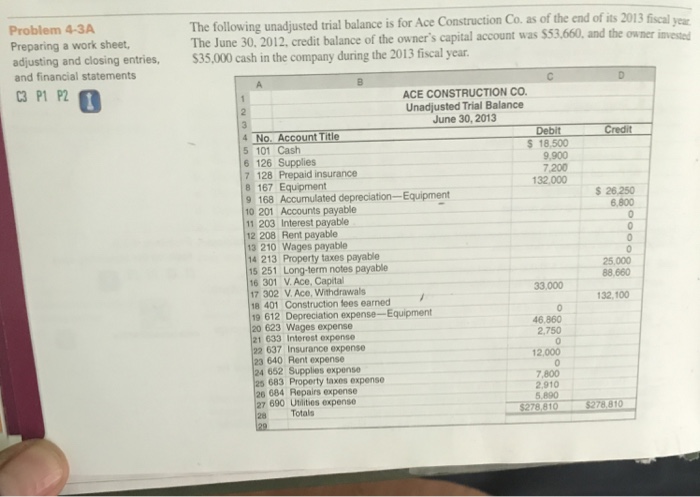

Problem 4-3A Preparing a work sheet, adjusting and closing entries, and financial statements 3 fiscal year 660, and the owner invested The following unadjusted trial balance is for Ace Construction Co. as of the end of its 2013 fisc The June 30. 2012, credit balance of the owner's capital account was $53 $35,000 cash in the company during the 2013 fiscal year a PI PL ACE CONSTRUCTION CO Unadjusted Trial Balance June 30, 2013 4 No. Account Title 5 101 Cash 6 126 Supplies 7 128 Prepaid insurance 8167 Equipment S 18,500 9,900 7,200 132000 26,250 6,800 168 Accumulated depreciation-Equipment 10 201 Accounts payable 11 203 Interest payable 2 208 Rent payable 3 210 Wages payable 14 213 Property taxes payable 15 251 Long-term notes payable 16 301 V.Ace, Capital 17 302 V.Ace, Withdrawals 8 401 Construction fees earned 9612 Depreciation expense-Equipment 20 623 Wages expense 21 633 Interest expense 22 637 Insurance expense 23 640 Rent expense 24 652 Supplies expense 25 683 Property taxes expense 26 684 Repairs expense 27 690 Uities expense 25,000 88,660 33,000 132,100 46.860 2,750 2. 12,000 7,800 2.910 5,890 Totals Problem 4-3A Preparing a work sheet, adjusting and closing entries, and financial statements 3 fiscal year 660, and the owner invested The following unadjusted trial balance is for Ace Construction Co. as of the end of its 2013 fisc The June 30. 2012, credit balance of the owner's capital account was $53 $35,000 cash in the company during the 2013 fiscal year a PI PL ACE CONSTRUCTION CO Unadjusted Trial Balance June 30, 2013 4 No. Account Title 5 101 Cash 6 126 Supplies 7 128 Prepaid insurance 8167 Equipment S 18,500 9,900 7,200 132000 26,250 6,800 168 Accumulated depreciation-Equipment 10 201 Accounts payable 11 203 Interest payable 2 208 Rent payable 3 210 Wages payable 14 213 Property taxes payable 15 251 Long-term notes payable 16 301 V.Ace, Capital 17 302 V.Ace, Withdrawals 8 401 Construction fees earned 9612 Depreciation expense-Equipment 20 623 Wages expense 21 633 Interest expense 22 637 Insurance expense 23 640 Rent expense 24 652 Supplies expense 25 683 Property taxes expense 26 684 Repairs expense 27 690 Uities expense 25,000 88,660 33,000 132,100 46.860 2,750 2. 12,000 7,800 2.910 5,890 Totals