Answered step by step

Verified Expert Solution

Question

1 Approved Answer

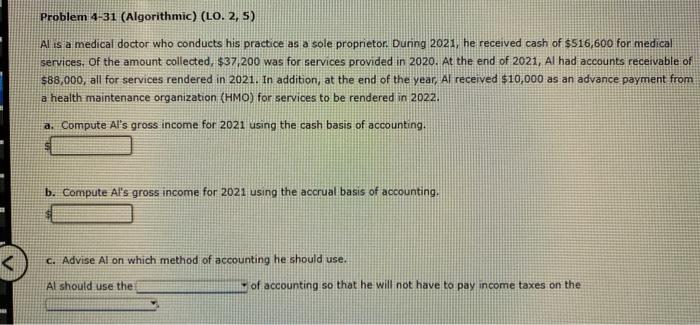

Problem 4-31 (Algorithmic) (LO. 2, 5) Al is a medical doctor who conducts his practice as a sole proprietor. During 2021, he received cash

Problem 4-31 (Algorithmic) (LO. 2, 5) Al is a medical doctor who conducts his practice as a sole proprietor. During 2021, he received cash of $516,600 for medical services. Of the amount collected, $37,200 was for services provided in 2020. At the end of 2021, Al had accounts receivable of $88,000, all for services rendered in 2021. In addition, at the end of the year, Al received $10,000 as an advance payment from a health maintenance organization (HMO) for services to be rendered in 2022. a. Compute Al's gross income for 2021 using the cash basis of accounting. b. Compute Al's gross income for 2021 using the accrual basis of accounting. c. Advise Al on which method of accounting he should use. Al should use the of accounting so that he will not have to pay income taxes on the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started