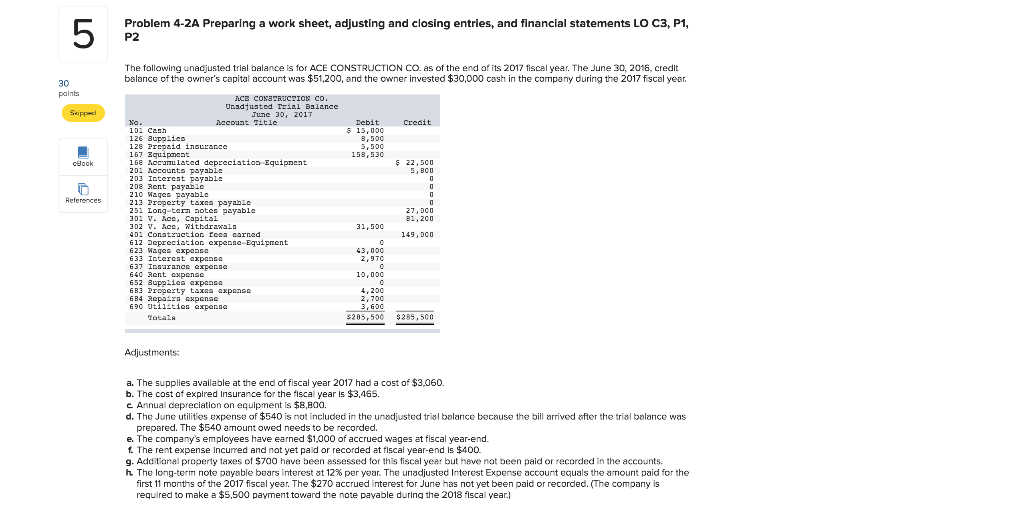

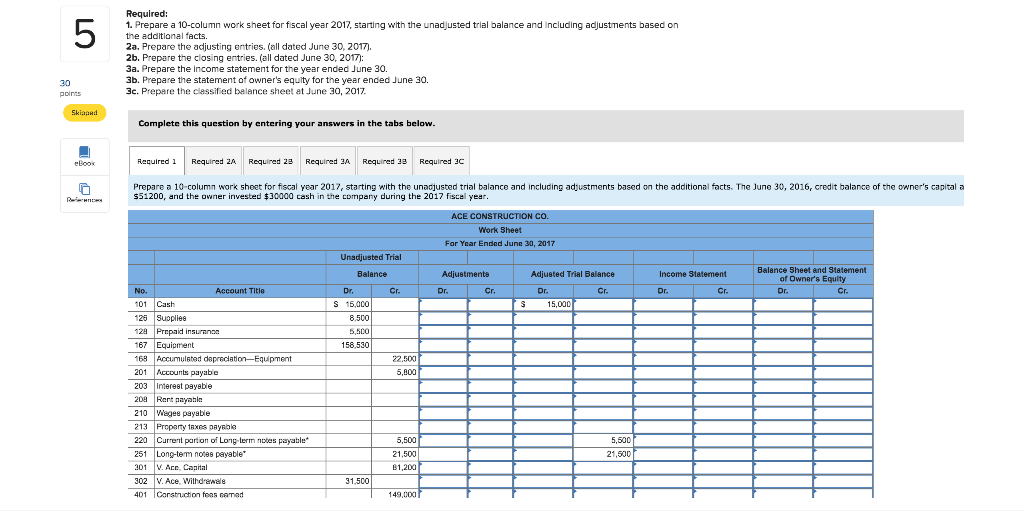

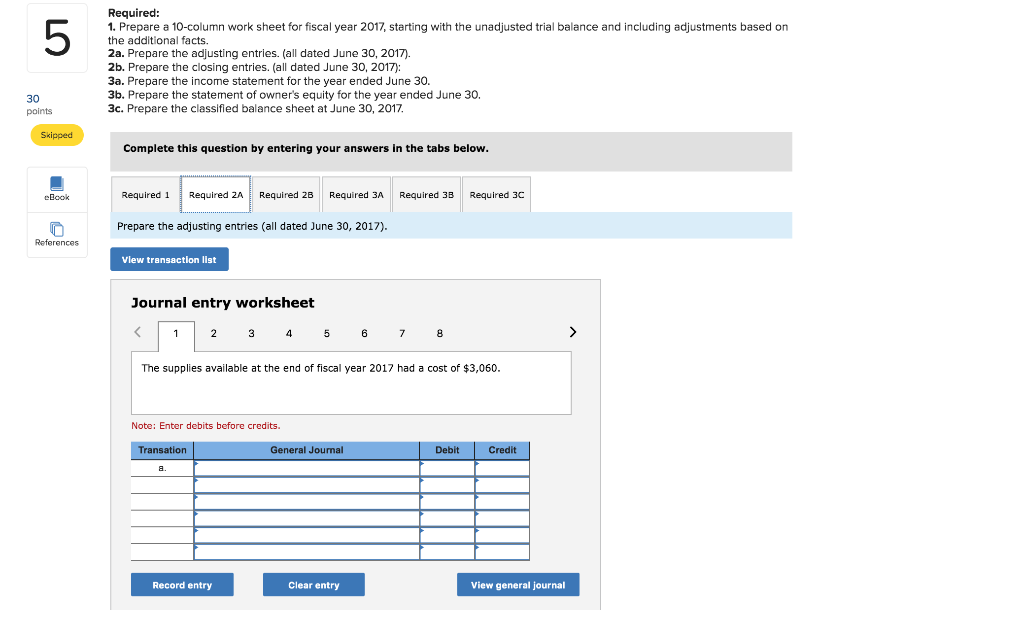

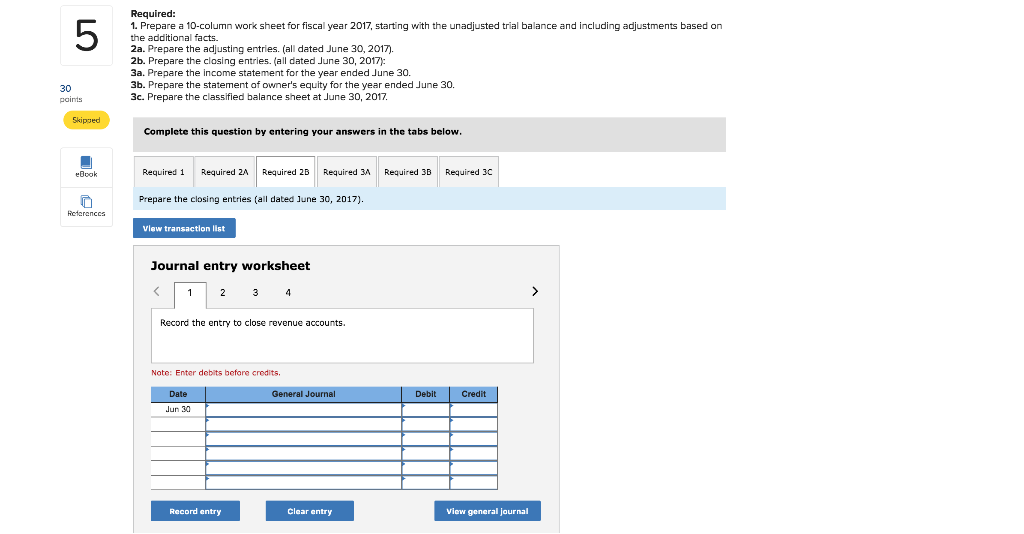

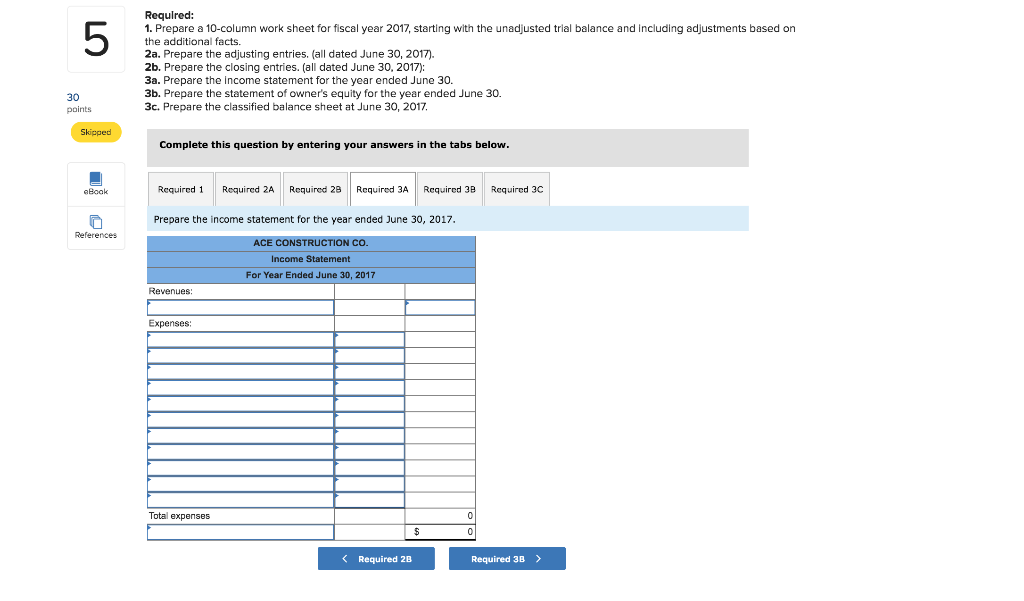

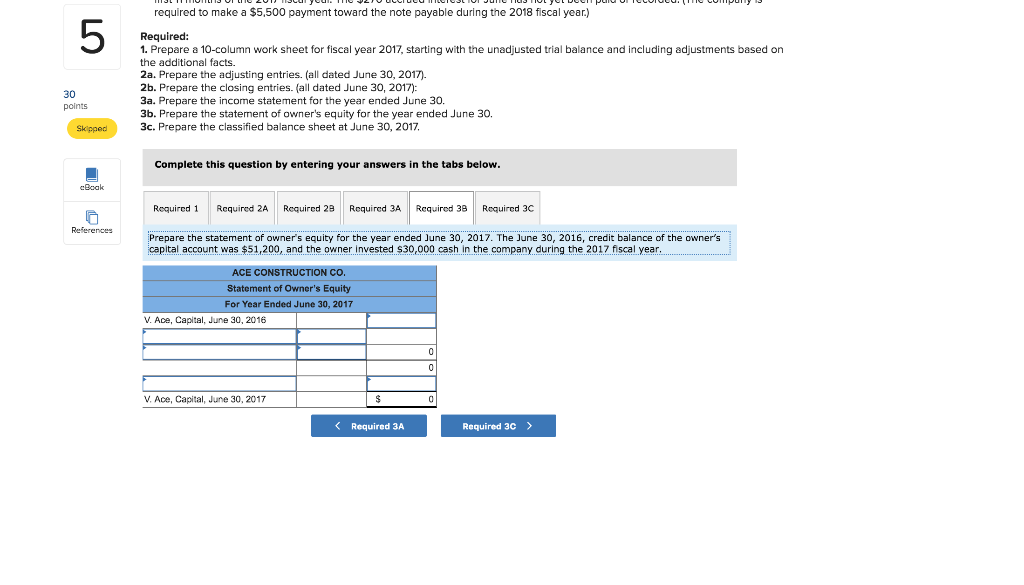

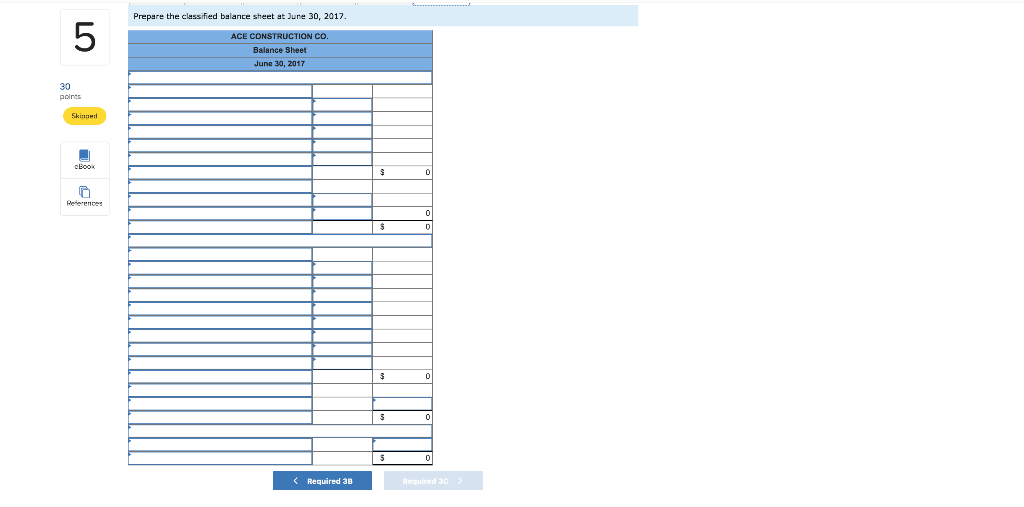

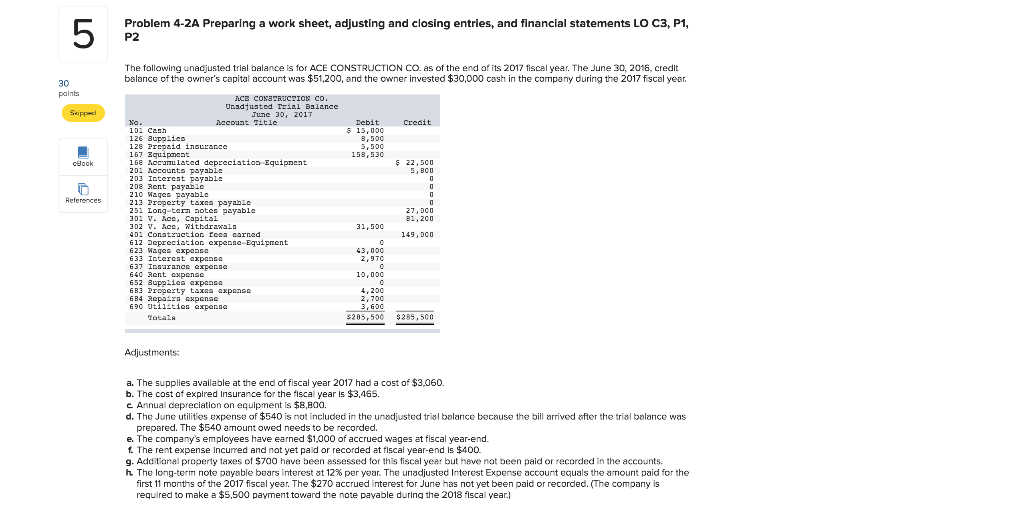

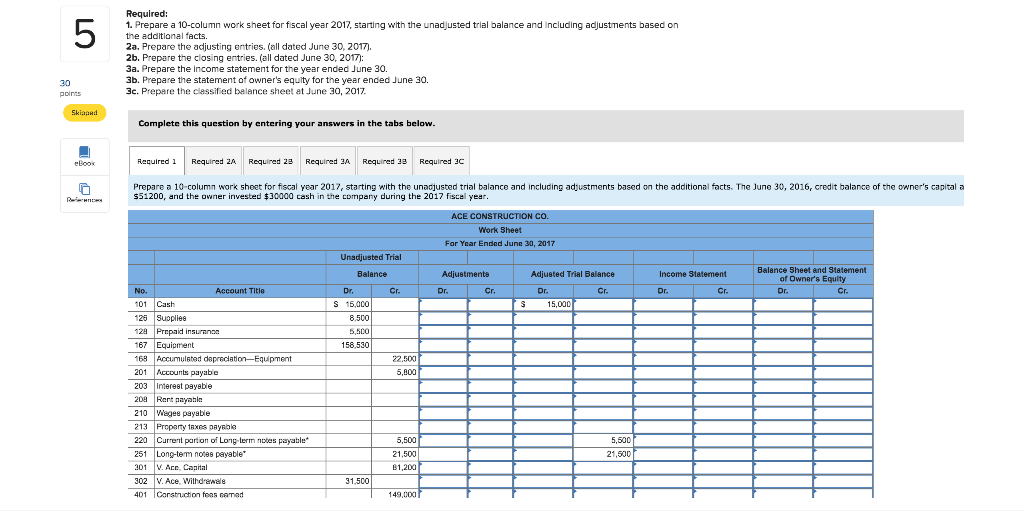

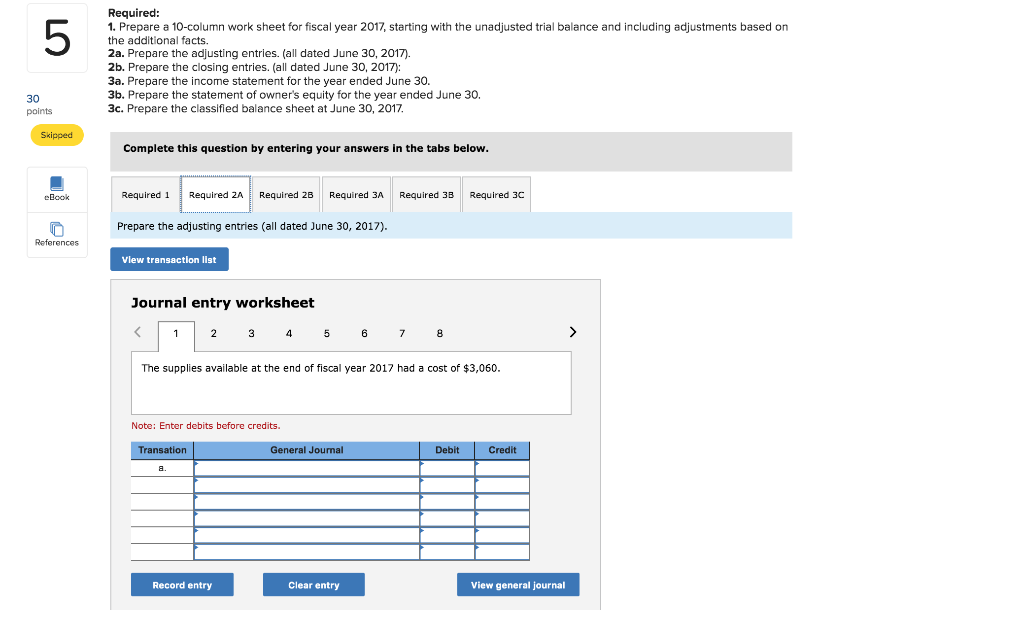

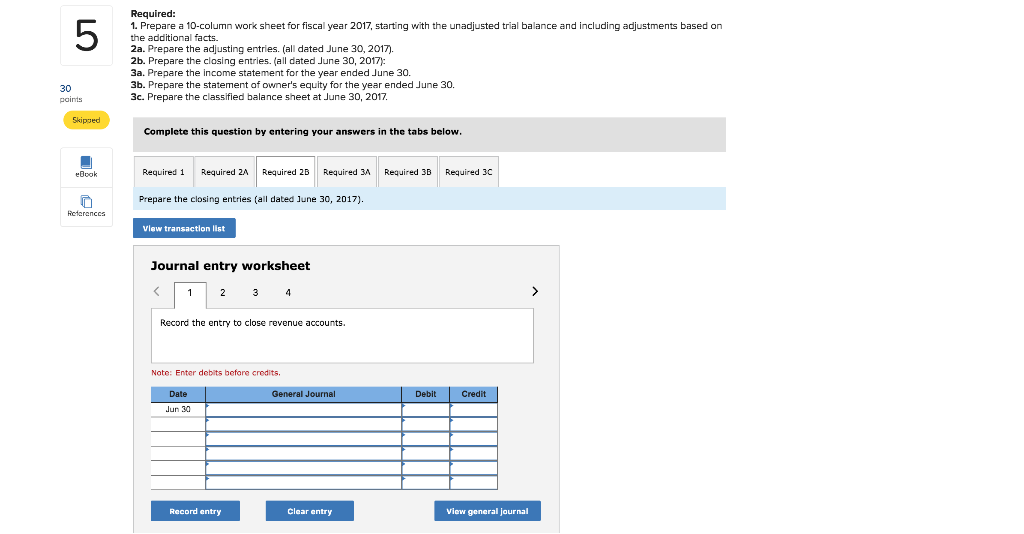

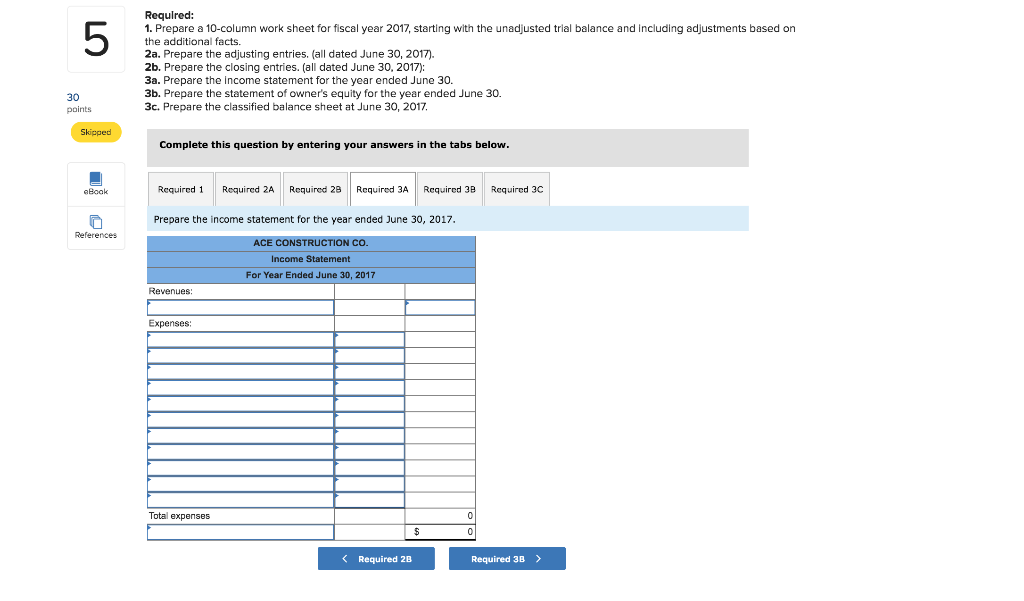

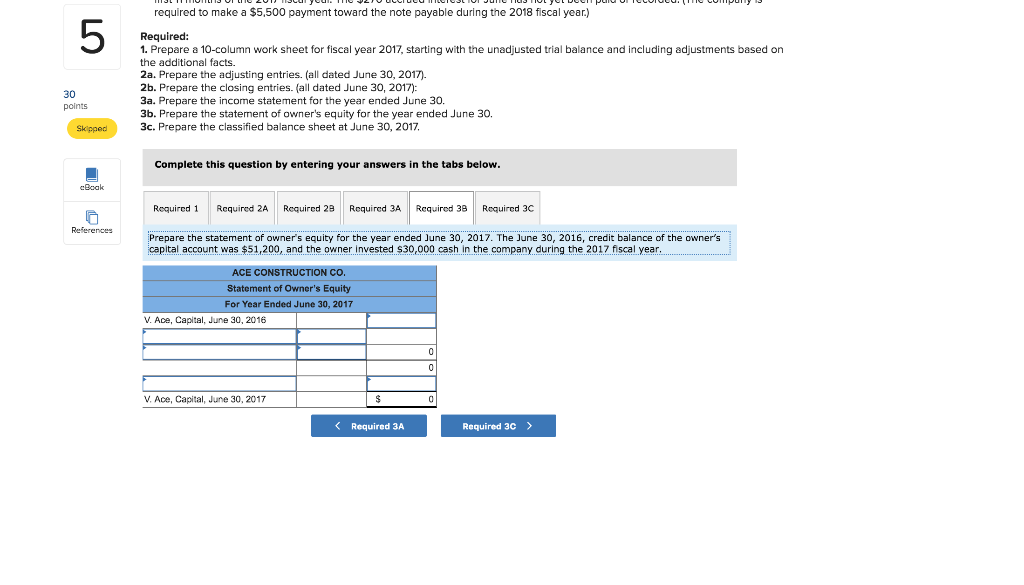

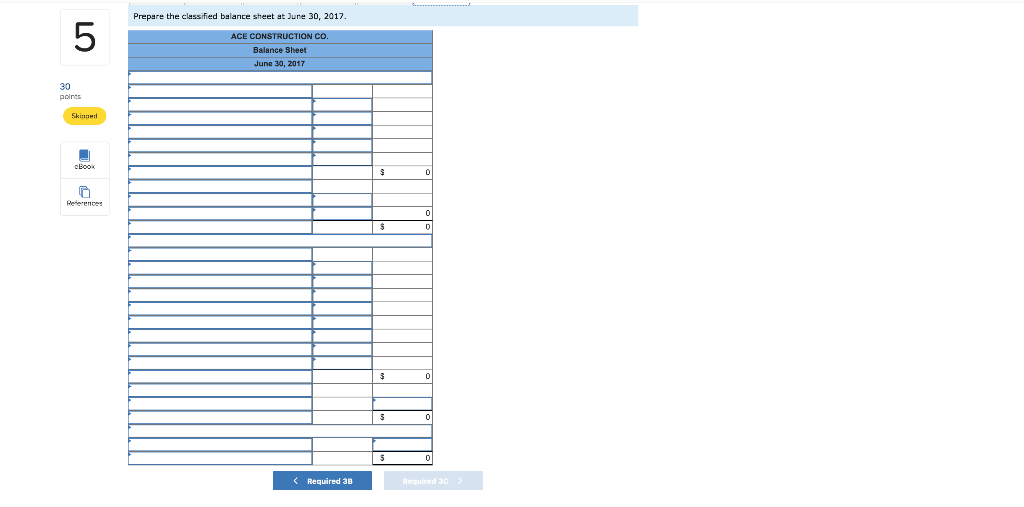

Problem 4-2A Preparing a work sheet, adjusting and closing entries, and financial statements LO C3, P1, P2 halance of the 's.cnital acrouct was 51 200 and the cwner invested $an co0.csh in the compamy.durig the 2017 fscal vear noint Inadtuated Teial Balance Skippd 201T Accpu Debit Credit No. R530 cHock peciation Equipnent 20 Aocort able 4 a t tazes payabie References o payable sen 30 31,500 an Conatractior feea carned 149.000 C Kscor av xpense-Eguipnent 43,000 2,970 10,000 684 2or xas axpanse c1 2.700 690 Totals $205,500 $285,500 Adiustments: The supplies available at the end of fiscal year 2017 had a cost of $3,060 b. The cost of explred Insurance for the fiscal year is $3,465. Annual depreciation on equipment is $8,800. ded in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $540 