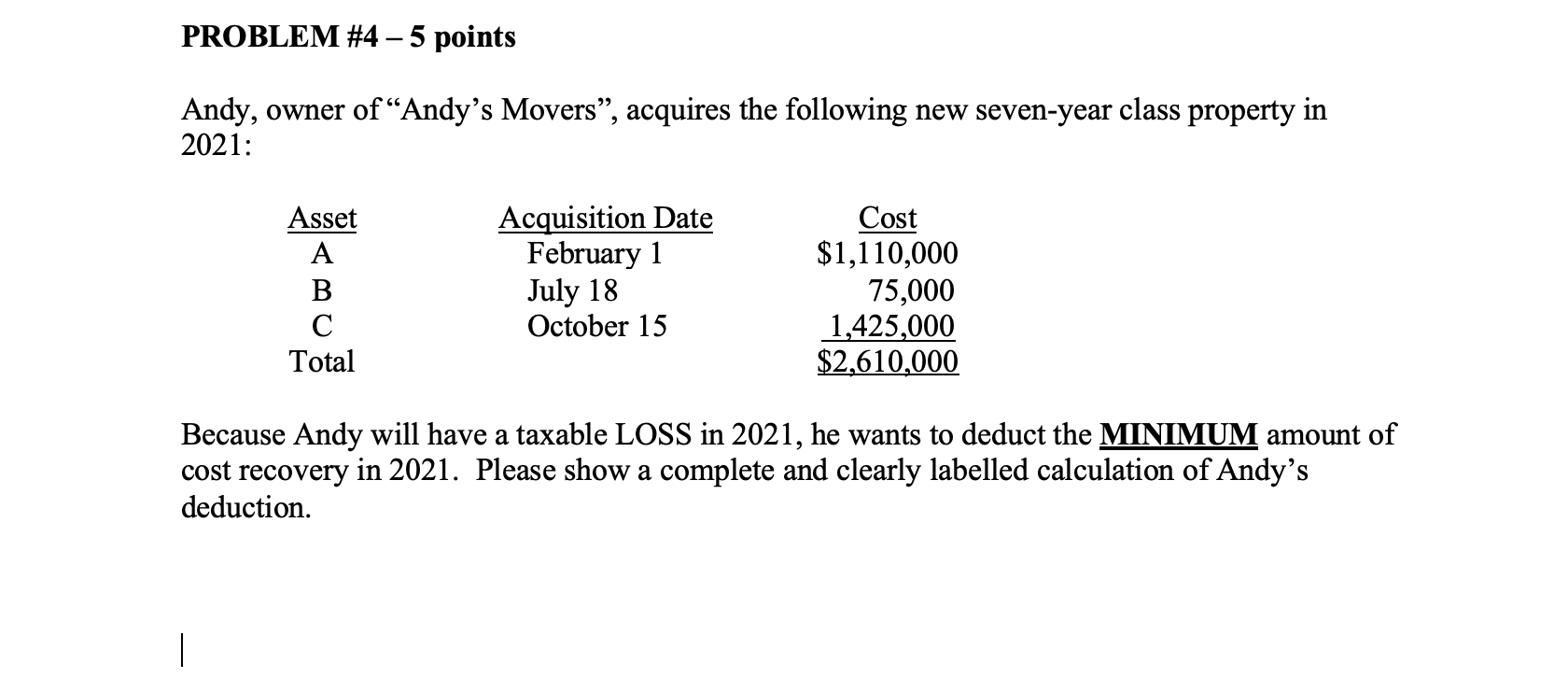

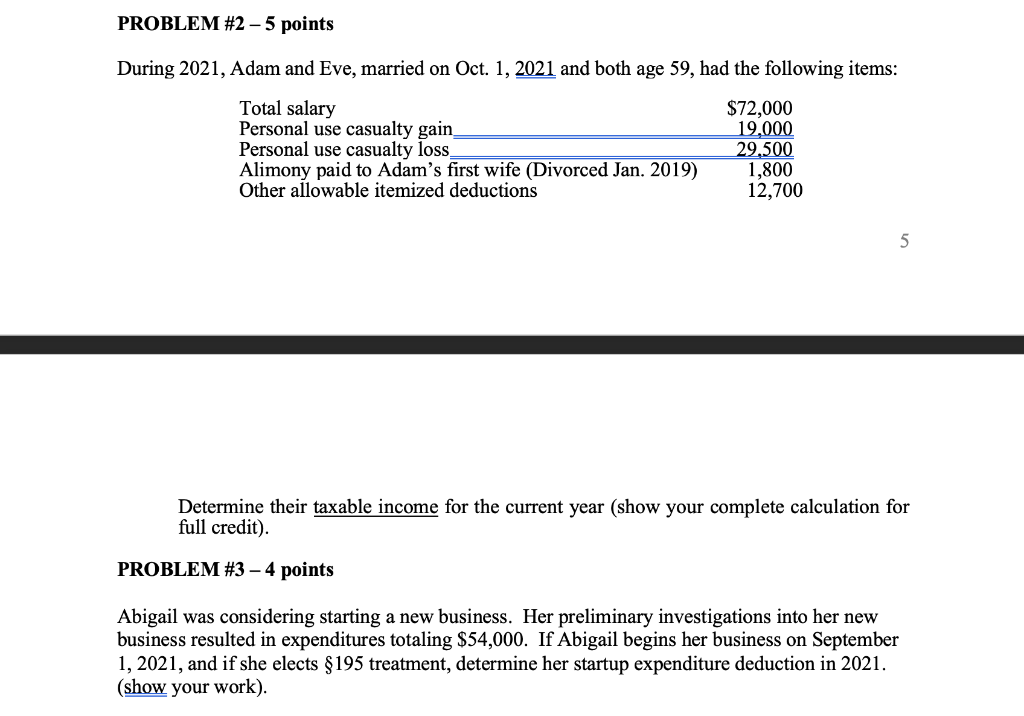

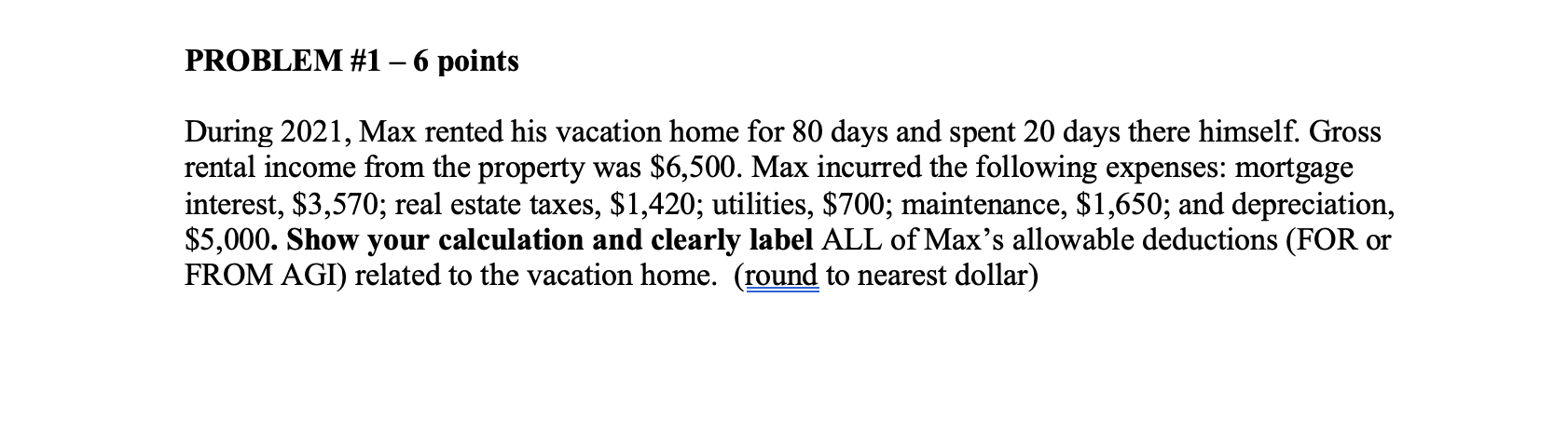

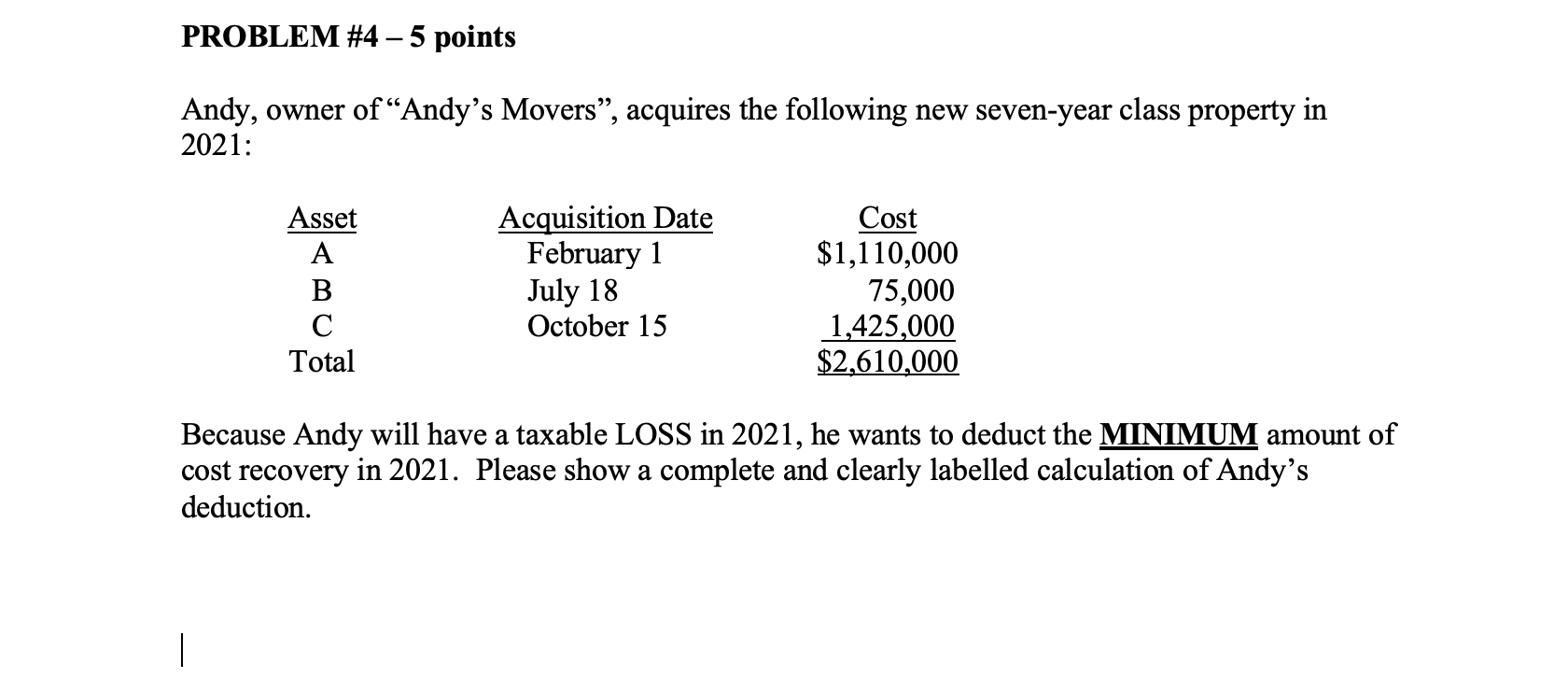

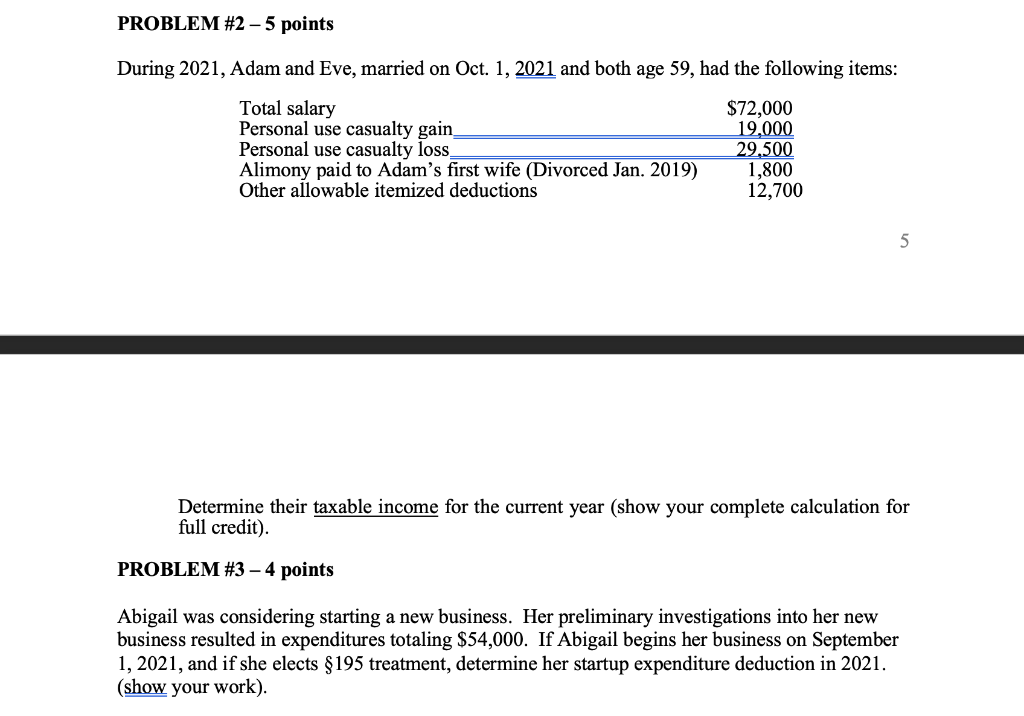

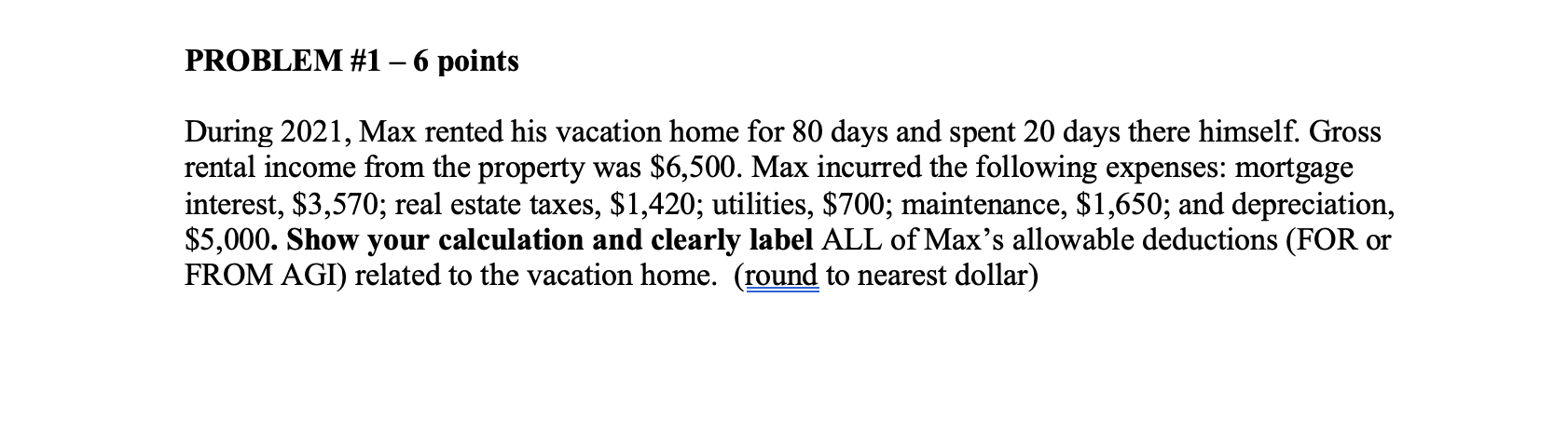

PROBLEM #4 5 points Andy, owner of Andy's Movers, acquires the following new seven-year class property in 2021: Asset A B Total Acquisition Date February 1 July 18 October 15 Cost $1,110,000 75,000 1,425,000 $2,610,000 a Because Andy will have a taxable LOSS in 2021, he wants to deduct the MINIMUM amount of cost recovery in 2021. Please show a complete and clearly labelled calculation of Andy's deduction. 