Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4: Phelps Dodge Corporation was one of the world's largest mining companies. They owned and mined copper deposits in Morenci, Arizona (and other

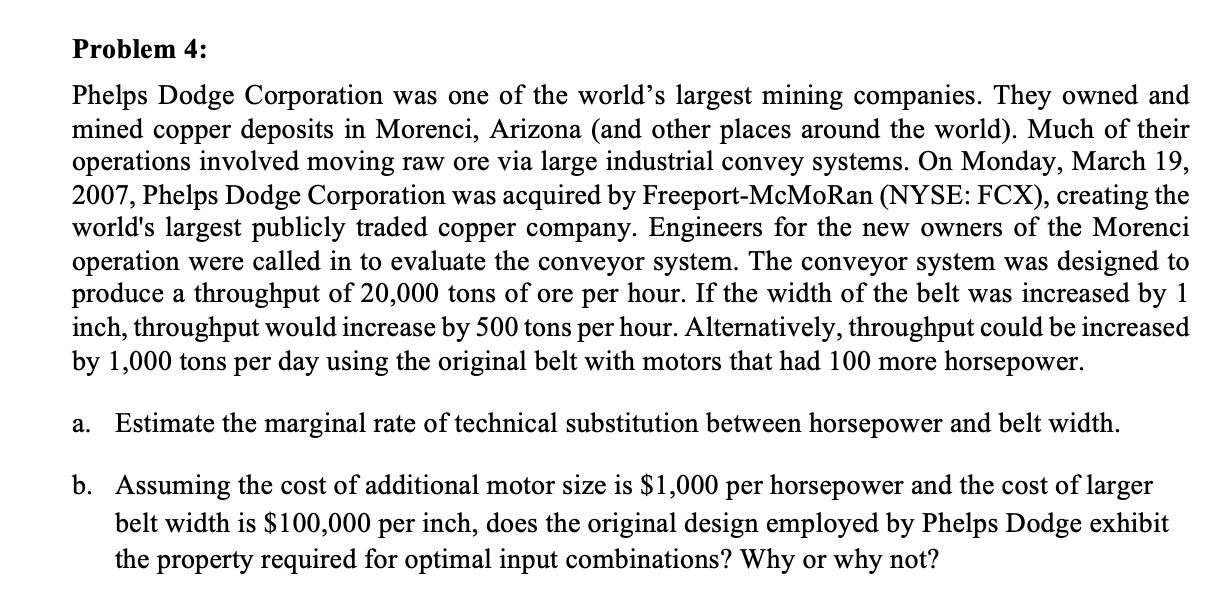

Problem 4: Phelps Dodge Corporation was one of the world's largest mining companies. They owned and mined copper deposits in Morenci, Arizona (and other places around the world). Much of their operations involved moving raw ore via large industrial convey systems. On Monday, March 19, 2007, Phelps Dodge Corporation was acquired by Freeport-McMoRan (NYSE: FCX), creating the world's largest publicly traded copper company. Engineers for the new owners of the Morenci operation were called in to evaluate the conveyor system. The conveyor system was designed to produce a throughput of 20,000 tons of ore per hour. If the width of the belt was increased by 1 inch, throughput would increase by 500 tons per hour. Alternatively, throughput could be increased by 1,000 tons per day using the original belt with motors that had 100 more horsepower. a. Estimate the marginal rate of technical substitution between horsepower and belt width. b. Assuming the cost of additional motor size is $1,000 per horsepower and the cost of larger belt width is $100,000 per inch, does the original design employed by Phelps Dodge exhibit the property required for optimal input combinations? Why or why not?

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A Marginal rate of technical substitution MRTS is the rate at which a firm can su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started