Answered step by step

Verified Expert Solution

Question

1 Approved Answer

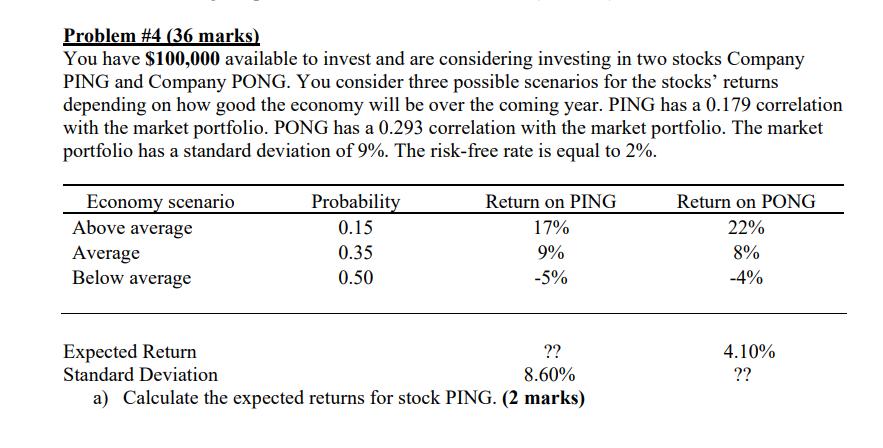

Problem #4 (36 marks) You have $100,000 available to invest and are considering investing in two stocks Company PING and Company PONG. You consider

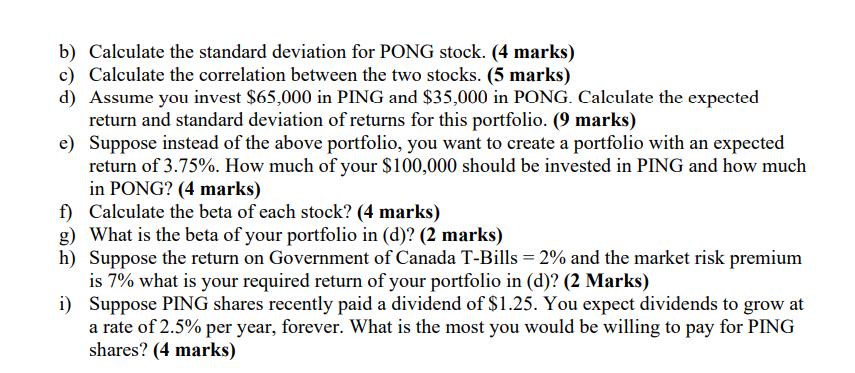

Problem #4 (36 marks) You have $100,000 available to invest and are considering investing in two stocks Company PING and Company PONG. You consider three possible scenarios for the stocks' returns depending on how good the economy will be over the coming year. PING has a 0.179 correlation with the market portfolio. PONG has a 0.293 correlation with the market portfolio. The market portfolio has a standard deviation of 9%. The risk-free rate is equal to 2%. Economy scenario Above average Average Below average Probability 0.15 0.35 0.50 Return on PING 17% 9% -5% Expected Return ?? Standard Deviation 8.60% a) Calculate the expected returns for stock PING. (2 marks) Return on PONG 22% 8% -4% 4.10% ?? b) Calculate the standard deviation for PONG stock. (4 marks) c) Calculate the correlation between the two stocks. (5 marks) d) Assume you invest $65,000 in PING and $35,000 in PONG. Calculate the expected return and standard deviation of returns for this portfolio. (9 marks) e) Suppose instead of the above portfolio, you want to create a portfolio with an expected return of 3.75%. How much of your $100,000 should be invested in PING and how much in PONG? (4 marks) f) Calculate the beta of each stock? (4 marks) g) What is the beta of your portfolio in (d)? (2 marks) h) Suppose the return on Government of Canada T-Bills = 2% and the market risk premium is 7% what is your required return of your portfolio in (d)? (2 Marks) i) Suppose PING shares recently paid a dividend of $1.25. You expect dividends to grow at a rate of 2.5% per year, forever. What is the most you would be willing to pay for PING shares? (4 marks)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started