amount owed needs to be recorded. The company's employees have earned $1,000 of accrued wages :fiscal year-end. Aeitonal proery taxes of S700 hava been essessed for this fiscal vear but heve nat been oaid or recorded in the accounts. The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the st m ake a $5 500 le 2/0 8c le during the 2019 aid or recorded. (The company is LO Required: 1. Prepare a 10-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on Baara the adiusting entries, (all dated June 30, 2017). 5 2b. Prepare the closing entries. (all dated June 30, 2017): 3a. Prepare the income statement for the year ended June 30. ended June 30, 3c. Prepare the clessified balance sheet at June 30, 2017. Skiaged Complete this question by entering your answers in the tabs below. Reguired 2 Required 38 Required 3C Reauired 2A Reauired 28 Required 3A Dook 0-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts. The June 30, 2016, credit baland the owner's capital a Prepare a s51200, and the owner invested $30000 cash the company during the 2017 fiscel year. ACE CONSTRUCTION CO Work Sheet r Year Ended June 30, 2017 Unadjusted Trial Balance Sheet and Statement Balance Adjustments Adiusted Trial Belance Income Statement Owner's Equity Account Title C Cr. Dr Cr. Dr Cr. Cr Dr. S 15.000 15.000 Cash S 126 Suopliee 8,500 12 Prepaid insuranoe 5.500 167 Equipment 168 