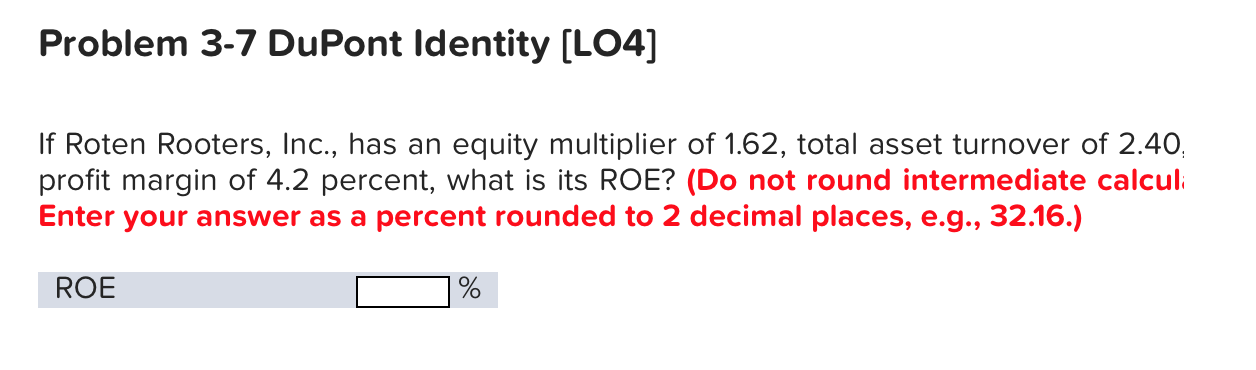

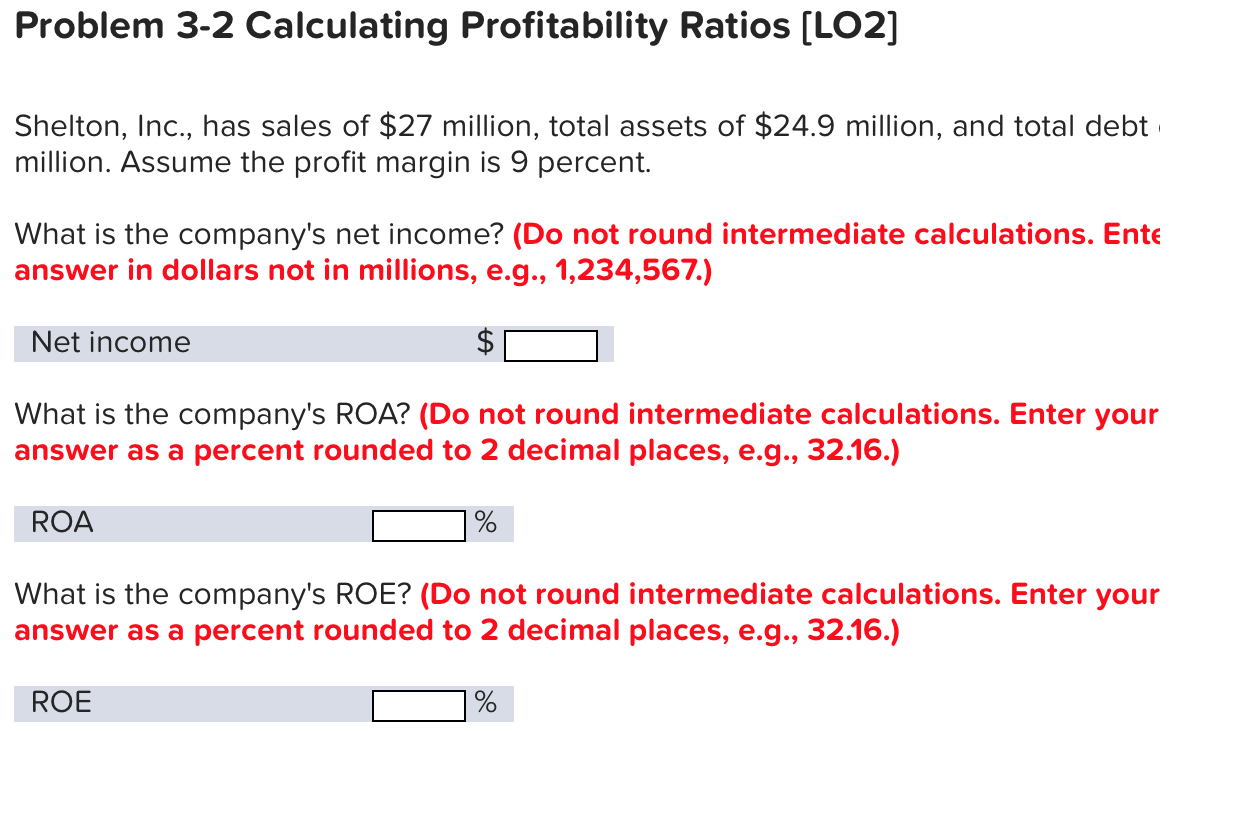

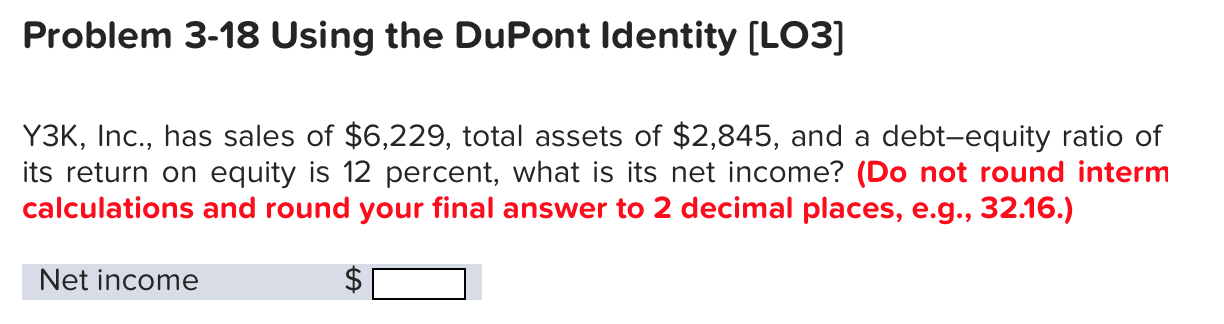

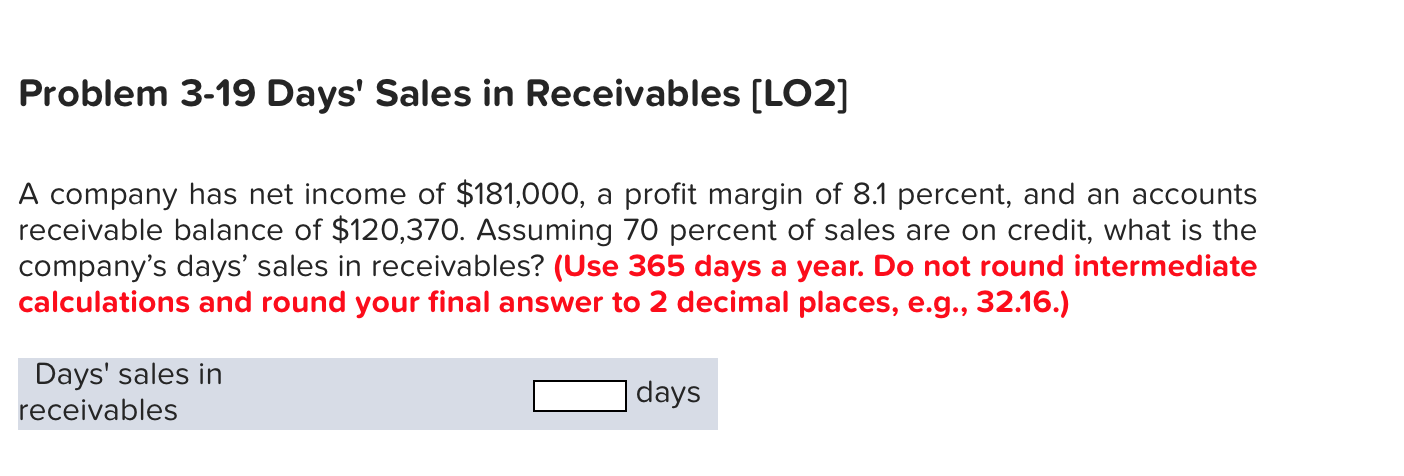

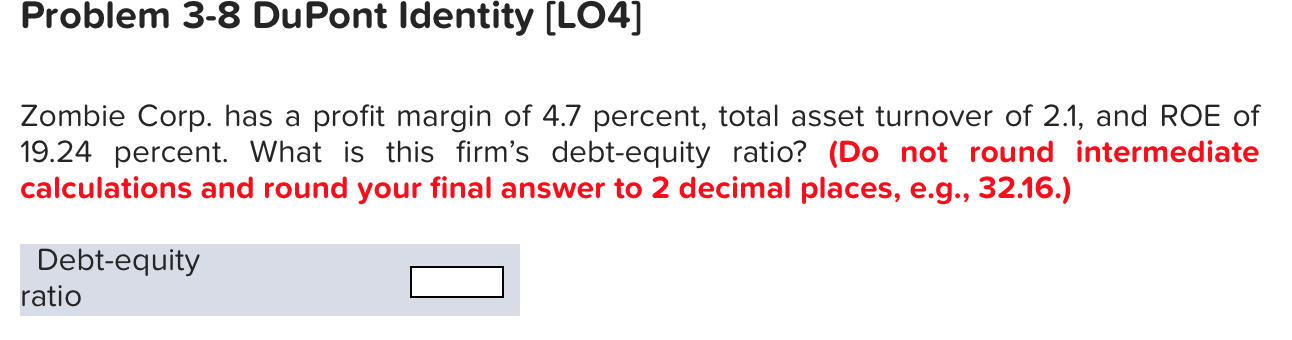

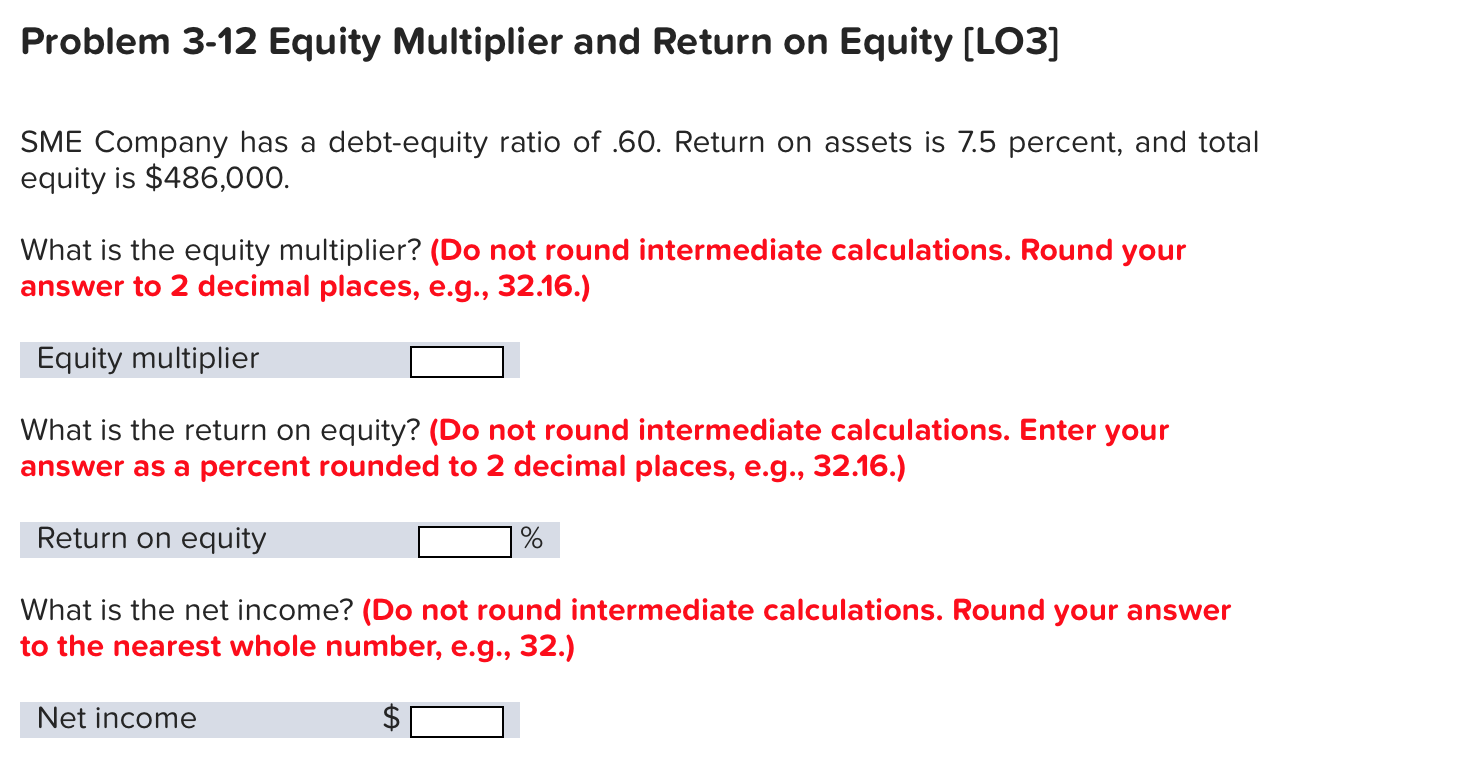

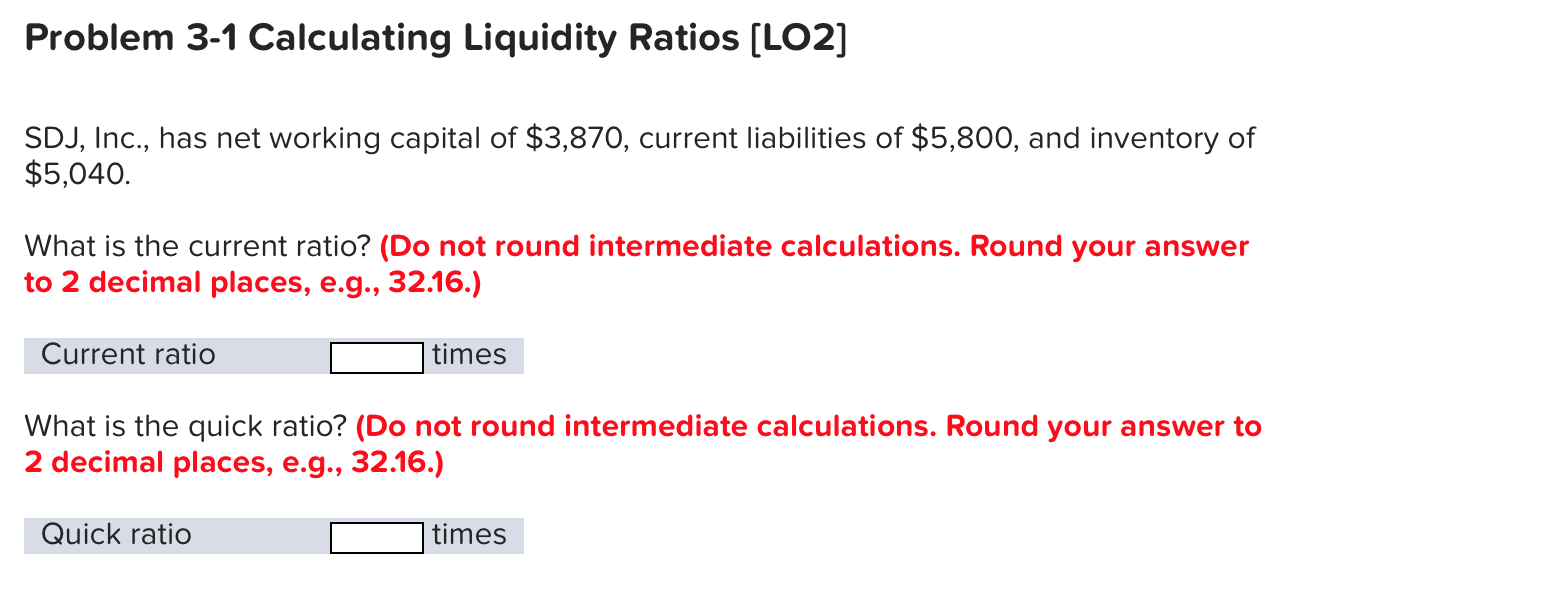

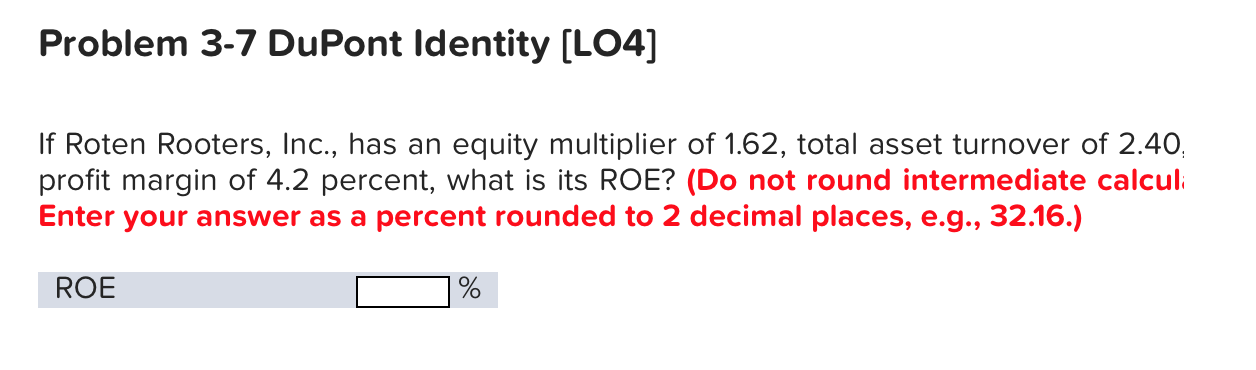

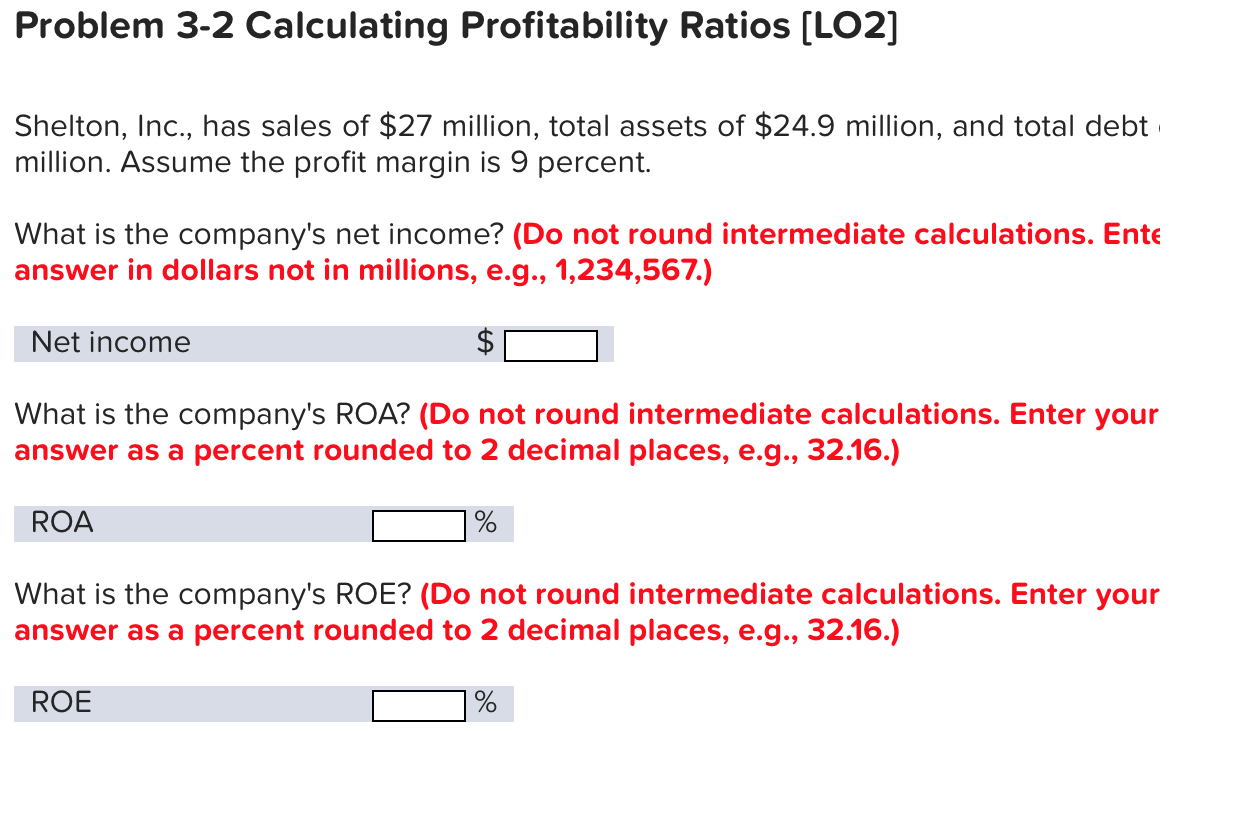

