profit Selling and administrative expenset Depreciation expense Operating profit Interest expense Earnings before taxes Tax expense Net income $ 1,170,000 659,000 $ 511,000 292,000 50,300 $ 168,700 26,300 142,400 54,900 $ 87,500 tincludes $16,200 in lease payments. a. Compute the following ratios. (Use a 360-day year. Do not round intermediate calculations. Input your profit margin, return on assets, return on equity, and debt to total assets answers as a percent rounded to 2 decimal places. Round all other answers to 2 decimal places.) Jones Corp. Smith Corp. % % % % % Profit margin Return on assets investments) Return on equity Receivable turnover Average collection period Inventory turnover Fixed asset turnover times times days days times times times times Total asset turnover times times Current ratio times times Quick ratio times times Debt to total assets % % Times interest earned times times times times Fixed charge coverage