Accumulatod dapreciation-Equipment 201 Accunts payabe 158.530 22,500 5 800 20 yble 210 Wagee payable 213 Proparty taxes payable 220 Current partion of Long-term notes payatble 251 Long-tem notes payable 5,500 5,500 21.500 21,500 201 VAce, Capital B1,200 31,500 401 Carstruction feas eemed 149.000 LO Required: 1. Prepare a 10-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts. 2a. Prepare the adjusting entries. (all dated June 30, 2017). 2b. Prepare the closing entries. (all dated June 30, 2017): ne 30. 3b. Prepare the statement of owner's equity for the vear ended June 30. 3c. Prepare the classified balance sheet at June 30, 2017 ts Skipped Complete this question by entering your answers in the tabs below. Required 3A Required 1 Required 2 Required 2B Required 3B Required 3C eBook Prepare the adjusting entries (all dated June 30, 2017) References Vlew transaction Illst Journal entry worksheet 2 3 4 5 7 The supplies available at the end of fiscal year 2017 had a cost of $3,060. Note: Enter debits before credits. Transation General Joumal Debit Credit View general journal Record entry Clear entry LO Required: . Prepare a 10-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts 5 entries, (all dated June 30, 2017) 2b, Prepare the closing entries, (all dated June 30, 2017: 3a. Prepare the income statement 3b. Prepare the statement af owner's equity for the