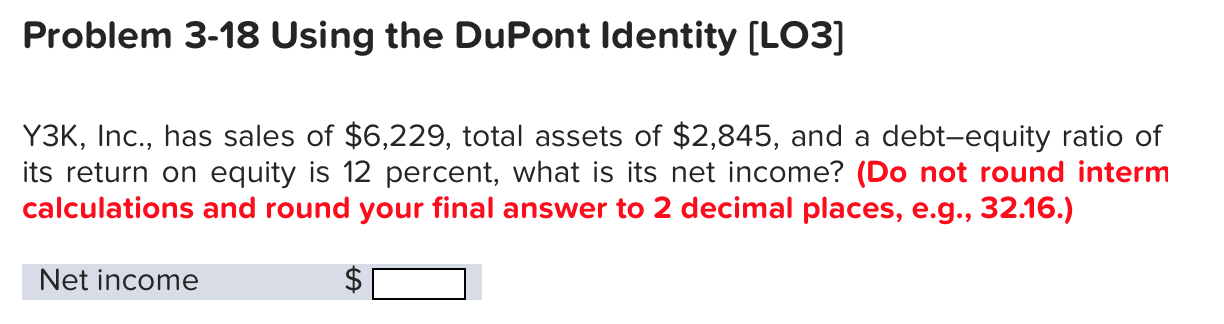

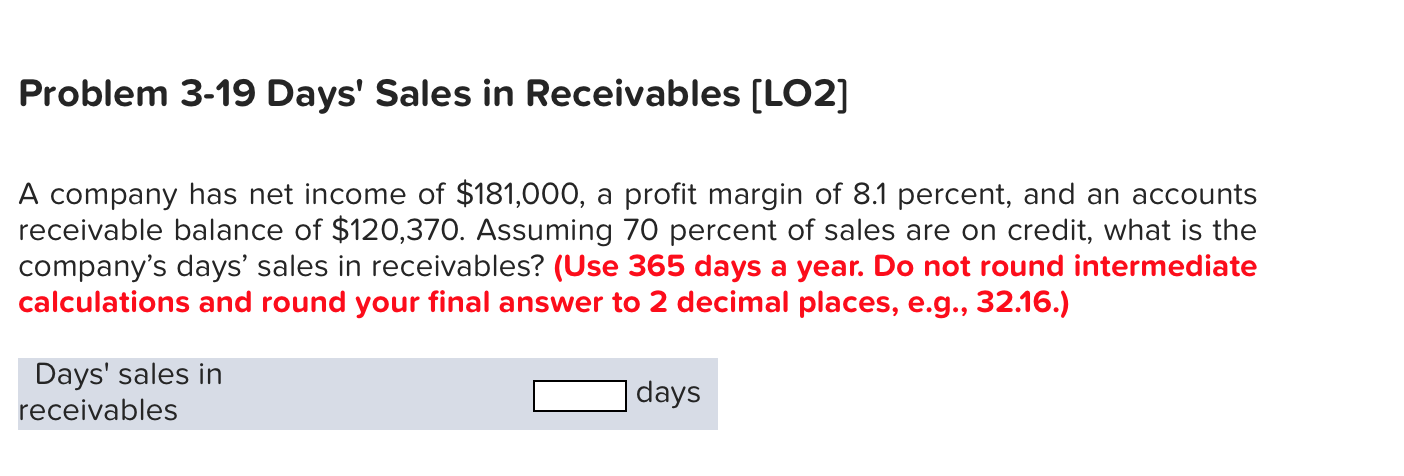

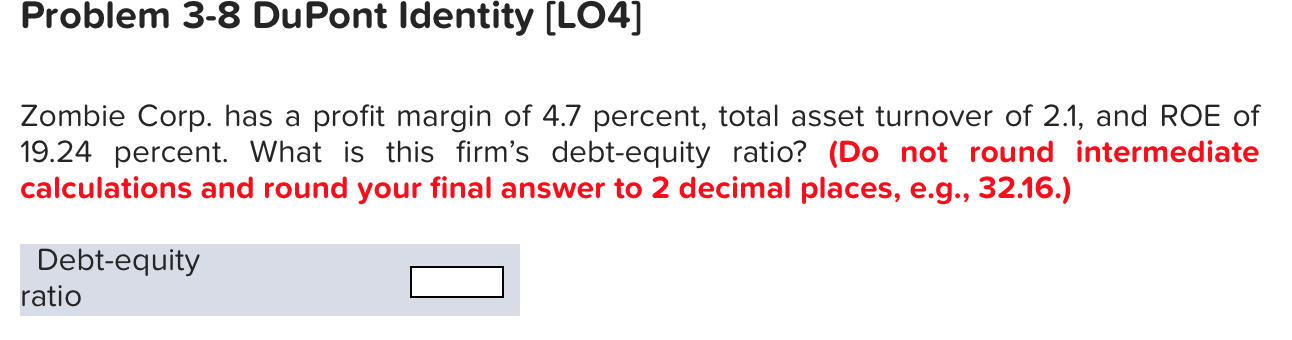

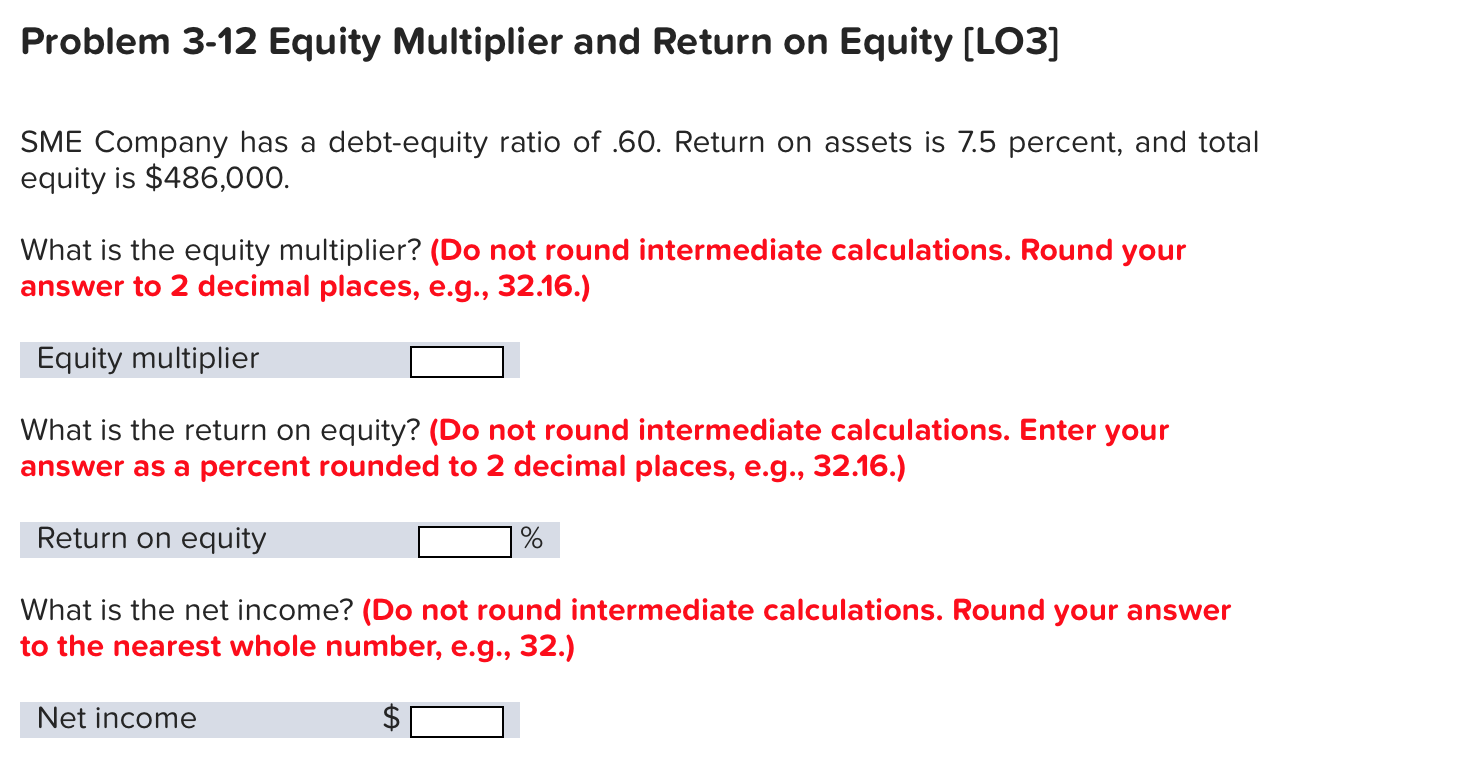

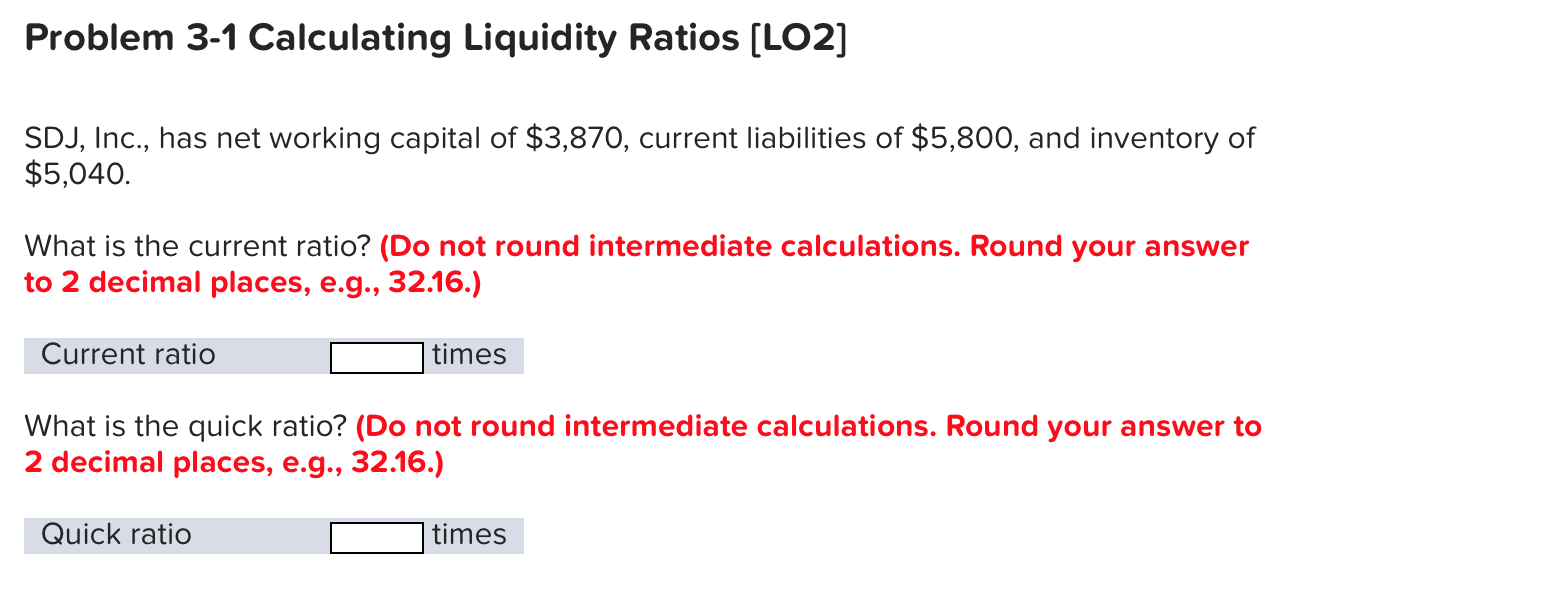

Problem 3-7 DuPont Identity [LO4] If Roten Rooters, Inc., has an equity multiplier of 1.62, total asset turnover of 2.40 profit margin of 4.2 percent, what is its ROE? (Do not round intermediate