Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4: Consider the two situations independently (and SHOW WORK!). (A) The Martha Corporation had equipment with a cost of $60,000 and book value of

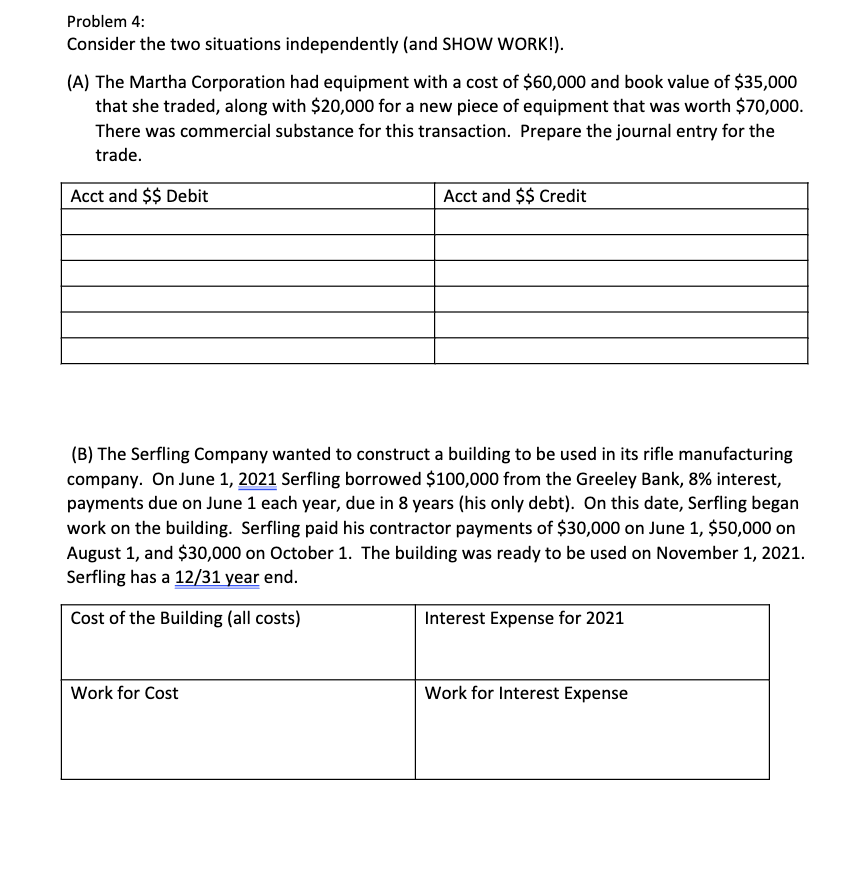

Problem 4: Consider the two situations independently (and SHOW WORK!). (A) The Martha Corporation had equipment with a cost of $60,000 and book value of $35,000 that she traded, along with $20,000 for a new piece of equipment that was worth $70,000. There was commercial substance for this transaction. Prepare the journal entry for the trade. (B) The Serfling Company wanted to construct a building to be used in its rifle manufacturing company. On June 1, 2021 Serfling borrowed $100,000 from the Greeley Bank, 8\% interest, payments due on June 1 each year, due in 8 years (his only debt). On this date, Serfling began work on the building. Serfling paid his contractor payments of $30,000 on June 1,$50,000 on August 1 , and $30,000 on October 1 . The building was ready to be used on November 1, 2021. Serfling has a 12/31 year end. Problem 4: Consider the two situations independently (and SHOW WORK!). (A) The Martha Corporation had equipment with a cost of $60,000 and book value of $35,000 that she traded, along with $20,000 for a new piece of equipment that was worth $70,000. There was commercial substance for this transaction. Prepare the journal entry for the trade. (B) The Serfling Company wanted to construct a building to be used in its rifle manufacturing company. On June 1, 2021 Serfling borrowed $100,000 from the Greeley Bank, 8\% interest, payments due on June 1 each year, due in 8 years (his only debt). On this date, Serfling began work on the building. Serfling paid his contractor payments of $30,000 on June 1,$50,000 on August 1 , and $30,000 on October 1 . The building was ready to be used on November 1, 2021. Serfling has a 12/31 year end

Problem 4: Consider the two situations independently (and SHOW WORK!). (A) The Martha Corporation had equipment with a cost of $60,000 and book value of $35,000 that she traded, along with $20,000 for a new piece of equipment that was worth $70,000. There was commercial substance for this transaction. Prepare the journal entry for the trade. (B) The Serfling Company wanted to construct a building to be used in its rifle manufacturing company. On June 1, 2021 Serfling borrowed $100,000 from the Greeley Bank, 8\% interest, payments due on June 1 each year, due in 8 years (his only debt). On this date, Serfling began work on the building. Serfling paid his contractor payments of $30,000 on June 1,$50,000 on August 1 , and $30,000 on October 1 . The building was ready to be used on November 1, 2021. Serfling has a 12/31 year end. Problem 4: Consider the two situations independently (and SHOW WORK!). (A) The Martha Corporation had equipment with a cost of $60,000 and book value of $35,000 that she traded, along with $20,000 for a new piece of equipment that was worth $70,000. There was commercial substance for this transaction. Prepare the journal entry for the trade. (B) The Serfling Company wanted to construct a building to be used in its rifle manufacturing company. On June 1, 2021 Serfling borrowed $100,000 from the Greeley Bank, 8\% interest, payments due on June 1 each year, due in 8 years (his only debt). On this date, Serfling began work on the building. Serfling paid his contractor payments of $30,000 on June 1,$50,000 on August 1 , and $30,000 on October 1 . The building was ready to be used on November 1, 2021. Serfling has a 12/31 year end Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started