year ended June 30. Prepare the year ended June 30 30 balance sheet at June 30, paints Skiped Complete this question by entering your answers in the tabs below. eBeok Required 1 Required 2A Required 2B Required 3 Required 3B Required 3C Prepare the closing entries (all dated June 30, 2017). Reterenccs View transactlon list Journal entry worksheet 2 3 Record the entry to close revenue accounts. Note: Enter debits before crodits. General Journal Credit Date Debit Jun 30 Record entry Clear entry View general journal LO required to make a $5,500 payment toward the note payable during the 2018 fiscal year) Required: mn work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts. 2a. Prepare the adjusting entries. (all dated June 30, 2017). 2b. Prepare the closing entries. (all dated June 30, 2017): 3a. Prepare the income statement for the year ended June 30. 30 points ended June 30 3c. Prepare the classified halance sheet at une 30 2017 Skipped Complete this question by entering your answers in the tabs below. Dnak Required 38 Required Required 3A Required 2A Required 28 Required 3C References owner's equity for the year ended June 30, 2017. The June 30, 2016, credit balance of the owner's Prepare the statement capital account was $51,200, and the owner invested S30,000 cash in the company during the 2017 fiscal year. ACE CONSTRUCTION CO. Statement of Owner's Equity r Year EndeJune 30, 2017 Ace, Capital, June 30, 2016 , Ace, Capital , June 30, 2017 Required 3A Required 3C LO Prepare the classified balance sheet at June 30, 2017 5 ACE CONSTRUCTION CO. 30 points Skinned cBook Rederences Required 30 Required 3B LO Problem 4-2A Preparing a work sheet, adjusting and closing entries, and financial statements LO C3, P1, P2 halance of the 's.cnital acrouct was 51 200 and the cwner invested $an co0.csh in the compamy.durig the 2017 fscal vear noint Inadtuated Teial Balance Skippd 201T Accpu Debit Credit No. R530 cHock peciation Equipnent 20 Aocort able 4 a t tazes payabie References o payable sen 30 31,500 an Conatractior feea carned 149.000 C Kscor av xpense-Eguipnent 43,000 2,970 10,000 684 2or xas axpanse c1 2.700 690 Totals $205,500 $285,500 Adiustments: The supplies available at the end of fiscal year 2017 had a cost of $3,060 b. The cost of explred Insurance for the fiscal year is $3,465. Annual depreciation on equipment is $8,800. ded in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $540 amount owed needs to be recorded. The company's employees have earned $1,000 of accrued wages :fiscal year-end. Aeitonal proery taxes of S700 hava been essessed for this fiscal vear but heve nat been oaid or recorded in the accounts. The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the st m ake a $5 500 le 2/0 8c le during the 2019 aid or recorded. (The company is LO Required: 1. Prepare a 10-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on Baara the adiusting entries, (all dated June 30, 2017). 