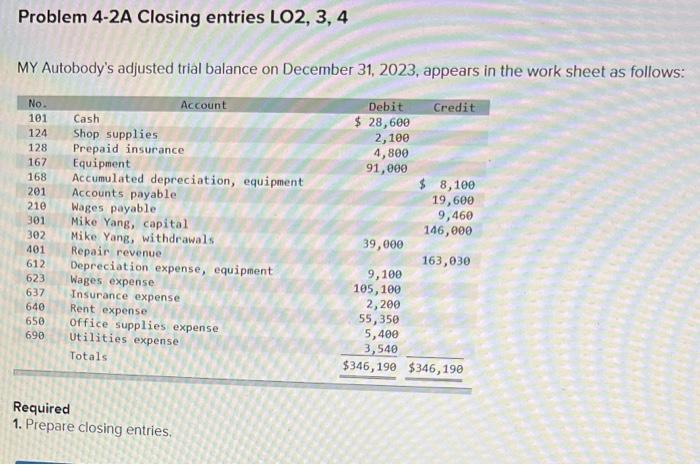

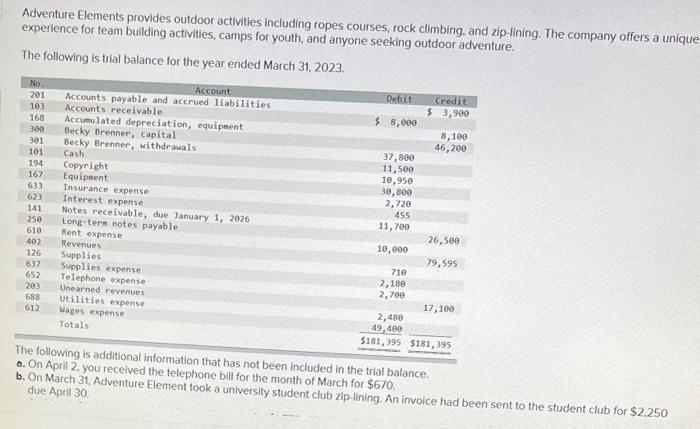

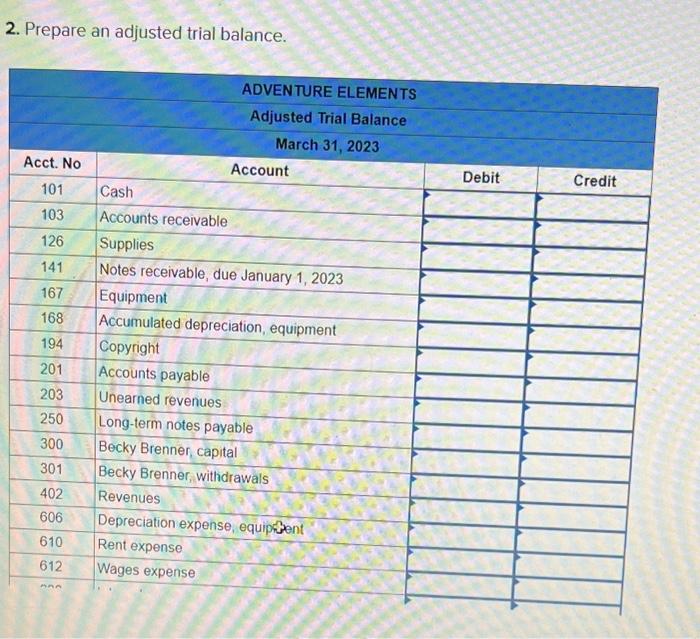

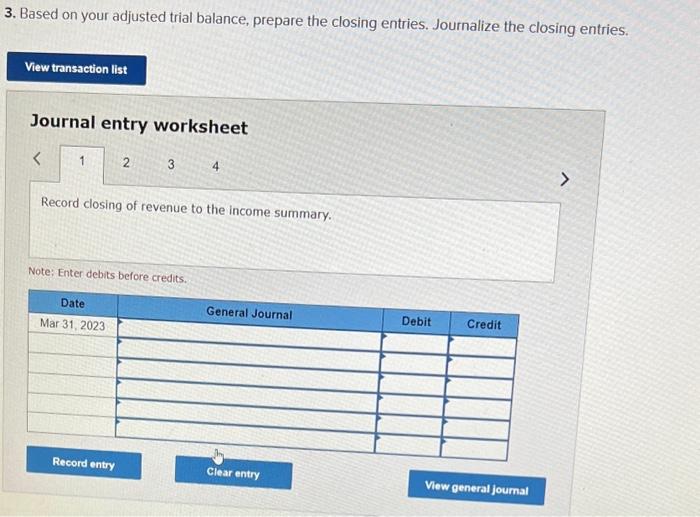

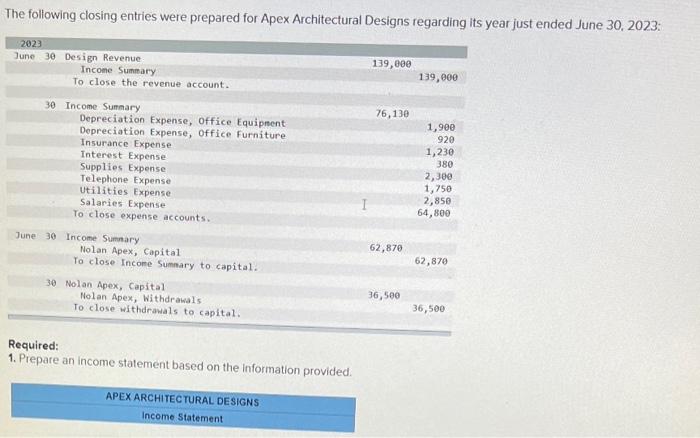

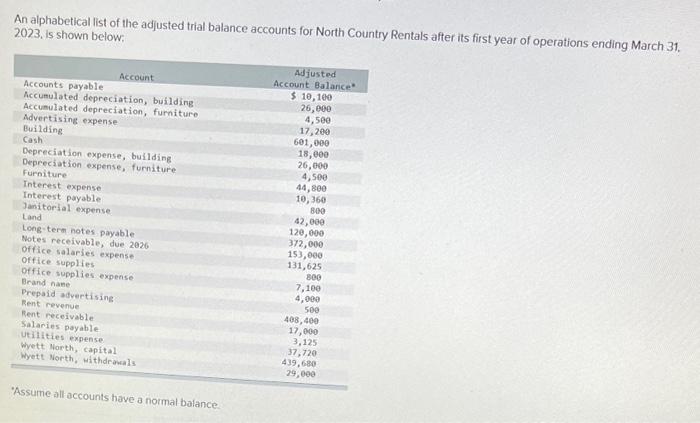

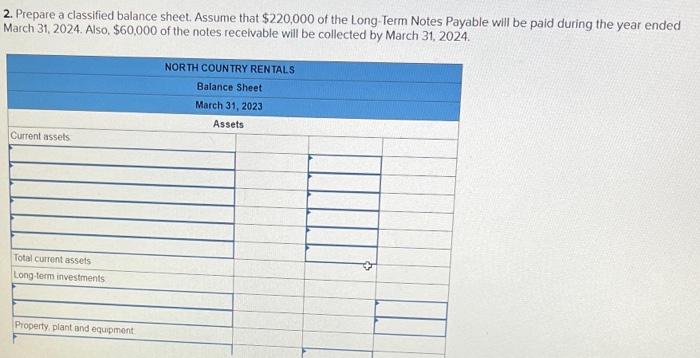

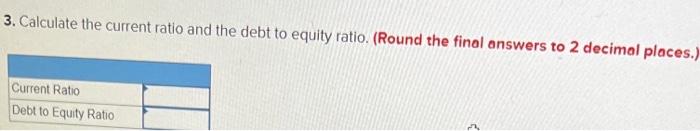

Problem 4-2A Closing entries LO2, 3, 4 MY Autobody's adjusted trial balance on December 31, 2023, appears in the work sheet as follows: Required 1. Prepare closing entries, 2. Prepare the post-closing trial balance at December 31,2023. Adventure Elements provides outdoor activities including ropes courses, rock climbing. and zip-lining. The company offers a unique experience for team building activities, camps for youth, and anyone seeking outdoor adventure. The following is trial balance for the year ended March 31, 2023. 0. On April 2, you recelved mormation that has not been included in the trial balance. b. On March 31, Adventure the telephone bill for the month of March for $670 due April 30. b. On March 31 , Adventure Element took a university student club zip-lining. An invoice had been sent to th due April 30. c. On March 31, the company held a teen's camp for $1,570. All tickets had been prepaid two weeks in adva d. The equipment has an estimated useful life of 20 years. Use straight-line method for depreciating Equipment. Required: 1. Prepare the missing adjusting entries for transactions a-d. Journal entry worksheet 2. Prepare an adjusted trial balance. Based on your adjusted trial balance, prepare the closing entries. Journalize the closing entries. Journal entry worksheet Record closing of revenue to the income summary. Note: Enter debits before credits. The following closing entries were prepared for Apex Architectural Designs regarding its year just ended June 30, 2023: Required: 1. Prepare an income statement based on the information provided. 2. Calculate the post-closing balance in the capital account at June 30,2023, given that the adjusted balance on June 30, 2022, was $87,500 An alphabetical list of the adjusted trial balance accounts for North Country Rentals after its first year of operations ending March 31. 2023. Is shown below: Mssume all accounts have a normal balance 2. Prepare a classified balance sheet. Assume that $220,000 of the Long-Term Notes Payable will be paid during the year ended March 31, 2024. Also, $60,000 of the notes recelvable will be collected by March 31, 2024. 3. Calculate the current ratio and the debt to equity ratio. (Round the final answers to 2 decimal places.)