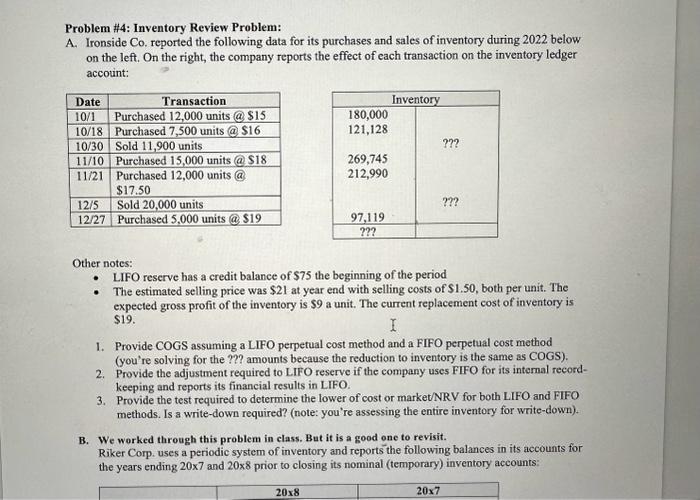

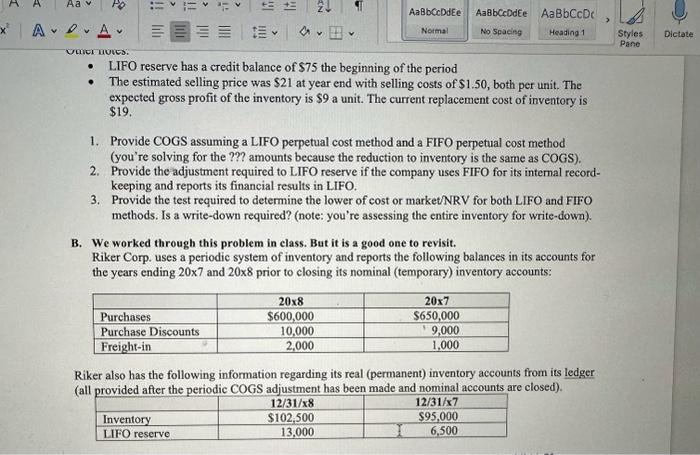

Problem \#4: Inventory Review Problem: A. Ironside Co. reported the following data for its purchases and sales of inventory during 2022 below on the left. On the right, the company reports the effect of each transaction on the inventory ledger accouint: Other notes: - LIFO reserve has a credit balance of $75 the beginning of the period - The estimated selling price was $21 at year end with selling costs of $1.50, both per unit. The expected gross profit of the inventory is $9 a unit. The current replacement cost of inventory is $19. I 1. Provide COGS assuming a LIFO perpetual cost method and a FIFO perpetual cost method (you're solving for the ??? amounts because the reduction to inventory is the same as COGS). 2. Provide the adjustment required to LIFO reserve if the company uses FIFO for its internal recordkeeping and reports its financial results in LIFO. 3. Provide the test required to determine the lower of cost or market/NRV for both LIFO and FIFO methods. Is a write-down required? (note: you're assessing the entire inventory for write-down). B. We worked through this problem in class. But it is a good one to revisit. Riker Corp. uses a periodic system of inventory and reports the following balances in its accounts for the years ending 207 and 208 prior to closing its nominal (temporary) inventory accounts: - LIFO reserve has a credit balance of $75 the beginning of the period - The estimated selling price was $21 at year end with selling costs of $1.50, both per unit. The expected gross profit of the inventory is $9 a unit. The current replacement cost of inventory is $19. 1. Provide COGS assuming a LIFO perpetual cost method and a FIFO perpetual cost method (you're solving for the ?? amounts because the reduction to inventory is the same as COGS). 2. Provide the adjustment required to LIFO reserve if the company uses FIFO for its internal recordkeeping and reports its financial results in LIFO. 3. Provide the test required to determine the lower of cost or market/NRV for both LIFO and FIFO methods. Is a write-down required? (note: you're assessing the entire inventory for write-down). B. We worked through this problem in class. But it is a good one to revisit. Riker Corp. uses a periodic system of inventory and reports the following balances in its accounts for the years ending 207 and 208 prior to closing its nominal (temporary) inventory accounts: Riker also has the following information regarding its real (permanent) inventory accounts from its ledger (all nrovided after the neriodic COGS adiustment has been made and nominal accounts are closed)