Question

Problem 3-9 LO2, 3 Three companies, A, L, and M, whose December 31, Year 5, balance sheets appear below, have agreed to combine as at

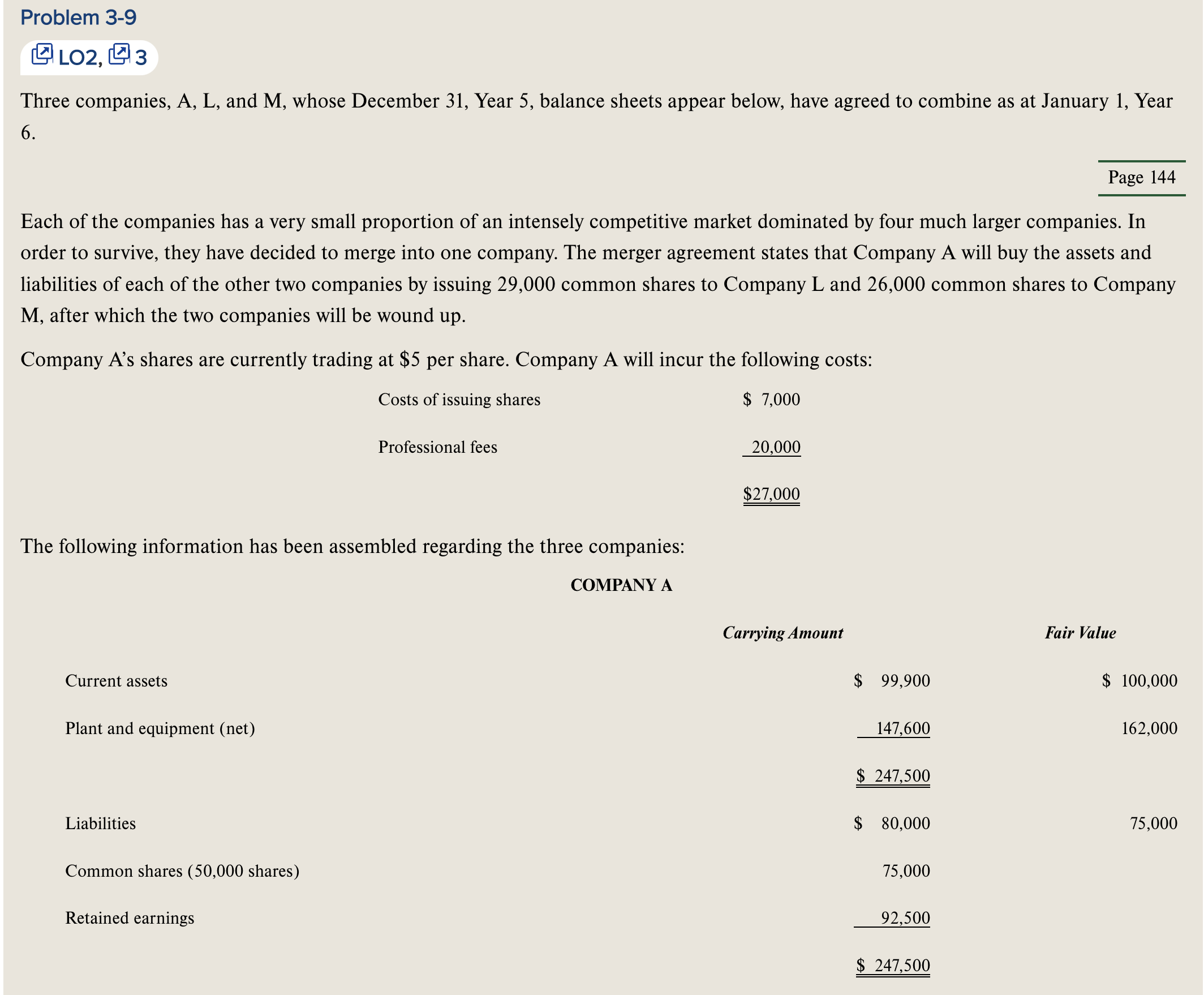

Problem 3-9\ LO2, 3\ Three companies, A, L, and M, whose December 31, Year 5, balance sheets appear below, have agreed to combine as at January 1, Year\ \ Each of the companies has a very small proportion of an intensely competitive market dominated by four much larger companies. In\ order to survive, they have decided to merge into one company. The merger agreement states that Company A will buy the assets and\ liabilities of each of the other two companies by issuing 29,000 common shares to Company

Land 26,000 common shares to Company\ M, after which the two companies will be wound up.\ Company A's shares are currently trading at

$5per share. Company A will incur the following costs:\ Costs of issuing shares\ Professional fees\ $ 7,000\

20,000_()\

$27,000_(_())\ The following information has been assembled regarding the three companies:\ COMPANY A\ Carrying Amount\ Current assets\ Plant and equipment (net)\ Liabilities\ Common shares (50,000 shares)\ Retained earnings\

$,99,900\ 147,600\

$247,500_()\

$,80,000\ 75,000\ 92,500\ Fair Value\

$100,000\ 162,000\ 75,000\

$247,500_(_())

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started