Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4. You are interested in the hedging of an American put option written on a stock index with a continuous dividend payment. You

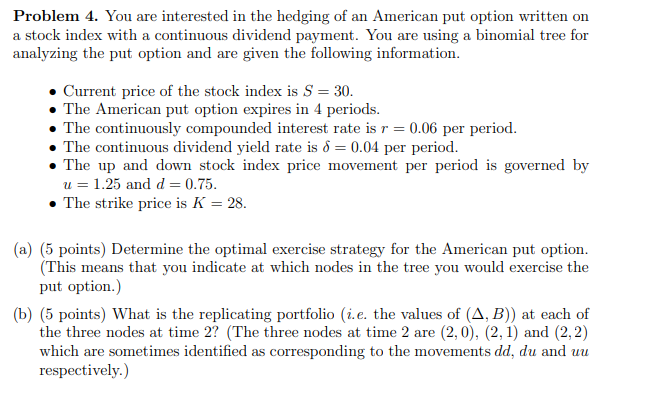

Problem 4. You are interested in the hedging of an American put option written on a stock index with a continuous dividend payment. You are using a binomial tree for analyzing the put option and are given the following information. Current price of the stock index is S = 30. The American put option expires in 4 periods. The continuously compounded interest rate is r = 0.06 per period. The continuous dividend yield rate is 6 = 0.04 per period. The up and down stock index price movement per period is governed by u = 1.25 and d = 0.75. The strike price is K = 28. (a) (5 points) Determine the optimal exercise strategy for the American put option. (This means that you indicate at which nodes in the tree you would exercise the put option.) (b) (5 points) What is the replicating portfolio (i.e. the values of (A, B)) at each of the three nodes at time 2? (The three nodes at time 2 are (2,0), (2, 1) and (2,2) which are sometimes identified as corresponding to the movements dd, du and uu respectively.)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine the optimal exercise strategy for the American put option in a binomial tree we compare the value of exercising the option early at each node to the value of holding the option a Optimal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started