5 2b. Prepare the closing entries. (all dated June 30, 2017): 3a. Prepare the income statement for the year ended June 30. ended June 30, 3c. Prepare the clessified balance sheet at June 30, 2017. Skiaged Complete this question by entering your answers in the tabs below. Reguired 2 Required 38 Required 3C Reauired 2A Reauired 28 Required 3A Dook 0-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts. The June 30, 2016, credit baland the owner's capital a Prepare a s51200, and the owner invested $30000 cash the company during the 2017 fiscel year. ACE CONSTRUCTION CO Work Sheet r Year Ended June 30, 2017 Unadjusted Trial Balance Sheet and Statement Balance Adjustments Adiusted Trial Belance Income Statement Owner's Equity Account Title C Cr. Dr Cr. Dr Cr. Cr Dr. S 15.000 15.000 Cash S 126 Suopliee 8,500 12 Prepaid insuranoe 5.500 167 Equipment 168 Accumulatod dapreciation-Equipment 201 Accunts payabe 158.530 22,500 5 800 20 yble 210 Wagee payable 213 Proparty taxes payable 220 Current partion of Long-term notes payatble 251 Long-tem notes payable 5,500 5,500 21.500 21,500 201 VAce, Capital B1,200 31,500 401 Carstruction feas eemed 149.000 LO Required: 1. Prepare a 10-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts. 2a. Prepare the adjusting entries. (all dated June 30, 2017). 