Answered step by step

Verified Expert Solution

Question

1 Approved Answer

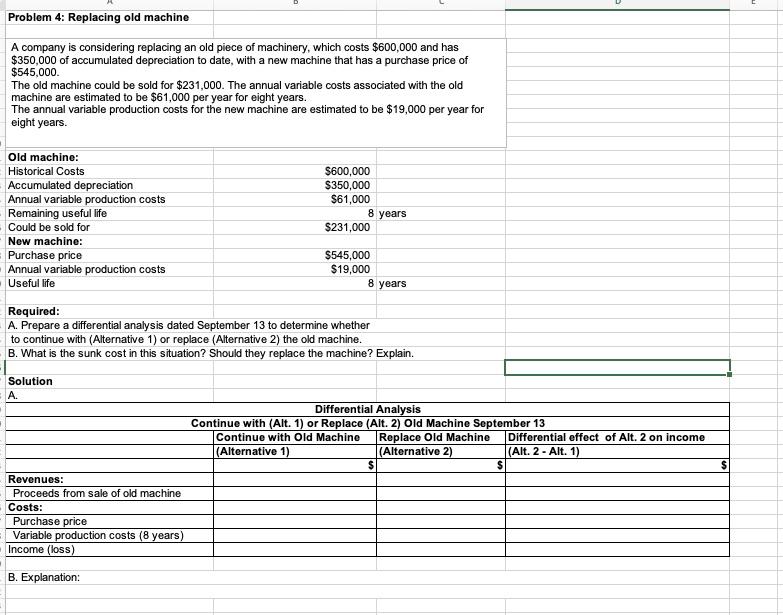

Problem 4: Replacing old machine A company is considering replacing an old piece of machinery, which costs $600,000 and has $350,000 of accumulated depreciation

Problem 4: Replacing old machine A company is considering replacing an old piece of machinery, which costs $600,000 and has $350,000 of accumulated depreciation to date, with a new machine that has a purchase price of $545,000. The old machine could be sold for $231,000. The annual variable costs associated with the old machine are estimated to be $61,000 per year for eight years. The annual variable production costs for the new machine are estimated to be $19,000 per year for eight years. Old machine: Historical Costs Accumulated depreciation $600,000 $350,000 Annual variable production costs $61,000 Remaining useful life 8 years Could be sold for $231,000 New machine: Purchase price Annual variable production costs $545,000 $19,000 Useful life 8 years Required: A. Prepare a differential analysis dated September 13 to determine whether to continue with (Alternative 1) or replace (Alternative 2) the old machine. B. What is the sunk cost in this situation? Should they replace the machine? Explain. Solution A. Revenues: Proceeds from sale of old machine Costs: Purchase price Variable production costs (8 years) Income (loss) B. Explanation: Differential Analysis Continue with (Alt. 1) or Replace (Alt. 2) Old Machine September 13 Continue with Old Machine (Alternative 1) Replace Old Machine (Alternative 2) $ $ Differential effect of Alt. 2 on income |(Alt. 2 Alt. 1) $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started