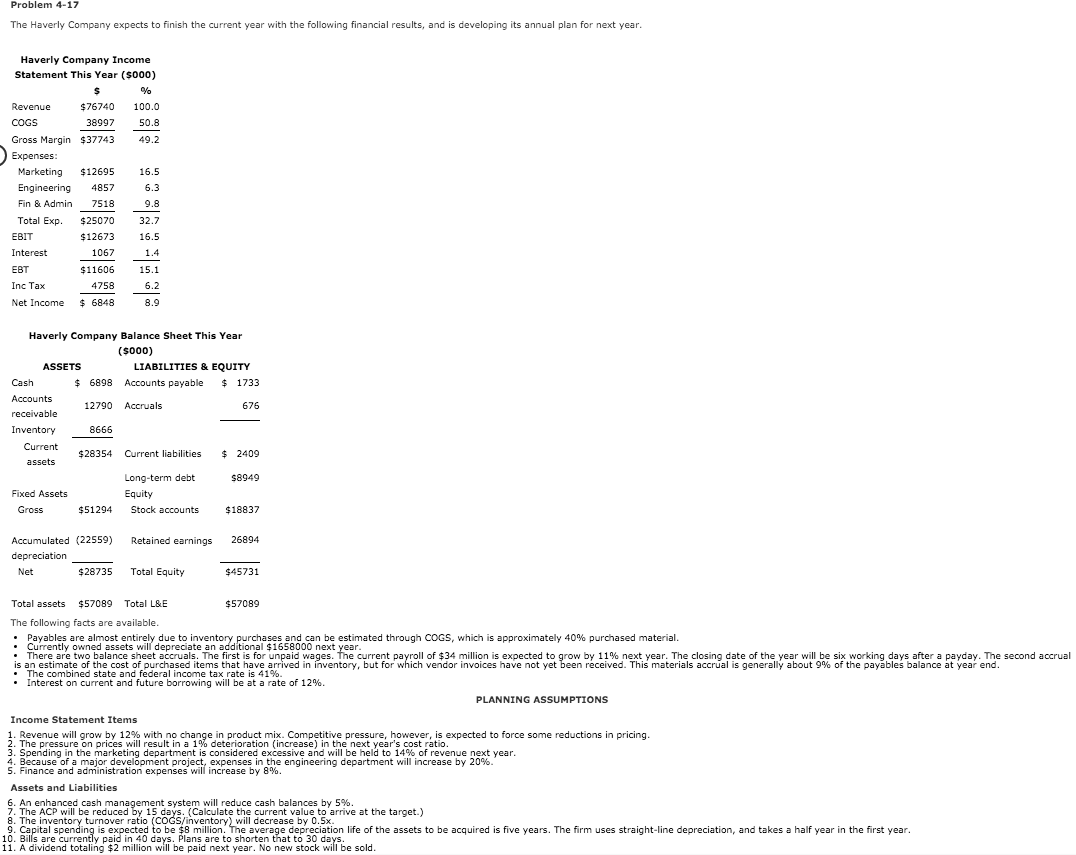

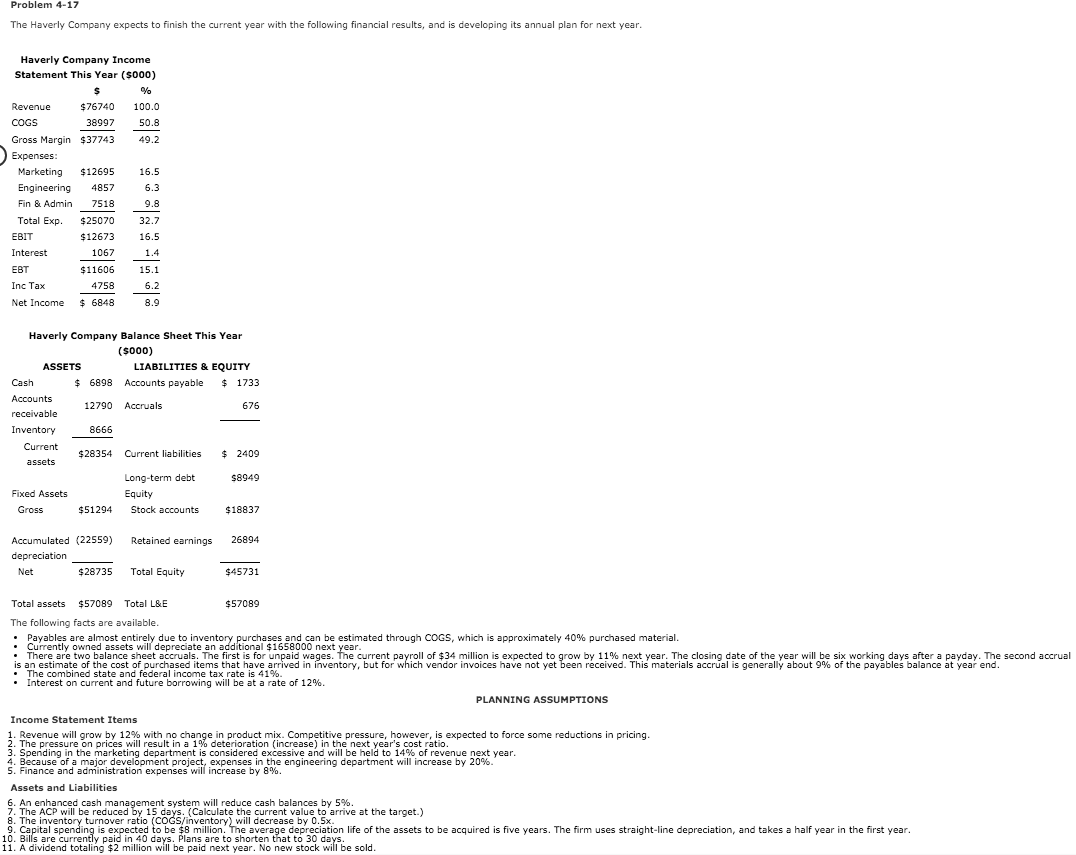

Problem 4-17 The Haverly Company expects to finish the current year with the following financial results, and is developing its annual plan for next year. Haverly Company Income Statement This Year (5000) 100.0 50.8 492 Revenue $76740 COGS 38997 Gross Margin $37743 Expenses: Marketing $12695 Engineering 4857 Fin & Admin 7518 Total Exp. $25070 EBIT $12673 Interest 1067 EBT $11605 Inc Tax 4758 Net Income $ 6848 512 Els bele ez Haverly Company Balance Sheet This Year (5000) ASSETS LIABILITIES & EQUITY Cash $ 6898 Accounts payable $ 1733 Accounts 12790 Accruals 676 receivable Inventory 8666 Current $28354 Current liabilities $2409 assets Long-term debt $8949 Fixed Assets Equity Gross $51294 Stock accounts $18837 Retained earnings 26894 Accumulated (22559) depreciation Net $28735 Total Equity $45731 Total assets $57089 Total L&E $57089 The following facts are available. Payables are almost entirely due to inventory purchases and can be estimated through COGS, which is approximately 40% purchased material. Currently owned assets will depreciate an additional $1658000 next year. There are two balance sheet accruals. The first is for unpaid wages. The current payroll of $34 million is expected to grow by 11% next year. The closing date of the year will be six working days after a payday. The second accrual is an estimate of the cost of purchased items that have arrived in inventory, but for which vendor invoices have not yet been received. This materials accrual is generally about 9% of the payables balance at year end. The combined state and federal income tax rate is 41%. Interest on current and future borrowing will be at a rate of 12%. PLANNING ASSUMPTIONS Income Statement Items 1. Revenue will grow by 12% with no change in product mix. Competitive pressure, however, is expected to force some reductions in pricing. 2. The pressure on prices will result in a 1% deterioration (increase) in the next year's cost ratio. 3. Spending in the marketing department is considered excessive and will be held to 14% of revenue next year. 4. Because of a major development project, expenses in the engineering department will increase by 20%. 5. Finance and administration expenses will increase by 8%. Assets and Liabilities 6. An enhanced cash management system will reduce cash balances by 5%. 7. The ACP will be reduced by 15 days. (Calculate the current value to arrive at the target.) 