Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 . 1 4 ( Return on Equity ) Pacific Packaging's ROE last year was only 2 % , but its management has developed

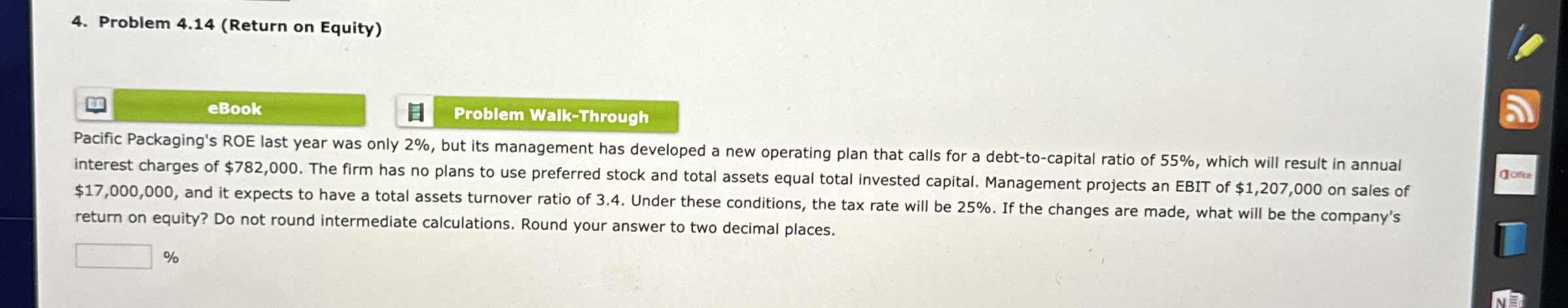

Problem Return on Equity

Pacific Packaging's ROE last year was only but its management has developed a new operating plan that calls for a debttocapital ratio of which will result in annual interest charges of $ The firm has no plans to use preferred stock and total assets equal total invested capital. Management projects an EBIT of $ on sales of $ and it expects to have a total assets turnover ratio of Under these conditions, the tax rate will be If the changes are made, what will be the company's return on equity? Do not round intermediate calculations. Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started