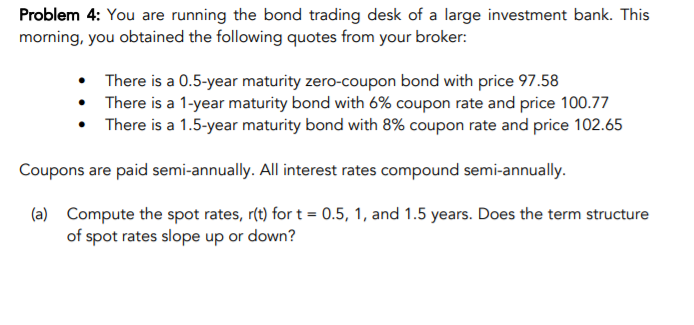

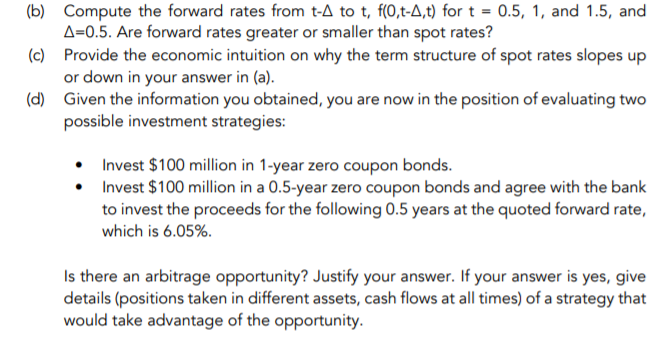

Problem 4: You are running the bond trading desk of a large investment bank. This morning, you obtained the following quotes from your broker: There is a 0.5-year maturity zero-coupon bond with price 97.58 There is a 1-year maturity bond with 6% coupon rate and price 100.77 There is a 1.5-year maturity bond with 8% coupon rate and price 102.65 Coupons are paid semi-annually. All interest rates compound semi-annually. (a) Compute the spot rates, r(t) for t = 0.5, 1, and 1.5 years. Does the term structure of spot rates slope up or down? (b) Compute the forward rates from t-A to t, f(0,t-A,t) for t = 0.5, 1, and 1.5, and A=0.5. Are forward rates greater or smaller than spot rates? (c) Provide the economic intuition on why the term structure of spot rates slopes up or down in your answer in (a). (d) Given the information you obtained, you are now in the position of evaluating two possible investment strategies: Invest $100 million in 1-year zero coupon bonds. Invest $ 100 million in a 0.5-year zero coupon bonds and agree with the bank to invest the proceeds for the following 0.5 years at the quoted forward rate, which is 6.05%. Is there an arbitrage opportunity? Justify your answer. If your answer is yes, give details (positions taken in different assets, cash flows at all times) of a strategy that would take advantage of the opportunity. Problem 4: You are running the bond trading desk of a large investment bank. This morning, you obtained the following quotes from your broker: There is a 0.5-year maturity zero-coupon bond with price 97.58 There is a 1-year maturity bond with 6% coupon rate and price 100.77 There is a 1.5-year maturity bond with 8% coupon rate and price 102.65 Coupons are paid semi-annually. All interest rates compound semi-annually. (a) Compute the spot rates, r(t) for t = 0.5, 1, and 1.5 years. Does the term structure of spot rates slope up or down? (b) Compute the forward rates from t-A to t, f(0,t-A,t) for t = 0.5, 1, and 1.5, and A=0.5. Are forward rates greater or smaller than spot rates? (c) Provide the economic intuition on why the term structure of spot rates slopes up or down in your answer in (a). (d) Given the information you obtained, you are now in the position of evaluating two possible investment strategies: Invest $100 million in 1-year zero coupon bonds. Invest $ 100 million in a 0.5-year zero coupon bonds and agree with the bank to invest the proceeds for the following 0.5 years at the quoted forward rate, which is 6.05%. Is there an arbitrage opportunity? Justify your answer. If your answer is yes, give details (positions taken in different assets, cash flows at all times) of a strategy that would take advantage of the opportunity