calcul Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROE % Problem 3-2 Calculating Profitability Ratios [LO2] Shelton, Inc., has sales of $27 million, total assets of $24.9 million, and total debt million. Assume the profit margin is 9 percent What is the company's net income? (Do not round intermediate calculations. Ente answer in dollars not in millions, e.g., 1,234,567.) Net income What is the company's ROA? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROA What is the company's ROE? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROE % Problem 3-18 Using the DuPont Identity [LO3] Y3K, Inc., has sales of $6,229, total assets of $2,845, and a debt-equity ratio of its return on equity is 12percent, what is its net income? (Do not round interm calculations and round your final answer to 2 decimal places, e.g., 32.16.) Net income Problem 3-19 Days' Sales in Receivables [LO2] A company has net income of $181,000, a profit margin of 8.1 percent, and an accounts receivable balance of $120,370. Assuming 70 percent of sales are on credit, what is the company's days' sales in receivables? (Use 365 days a year. Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 32.16.) Days' sales in receivables days Problem 3-8 DuPont Identity [LO4] Zombie Corp. has a 19.24 percent. What is this firm's debt-equity ratio? (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 32.16.) profit margin of 4.7 percent, total asset turnover of 2.1, and ROE of Debt-equity ratio Problem 3-12 Equity Multiplier and Return on Equity [LO3] SME Company has a debt-equity ratio of .60. Return on assets is 7.5 percent, and total equity is $486,000. What is the equity multiplier? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Equity multiplier What is the return on equity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Return on equity What is the net income? (Do not round intermediate calculations. Round your answer to the nearest whole number, e.g., 32.) Net income tA Problem 3-1 Calculating Liquidity Ratios [LO2] SDJ, Inc., has net working capital of $3,870, current liabilities of $5,800, and inventory of $5,040. What is the current ratio? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Current ratio times What is the quick ratio? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Quick ratio times