8. The inventory turnover ratio (COGS/inventory) will decrease by 0.5x 9. Capital spending is expected to be $8 million. The average depreciation life of the assets to be acquired is five years. The firm uses straight-line depreciation, and takes a half year in the first year. 10. Bills are currently paid in 40 days. Plans are to shorten that to 30 days. 11. A dividend totaling $2 million will be paid next year. No new stock will be sold. Problem 4-17 The Haverly Company expects to finish the current year with the following financial results, and is developing its annual plan for next year. Haverly Company Income Statement This Year (5000) 100.0 50.8 492 Revenue $76740 COGS 38997 Gross Margin $37743 Expenses: Marketing $12695 Engineering 4857 Fin & Admin 7518 Total Exp. $25070 EBIT $12673 Interest 1067 EBT $11605 Inc Tax 4758 Net Income $ 6848 512 Els bele ez Haverly Company Balance Sheet This Year (5000) ASSETS LIABILITIES & EQUITY Cash $ 6898 Accounts payable $ 1733 Accounts 12790 Accruals 676 receivable Inventory 8666 Current $28354 Current liabilities $2409 assets Long-term debt $8949 Fixed Assets Equity Gross $51294 Stock accounts $18837 Retained earnings 26894 Accumulated (22559) depreciation Net $28735 Total Equity $45731 Total assets $57089 Total L&E $57089 The following facts are available. Payables are almost entirely due to inventory purchases and can be estimated through COGS, which is approximately 40% purchased material. Currently owned assets will depreciate an additional $1658000 next year. There are two balance sheet accruals. The first is for unpaid wages. The current payroll of $34 million is expected to grow by 11% next year. The closing date of the year will be six working days after a payday. The second accrual is an estimate of the cost of purchased items that have arrived in inventory, but for which vendor invoices have not yet been received. This materials accrual is generally about 9% of the payables balance at year end. The combined state and federal income tax rate is 41%. Interest on current and future borrowing will be at a rate of 12%. PLANNING ASSUMPTIONS Income Statement Items 1. Revenue will grow by 12% with no change in product mix. Competitive pressure, however, is expected to force some reductions in pricing. 2. The pressure on prices will result in a 1% deterioration (increase) in the next year's cost ratio. 3. Spending in the marketing department is considered excessive and will be held to 14% of revenue next year. 4. Because of a major development project, expenses in the engineering department will increase by 20%. 5. Finance and administration expenses will increase by 8%. Assets and Liabilities 6. An enhanced cash management system will reduce cash balances by 5%. 7. The ACP will be reduced by 15 days. (Calculate the current value to arrive at the target.) 8. The inventory turnover ratio (COGS/inventory) will decrease by 0.5x 9. Capital spending is expected to be $8 million. The average depreciation life of the assets to be acquired is five years. The firm uses straight-line depreciation, and takes a half year in the first year. 10. Bills are currently paid in 40 days. Plans are to shorten that to 30 days. 11. A dividend totaling $2 million will be paid next year. No new stock will be sold