Answered step by step

Verified Expert Solution

Question

1 Approved Answer

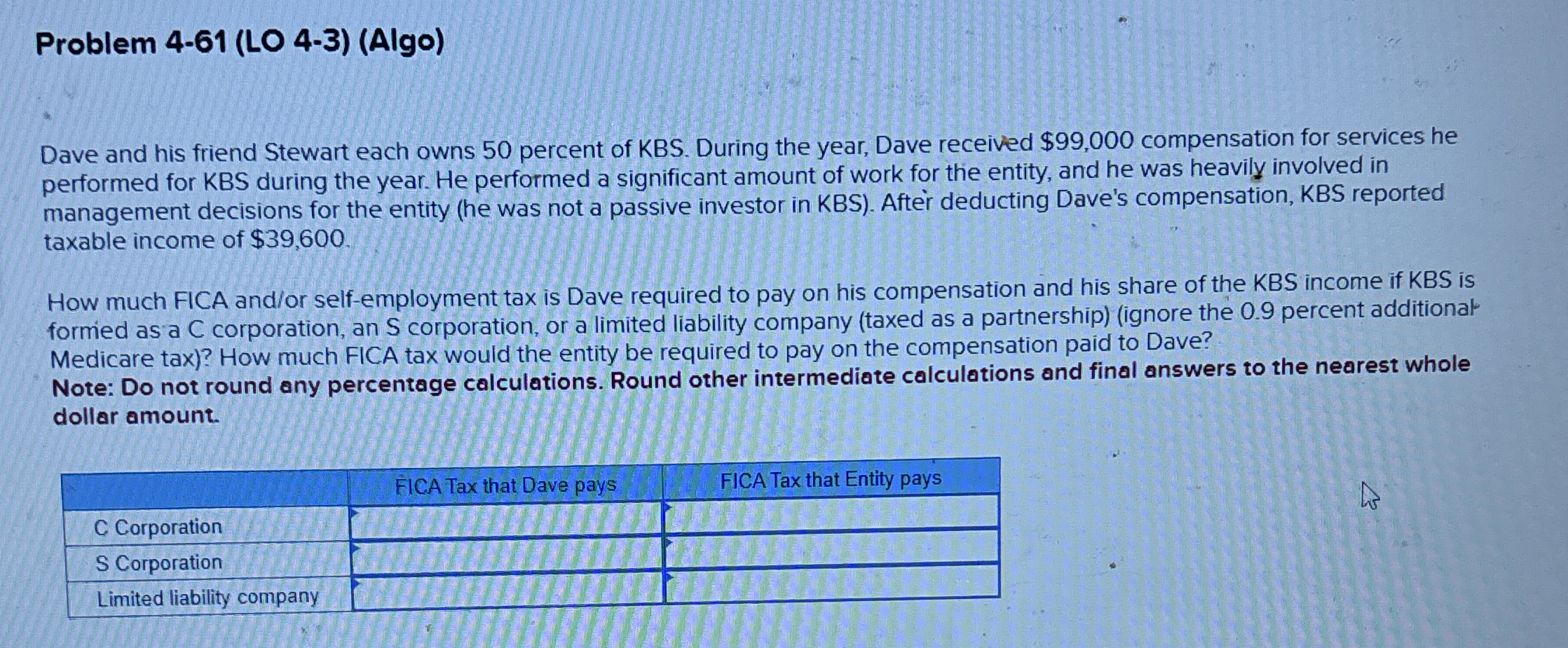

Problem 4 - 6 1 ( LO 4 - 3 ) ( Algo ) Dave and his friend Stewart each owns 5 0 percent of

Problem LO Algo

Dave and his friend Stewart each owns percent of KBS During the year, Dave received $ compensation for services he

performed for KBS during the year. He performed a significant amount of work for the entity, and he was heavily involved in

management decisions for the entity he was not a passive investor in KBS After deducting Dave's compensation, KBS reported

taxable income of $

How much FICA andor selfemployment tax is Dave required to pay on his compensation and his share of the KBS income if KBS is

formied as a C corporation, an S corporation, or a limited liability company taxed as a partnershipignore the percent additional

Medicare tax How much FICA tax would the entity be required to pay on the compensation paid to Dave?

Note: Do not round any percentage calculations. Round other intermediate calculations and final answers to the nearest whole

dollar amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started