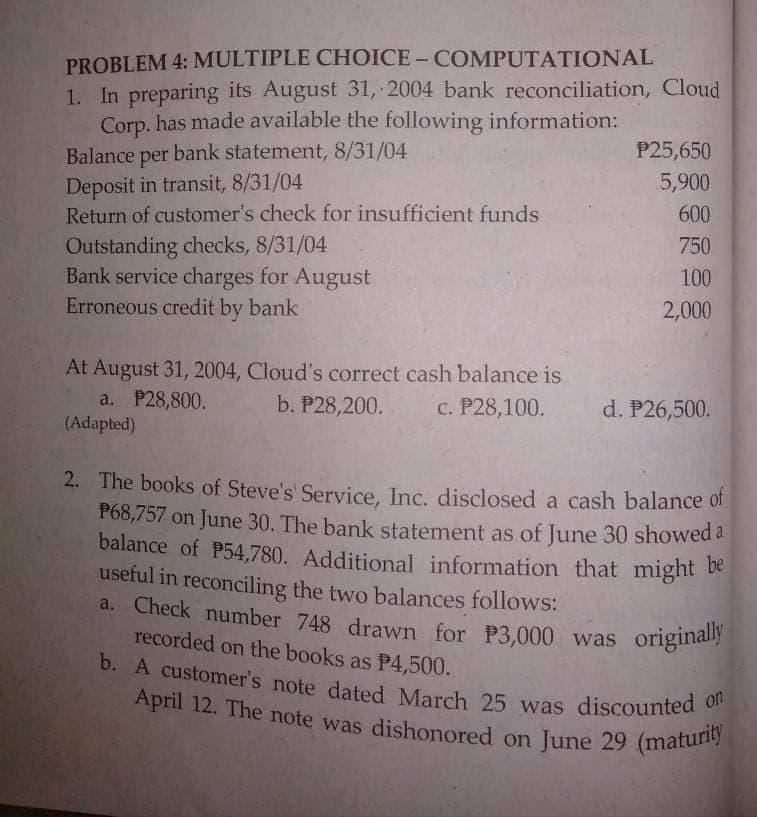

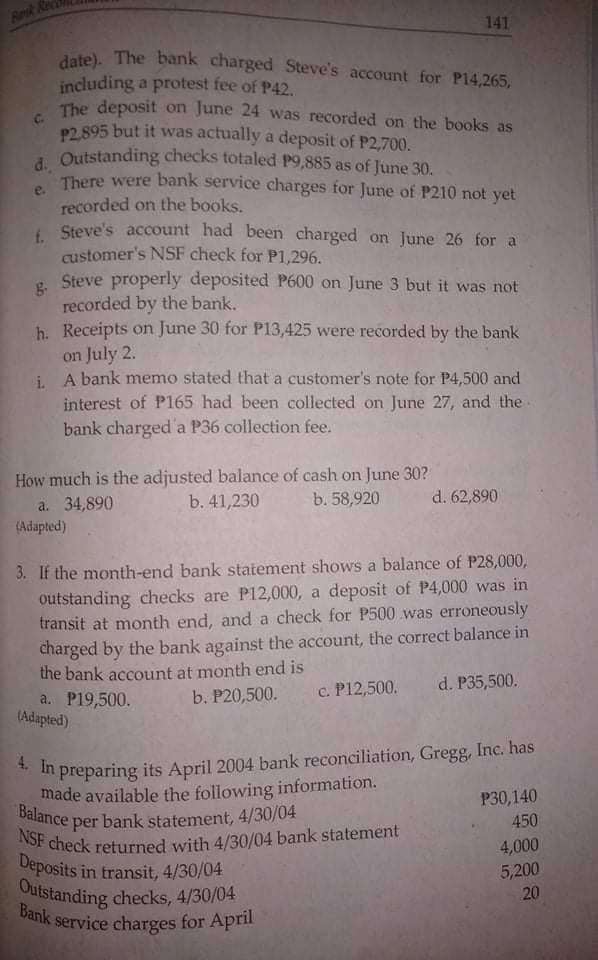

PROBLEM 4: MULTIPLE CHOICE - COMPUTATIONAL 1. In preparing its August 31, 2004 bank reconciliation, Cloud Corp. has made available the following information: Balance per bank statement, 8/31/04 P25,650 Deposit in transit, 8/31/04 5,900 Return of customer's check for insufficient funds 600 Outstanding checks, 8/31/04 750 Bank service charges for August 100 Erroneous credit by bank 2,000 At August 31, 2004, Cloud's correct cash balance is a. P28,800. b. P28,200. c. P28,100. (Adapted) d. P26,500 2. The books of Steve's Service, Inc. disclosed a cash balance of P68,757 on June 30. The bank statement as of June 30 showed a balance of P54,780. Additional information that might be useful in reconciling the two balances follows: a. Check number 748 drawn for P3,000 was originally recorded on the books as P4,500. b. A customer's note dated March 25 was discounted on April 12. The note was dishonored on June 29 (maturiy 141 c date). The bank charged Steve's account for P14,265, including a protest fee of P42. The deposit on June 24 was recorded on the books as P2.895 but it was actually a deposit of P2,700. d Outstanding checks totaled P9,885 as of June 30. e There were bank service charges for June of P210 not yet recorded on the books. Steve's account had been charged on June 26 for a customer's NSF check for P1,296. Steve properly deposited P600 on June 3 but it was not recorded by the bank. h. Receipts on June 30 for P13,425 were recorded by the bank 8 on July 2 i A bank memo stated that a customer's note for P4,500 and interest of P165 had been collected on June 27, and the bank charged a P36 collection fee. How much is the adjusted balance of cash on June 30? a. 34,890 b. 41,230 b. 58,920 d. 62,890 (Adapted) 3. If the month-end bank statement shows a balance of P28,000, outstanding checks are P12,000, a deposit of P4,000 was in transit at month end, and a check for P500 was erroneously charged by the bank against the account, the correct balance in the bank account at month end is a. P19,500 b. P20,500 c. P12,500. d. P35,500 (Adapted) Balance NSF check returned with 4/30/04 bank statement Deposits in transit, 4/30/04 Outstanding checks, 4/30/04 Bank service charges for April 4 In preparing its April 2004 bank reconciliation, Gregg, Inc. has made available the following information. per bank