1 PROBLEM #2 - 5 points During 2021, Adam and Eve, married on Oct. 1, 2021 and both age 59, had the following items: Total salary Personal use casualty gain_ Personal use casualty loss Alimony paid to Adam's first wife (Divorced Jan. 2019) Other allowable itemized deductions $72,000 19,000 29.500 1,800 12,700 5 Determine their taxable income for the current year (show your complete calculation for full credit) PROBLEM #3 - 4 points Abigail was considering starting a new business. Her preliminary investigations into her new business resulted in expenditures totaling $54,000. If Abigail begins her business on September 1, 2021, and if she elects $195 treatment, determine her startup expenditure deduction in 2021. (show your work). PROBLEM #1 6 points During 2021, Max rented his vacation home for 80 days and spent 20 days there himself. Gross rental income from the property was $6,500. Max incurred the following expenses: mortgage interest, $3,570; real estate taxes, $1,420; utilities, $700; maintenance, $1,650; and depreciation, $5,000. Show your calculation and clearly label ALL of Max's allowable deductions (FOR or FROM AGI) related to the vacation home. (round to nearest dollar) PROBLEM #4 5 points Andy, owner of Andy's Movers, acquires the following new seven-year class property in 2021: Asset A B Total Acquisition Date February 1 July 18 October 15 Cost $1,110,000 75,000 1,425,000 $2,610,000 a