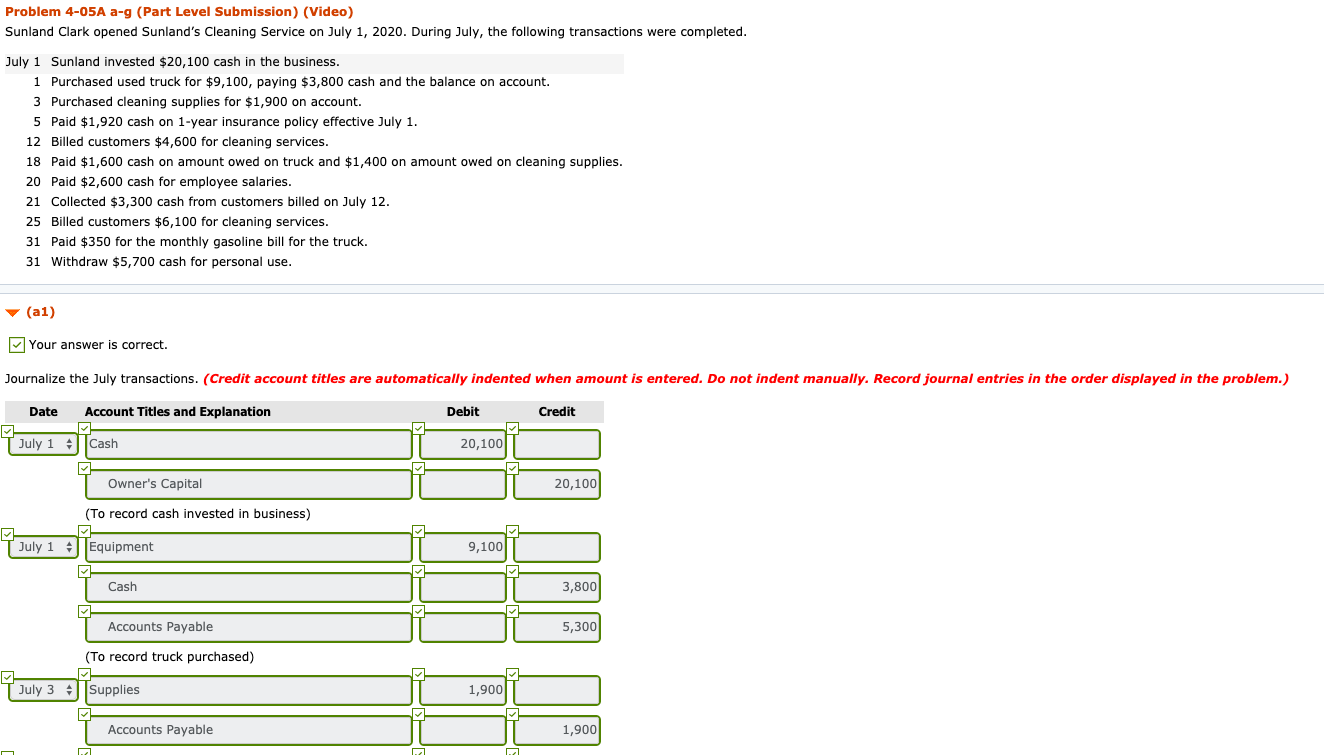

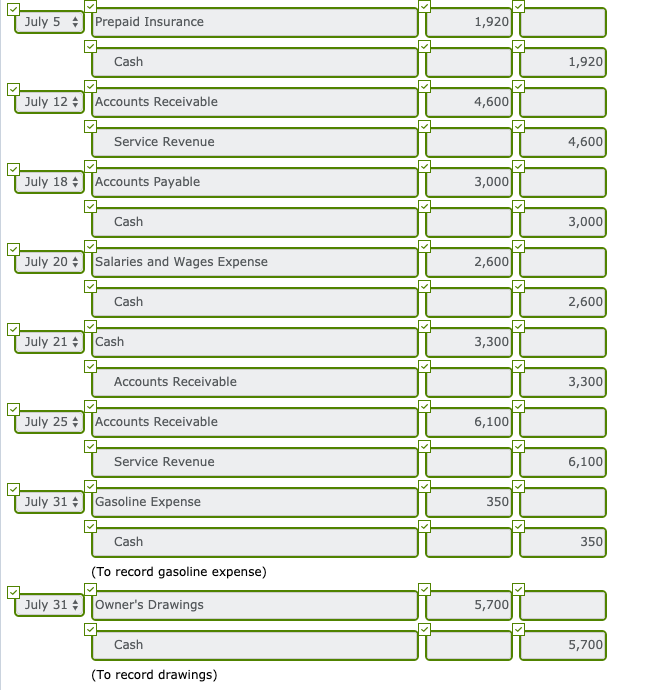

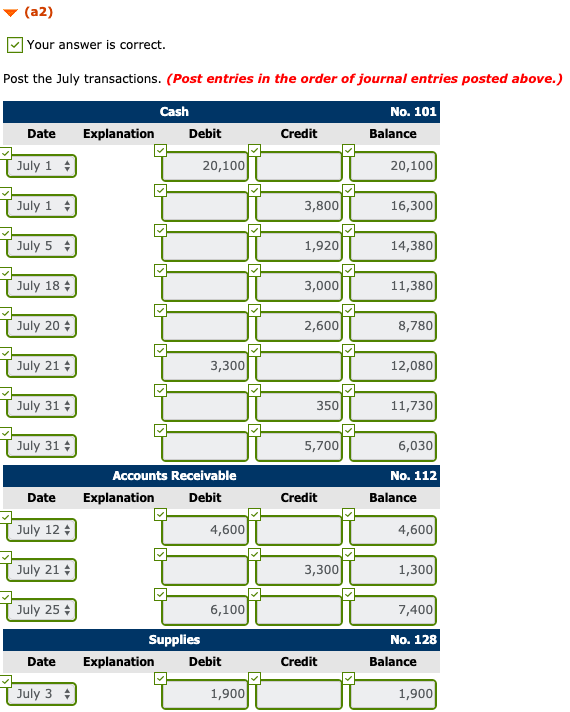

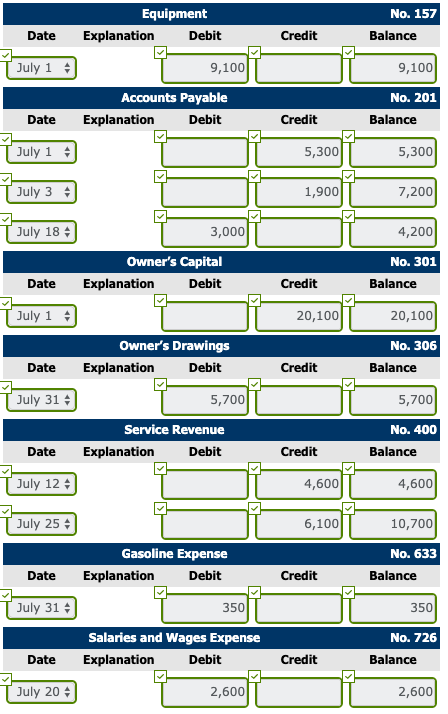

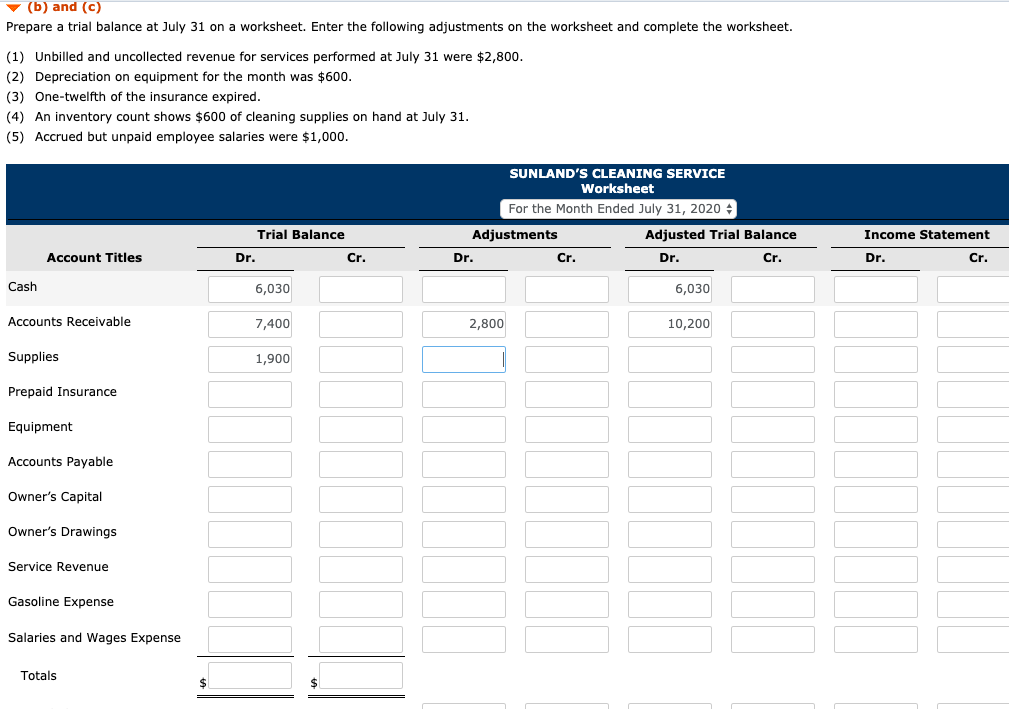

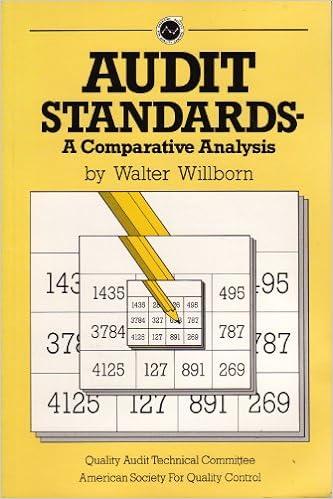

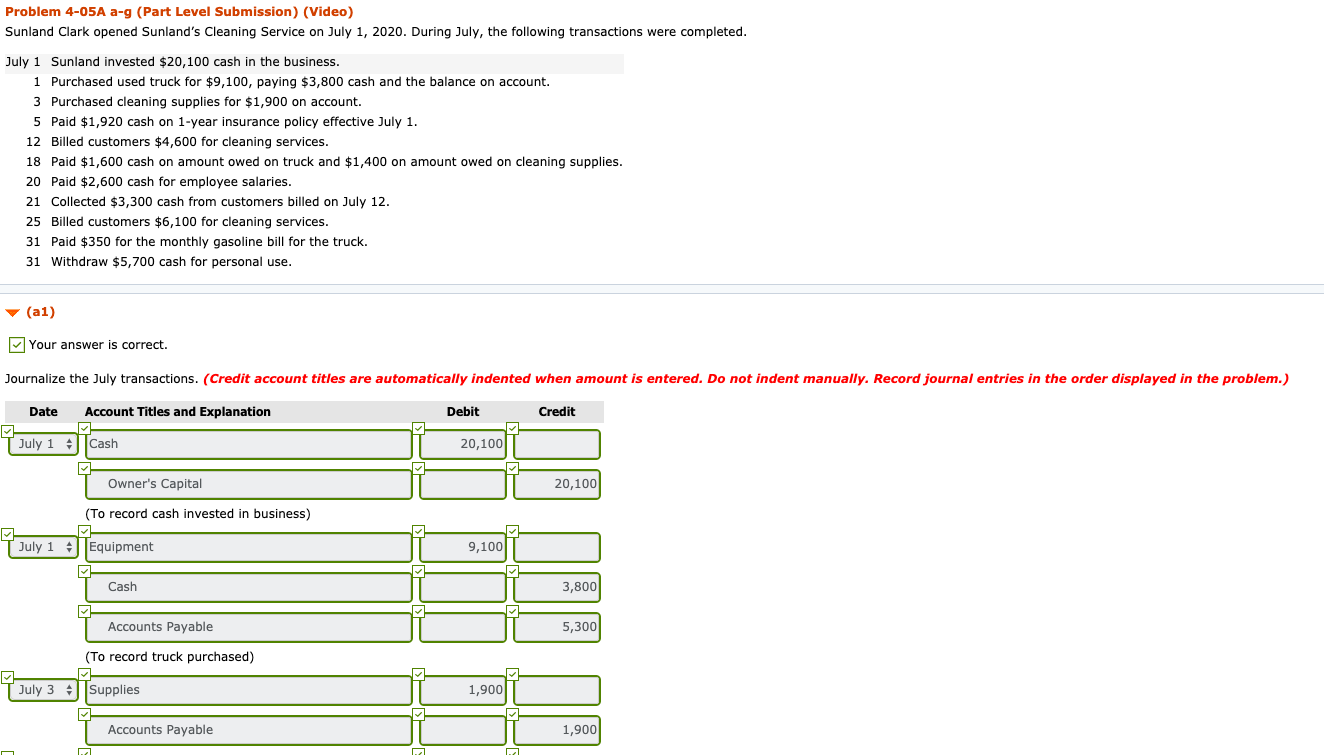

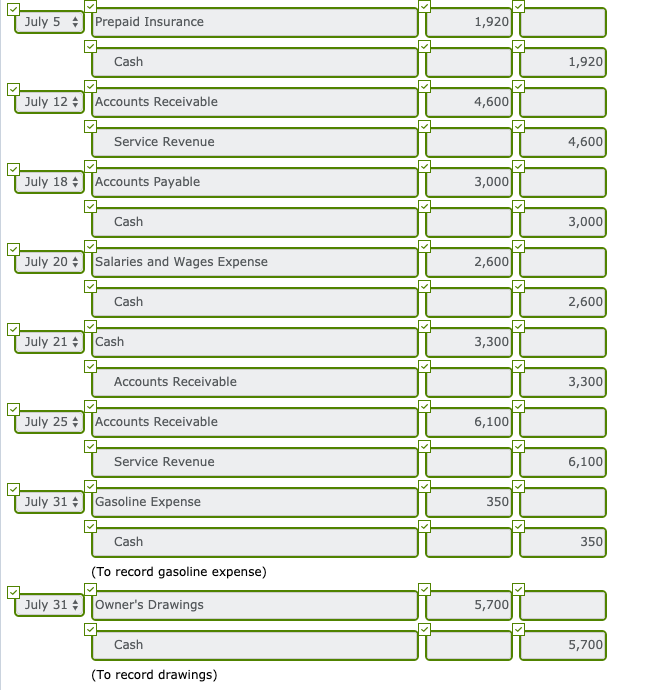

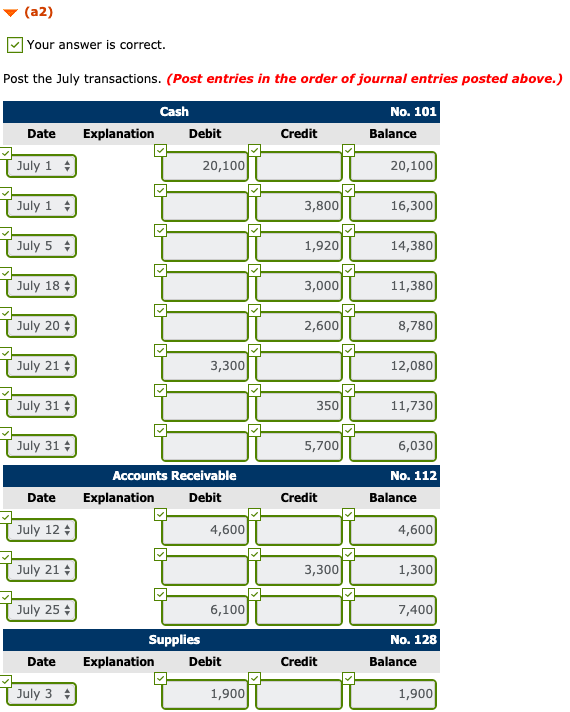

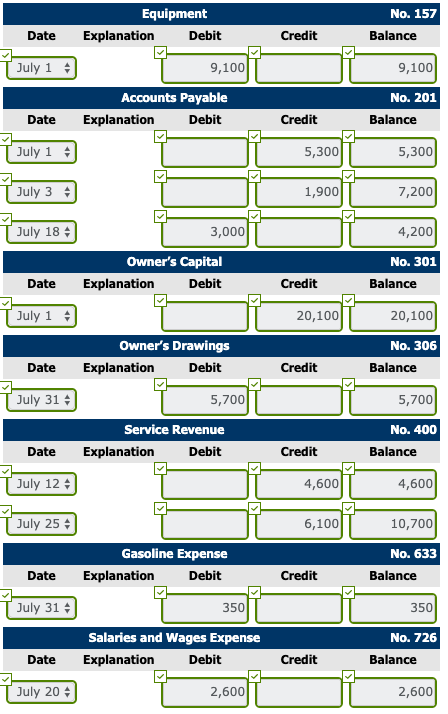

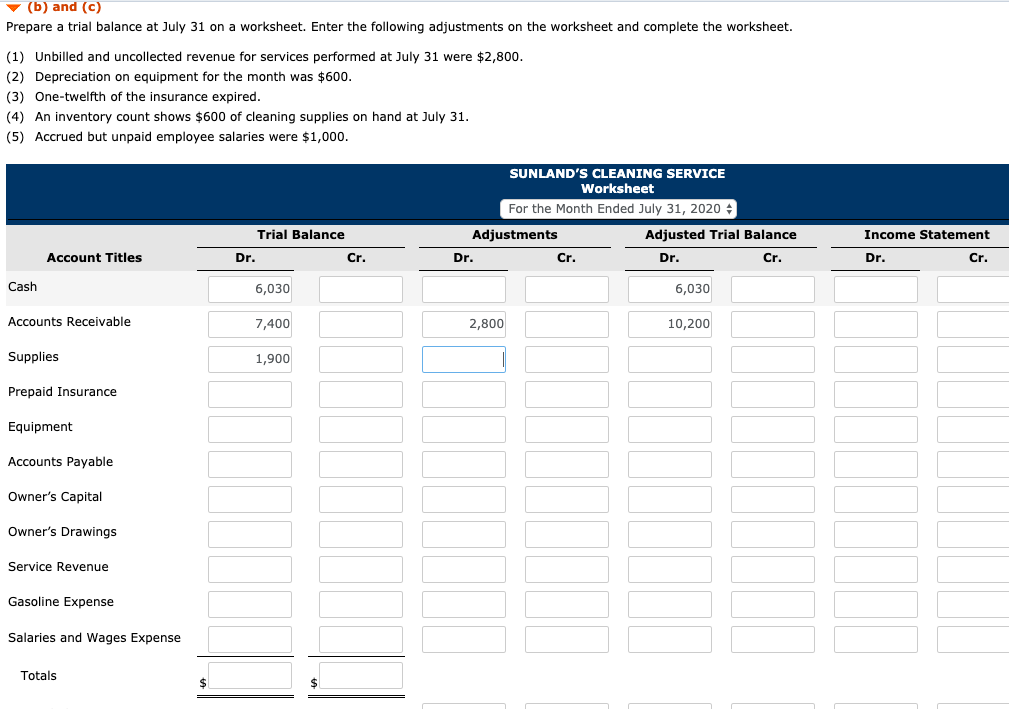

Problem 4-05A a-g (Part Level Submission) (Video) Sunland Clark opened Sunland's Cleaning Service on July 1, 2020. During July, the following transactions were completed. July 1 Sunland invested $20,100 cash in the business. 