statement, 4/30/04 P30,140 450 4,000 5,200 20 PROBLEM 4: MULTIPLE CHOICE - COMPUTATIONAL 1. In preparing its August 31, 2004 bank reconciliation, Cloud Corp. has made available the following information: Balance per bank statement, 8/31/04 P25,650 Deposit in transit, 8/31/04 5,900 Return of customer's check for insufficient funds 600 Outstanding checks, 8/31/04 750 Bank service charges for August 100 Erroneous credit by bank 2,000 At August 31, 2004, Cloud's correct cash balance is a. P28,800. b. P28,200. c. P28,100. (Adapted) d. P26,500 2. The books of Steve's Service, Inc. disclosed a cash balance of P68,757 on June 30. The bank statement as of June 30 showed a balance of P54,780. Additional information that might be useful in reconciling the two balances follows: a. Check number 748 drawn for P3,000 was originally recorded on the books as P4,500. b. A customer's note dated March 25 was discounted on April 12. The note was dishonored on June 29 (maturiy 141 c date). The bank charged Steve's account for P14,265, including a protest fee of P42. The deposit on June 24 was recorded on the books as P2.895 but it was actually a deposit of P2,700. d Outstanding checks totaled P9,885 as of June 30. e There were bank service charges for June of P210 not yet recorded on the books. Steve's account had been charged on June 26 for a customer's NSF check for P1,296. Steve properly deposited P600 on June 3 but it was not recorded by the bank. h. Receipts on June 30 for P13,425 were recorded by the bank 8 on July 2 i A bank memo stated that a customer's note for P4,500 and interest of P165 had been collected on June 27, and the bank charged a P36 collection fee. How much is the adjusted balance of cash on June 30? a. 34,890 b. 41,230 b. 58,920 d. 62,890 (Adapted) 3. If the month-end bank statement shows a balance of P28,000, outstanding checks are P12,000, a deposit of P4,000 was in transit at month end, and a check for P500 was erroneously charged by the bank against the account, the correct balance in the bank account at month end is a. P19,500 b. P20,500 c. P12,500. d. P35,500 (Adapted) Balance NSF check returned with 4/30/04 bank statement Deposits in transit, 4/30/04 Outstanding checks, 4/30/04 Bank service charges for April 4 In preparing its April 2004 bank reconciliation, Gregg, Inc. has made available the following information. per bank statement, 4/30/04 P30,140 450 4,000 5,200 20