Because Andy will have a taxable LOSS in 2021, he wants to deduct the MINIMUM amount of cost recovery in 2021. Please show a complete and clearly labelled calculation of Andy's deduction. 1 PROBLEM #2 - 5 points During 2021, Adam and Eve, married on Oct. 1, 2021 and both age 59, had the following items: Total salary Personal use casualty gain_ Personal use casualty loss Alimony paid to Adam's first wife (Divorced Jan. 2019) Other allowable itemized deductions $72,000 19,000 29.500 1,800 12,700 5 Determine their taxable income for the current year (show your complete calculation for full credit) PROBLEM #3 - 4 points Abigail was considering starting a new business. Her preliminary investigations into her new business resulted in expenditures totaling $54,000. If Abigail begins her business on September 1, 2021, and if she elects $195 treatment, determine her startup expenditure deduction in 2021. (show your work). PROBLEM #1 6 points During 2021, Max rented his vacation home for 80 days and spent 20 days there himself. Gross rental income from the property was $6,500. Max incurred the following expenses: mortgage interest, $3,570; real estate taxes, $1,420; utilities, $700; maintenance, $1,650; and depreciation, $5,000. Show your calculation and clearly label ALL of Max's allowable deductions (FOR or FROM AGI) related to the vacation home. (round to nearest dollar)