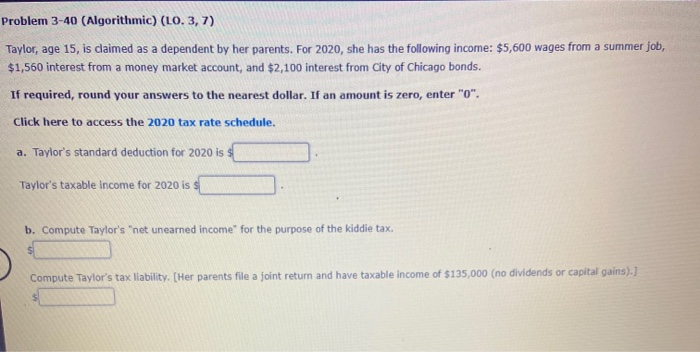

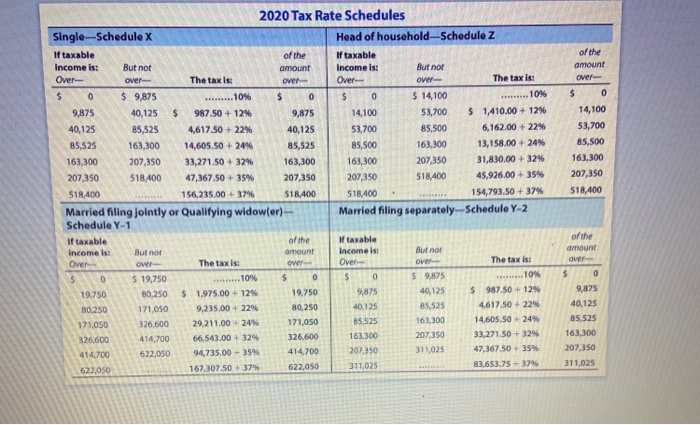

Problem 3-40 (Algorithmic) (LO. 3,7) Taylor, age 15, is claimed as a dependent by her parents. For 2020, she has the following income: $5,600 wages from a summer job, $1,560 interest from a money market account, and $2,100 interest from City of Chicago bonds. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". Click here to access the 2020 tax rate schedule. a. Taylor's standard deduction for 2020 is Taylor's taxable income for 2020 is b. Compute Taylor's "net unearned income for the purpose of the kiddie tax. S Compute Taylor's tax liability. (Her parents file a joint return and have taxable income of $135,000 (no dividends or capital gains).] of the amount Over ...... 10% ... 10% 2020 Tax Rate Schedules Single-Schedule x Head of household-Schedule z If taxable of the If taxable income is: But not amount Income is: But not Over over The tax is: over Over- over The tax is: $ 0 $ 9,875 $ 0 $ 0 $ 14,100 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410,00 + 12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 85,525 163,300 14,605.50 +24% 85,525 85,500 163,300 13,158.00 +24% 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830,00 + 32% 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00+ 35% 518,400 156,235.00+ 37% 518.400 518.400 154,793.50 +37% Married filing jointly or Qualifying widower) Married filing separately--Schedule Y-2 Schedule Y-1 If taxable of the If taxable Income is: But not amount Income is But not Over over The taxis over Over- over The tax is: $ 0 $ 19,750 $ 0 $ 0 59.875 19.750 80,250 $ 1,975.00+ 12% 19.750 9,875 40,125 $ 987.50 + 12% B0.250 171.050 9.235.00 +2296 80,250 40.125 85.525 4.617.50 +2296 171.050 326,600 29.211.00 24% 171,050 85,525 163,300 14,605.50 +24% 326,600 414,700 66,543.00 + 32% 326,600 163.300 207,350 33,271.50 + 3296 414,700 622,050 94,735.00 35% 414,700 207,350 311,025 47,367.50 + 35% 622,050 167,307.50 +37% 622,050 311,025 83,653.75 -37% $ 0 14,100 53,700 85,500 163,300 207,350 518,400 of the amount over $ 0 ... 10% ...10 9,875 40,125 85.525 163,300 207,350 311,025