1 Purchased used truck for $9,100, paying $3,800 cash and the balance on account. 3 Purchased cleaning supplies for $1,900 on account. 5 Paid $1,920 cash on 1-year insurance policy effective July 1. 12 Billed customers $4,600 for cleaning services. 18 Paid $1,600 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. 20 Paid $2,600 cash for employee salaries. 21 Collected $3,300 cash from customers billed on July 12. 25 Billed customers $6,100 for cleaning services. 31 Paid $350 for the monthly gasoline bill for the truck. 31 Withdraw $5,700 cash for personal use. (a1) Your answer is correct. Journalize the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order displayed in the problem.) Date Account Titles and Explanation Debit Credit July 1 | Cash 20,100 Owner's Capital 20,100 (To record cash invested in business) July 1 | Equipment 9,100 Cash 3,800 Accounts Payable 5,300 (To record truck purchased) July 3 | Supplies 1,900 Accounts Payable 1,900 R July 5 + Prepaid Insurance 1,9201 Cash 1,920 July 12 | Accounts Receivable 4,600 JUJOU Service Revenue 4,600 July 18 | Accounts Payable 3,000 Cash 3,000 July 20 Salaries and Wages Expense 2,600 Cash 2,600 July 21 ) Cash 3,300 Accounts Receivable 3,300 July 25 ) Accounts Receivable 6,100 Service Revenue 6,100 July 31 | Gasoline Expense 350 Cash 350 (To record gasoline expense) July 