2b. Prepare the closing entries. (all dated June 30, 2017): ne 30. 3b. Prepare the statement of owner's equity for the vear ended June 30. 3c. Prepare the classified balance sheet at June 30, 2017 ts Skipped Complete this question by entering your answers in the tabs below. Required 3A Required 1 Required 2 Required 2B Required 3B Required 3C eBook Prepare the adjusting entries (all dated June 30, 2017) References Vlew transaction Illst Journal entry worksheet 2 3 4 5 7 The supplies available at the end of fiscal year 2017 had a cost of $3,060. Note: Enter debits before credits. Transation General Joumal Debit Credit View general journal Record entry Clear entry LO Required: . Prepare a 10-column work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts 5 entries, (all dated June 30, 2017) 2b, Prepare the closing entries, (all dated June 30, 2017: 3a. Prepare the income statement 3b. Prepare the statement af owner's equity for the year ended June 30. Prepare the year ended June 30 30 balance sheet at June 30, paints Skiped Complete this question by entering your answers in the tabs below. eBeok Required 1 Required 2A Required 2B Required 3 Required 3B Required 3C Prepare the closing entries (all dated June 30, 2017). Reterenccs View transactlon list Journal entry worksheet 2 3 Record the entry to close revenue accounts. Note: Enter debits before crodits. General Journal Credit Date Debit Jun 30 Record entry Clear entry View general journal LO required to make a $5,500 payment toward the note payable during the 2018 fiscal year) Required: mn work sheet for fiscal year 2017, starting with the unadjusted trial balance and including adjustments based on the additional facts. 2a. Prepare the adjusting entries. (all dated June 30, 2017). 2b. Prepare the closing entries. (all dated June 30, 2017): 3a. Prepare the income statement for the year ended June 30. 30 points ended June 30 3c. Prepare the classified halance sheet at une 30 2017 Skipped Complete this question by entering your answers in the tabs below. Dnak Required 38 Required Required 3A Required 2A Required 28 Required 3C References owner's equity for the year ended June 30, 2017. The June 30, 2016, credit balance of the owner's Prepare the statement capital account was $51,200, and the owner invested S30,000 cash in the company during the 2017 fiscal year. ACE CONSTRUCTION CO. Statement of Owner's Equity r Year EndeJune 30, 2017 Ace, Capital, June 30, 2016 , Ace, Capital , June 30, 2017 Required 3A Required 3C LO Prepare the classified balance sheet at June 30, 2017 5 ACE CONSTRUCTION CO. 30 points Skinned cBook Rederences Required 30 Required 3B LO