Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem #4: How much will Joe have in his account after 10 quarters, if he invested $1,200 today at a 12% interest compounded monthly knowing

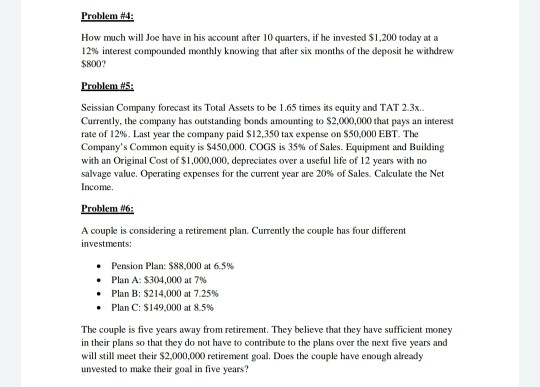

Problem #4: How much will Joe have in his account after 10 quarters, if he invested $1,200 today at a 12% interest compounded monthly knowing that after six months of the deposit he withdrew SROO? Problem #5: Seissian Company forecast its Total Assets to be 1.65 times its equity and TAT 2.3x. Currently, the company has outstanding bonds amounting to $2,000,000 that pays an interest rate of 12%. Last year the company paid $12,350 tax expense on S50,000 EBT. The Company's Common equity is $450,000. COGS is 35% of Sales. Equipment and Building with an Original Cost of $1,000,000, depreciates over a useful life of 12 years with no salvage value, Operating expenses for the current year are 20% of Sales Calculate the Net Income Problem 16: A couple is considering a retirement plan. Currently the couple has four different investments: Pension Plan: $88,000 at 6.5% Plan A: $304,000 at 7% Plan B: $214,000 at 7.25% Plan C: $149,000 at 85% The couple is five years away from retirement. They believe that they have sufficient money in their plans so that they do not have to contribute to the plans over the next five years and will still meet their $2,000,000 retirement goal. Does the couple have enough already unvested to make their goal in five years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started