Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 [ 1 5 points ] : You are working on the structuring desk in the fixed income division of an investment bank. A

Problem points:

You are working on the structuring desk in the fixed income division of an investment bank.

A salesperson stops by and asks you to help one of her institutional clients. The client will receive

a cash inflow of USD million one year from now and would like to invest it for one year there

after The client will invest the funds at the end of year and the strategy will return the funds

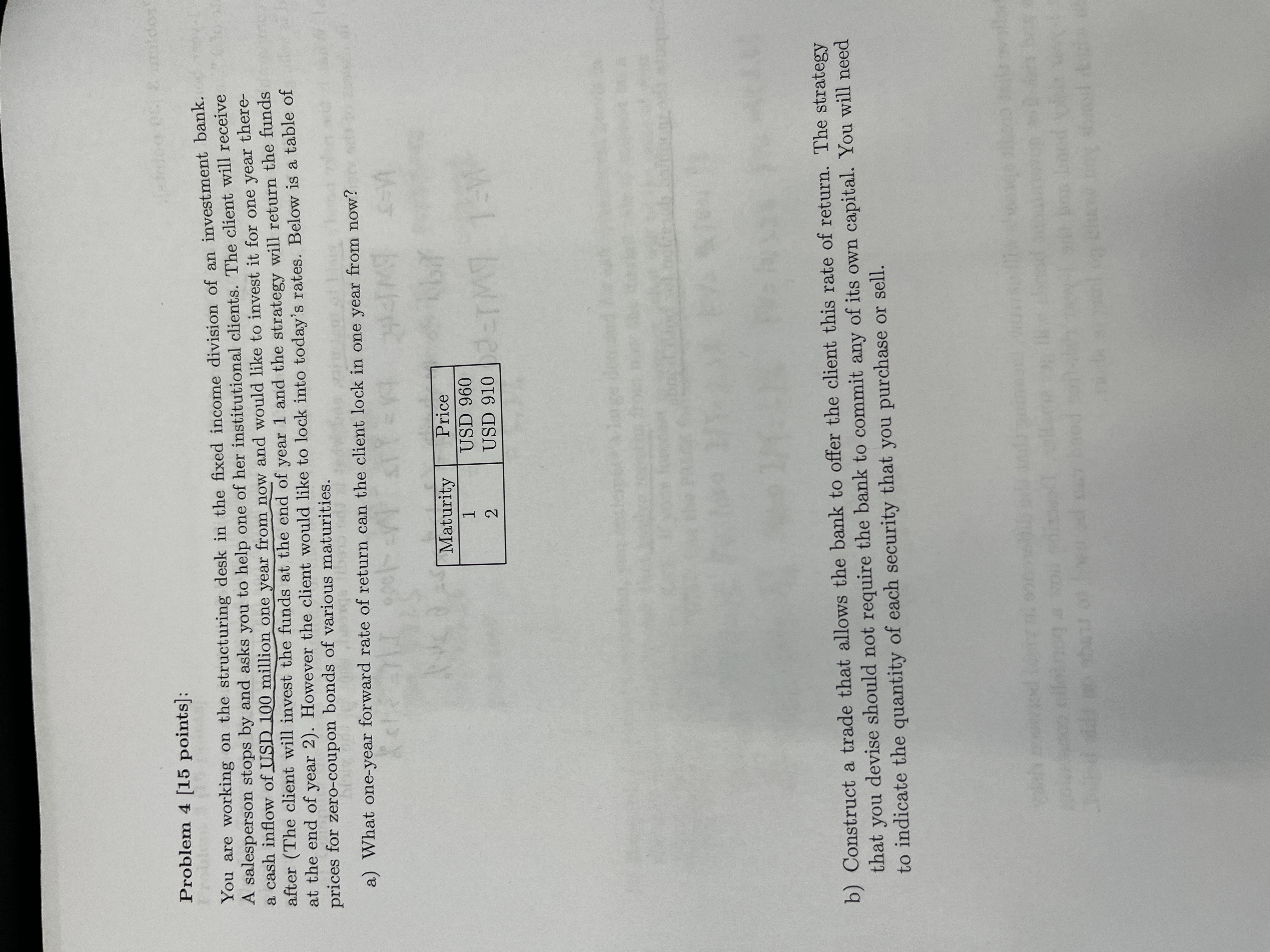

at the end of year However the client would like to lock into today's rates. Below is a table of

prices for zerocoupon bonds of various maturities.

a What oneyear forward rate of return can the client lock in one year from now?

b Construct a trade that allows the bank to offer the client this rate of return. The strategy

that you devise should not require the bank to commit any of its own capital. You will need

to indicate the quantity of each security that you purchase or sell.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started