31 ] Owner's Drawings 5,700 Cash 5,700 (To record drawings) (a2) Your answer is correct. Post the July transactions. (Post entries in the order of journal entries posted above.) Cash No. 101 Explanation Debit Credit Balance Date July 1 20,100 20,100 July 1 + 3,800 16,300 July 5 1,9201 14,380 July 18 3,000 11,380 July 20 2,600 8,780 July 21 3,300 12,080 July 31 350 11,730 July 31 5,700 6,030 Accounts Receivable Explanation Debit No. 112 Balance Date Credit July 12 4,600 4,600 July 21 3,300 1,300 July 25 6,100 7,400 Supplies Explanation Debit No. 128 Balance Date Credit July 3 4 1,900 1,900 No. 157 Equipment Explanation Debit Date Credit Balance July 1 2 9,100 9,100 Accounts Payable Explanation Debit No. 201 Balance Date Credit July 1 + 5,300 5,300 July 3 4 1,900 7,200 July 18 3,000 4,200 Owner's Capital Explanation Debit No. 301 Credit Balance Date July 1 20,100 20,100 Owner's Drawings Explanation Debit No. 306 Balance Date Credit July 31 5,700 5,700 Service Revenue Explanation Debit No. 400 Date Credit Balance July 12 4,600 4,600 July 25+ 6,100 10,700 Gasoline Expense Explanation Debit No. 633 Balance Date Credit July 31 350 350 No. 726 Salaries and Wages Expense Explanation Debit Date Credit Balance July 20 2,600 2,600 (b) and (c) Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for services performed at July 31 were $2,800. (2) Depreciation on equipment for the month was $600. (3) One-twelfth of the insurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $1,000. SUNLAND'S CLEANING SERVICE Worksheet For the Month Ended July 31, 2020 - Adjustments Adjusted Trial Balance Dr. Cr. Dr. Cr. Trial Balance Income Statement Dr. Cr. Account Titles Dr. Cr. Cash 6,030 6,030 Accounts Receivable 7,400 2,800 10,200 Supplies 1,900 Prepaid Insurance Equipment Accounts Payable Owner's Capital Owner's Drawings Service Revenue Gasoline Expense Salaries and Wages Expense Totals $ $ Depreciation Expense Accum. Depr.-Equipment Insurance Expense Supplies Expense Salaries and Wages Payable Totals Net Income Totals