Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have recently been tasked to come up with a set of 8-year payment options to cater to a specific customer's requirement of flexible

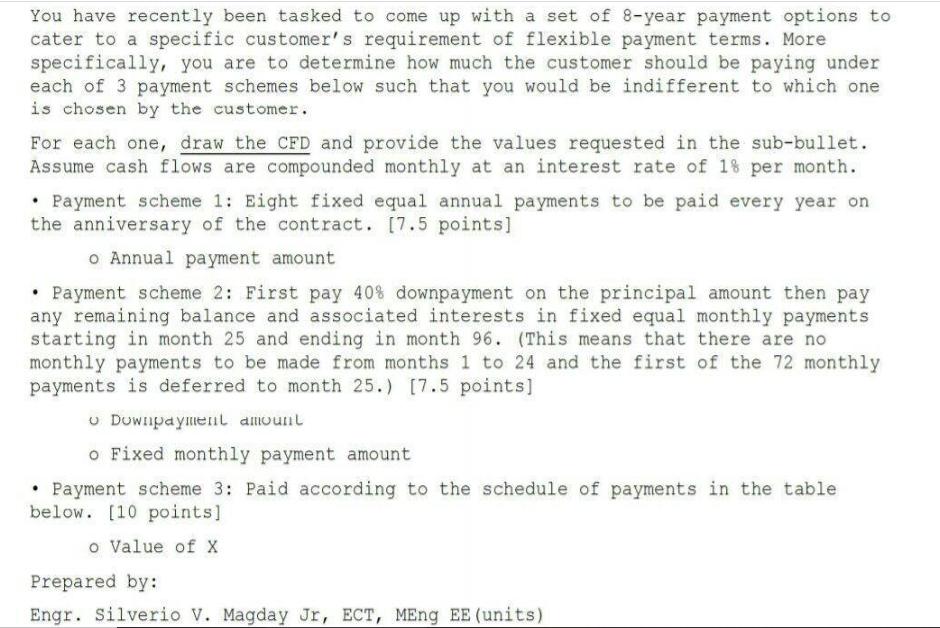

You have recently been tasked to come up with a set of 8-year payment options to cater to a specific customer's requirement of flexible payment terms. More specifically, you are to determine how much the customer should be paying under each of 3 payment schemes below such that you would be indifferent to which one is chosen by the customer. For each one, draw the CFD and provide the values requested in the sub-bullet. Assume cash flows are compounded monthly at an interest rate of 1% per month. Payment scheme 1: Eight fixed equal annual payments to be paid every year on the anniversary of the contract. [7.5 points] o Annual payment amount Payment scheme 2: First pay 40% downpayment on the principal amount then pay any remaining balance and associated interests in fixed equal monthly payments starting in month 25 and ending in month 96. (This means that there are no monthly payments to be made from months 1 to 24 and the first of the 72 monthly payments is deferred to month 25.) [7.5 points] Downpayment amount o Fixed monthly payment amount Payment scheme 3: Paid according to the schedule of payments in the table below. [10 points] o Value of X Prepared by: Engr. Silverio V. Magday Jr, ECT, MEng EE (units)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Payment Scheme 1 Under this payment scheme we are required to determine the annual payment amount that needs to be made every year for the next 8 years The cash flows can be represented using the foll...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started