Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 - 6 8 ( Static ) Closing a Plant ( LO 4 - 4 ) Wexford Manufacturing and Mining ( WMM ) operates

Problem Static Closing a Plant LO

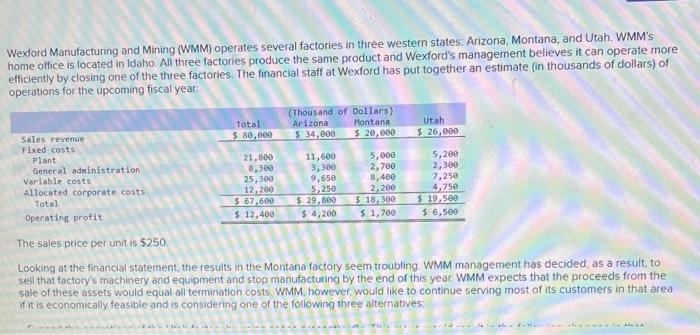

Wexford Manufacturing and Mining WMM operates several factories in three western states: Arizona, Montana, and Utah. WMMs home office is is located in Idaho. All three factories produce the same product and Wexford's management believes efficiently by closing one of the three factories. The financial staff at Wexford has put together an estimate in thousand It can operate more thousands of dollars of operations for the upcoming fiscal year:

Sales revenue

Tetal $

Arizona $

Utah

General administration

Allocated corporate costs

Total

$

Operating prefis

Thousand of Dollars

The sales price per unit is $

Looking at the financial statement, the results in the Montana factory seem troubling. WMM management has decided, as a result, to sell that factory's machinery and equipment and stop manufacturing by the end of this year. WMM expects that the proceeds from the sale of these assets would equal all termination costs. WMM however, would like to continue serving most of its customers in that ares If it is economically feasible and is considering one of the following three alternatives:

Expand the operations of the Utah factory by using space presently idle. This move would result in the following changes in that factory's operations:

Increase Utah's factory's current operations

Sales revenue

Administration

Under this proposal, variable costs would be $ per unit sold

Enter into a longterm contract with a competitor that will serve that aren's customers. This competitor would pay WMM a royalty of $ per unit based on an estimate of units being sold.

Close Montana factory and not expand the operations of the Utah factory

Total allocated corporate costs of $ will remain the same if the Utsh factory is expanded the first alternative above it competitor is used to serve the Montana market the second alternative above percent of the corporate cost allocated to the Montens factory will be saved. If the Montana factory is closed and the Utah factory's operations are not expanded the third alternative above percent of orate ted to the Montans factory will be saved.

Required: To assist the

menagement of WMM prepare a schedule computing WMMs estimated operating profit from the

Expension of the Utah factory berm contract on a royalty basis he longterm contract on a royalty Shutdown of the Montana operetions with no expension at other locations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started