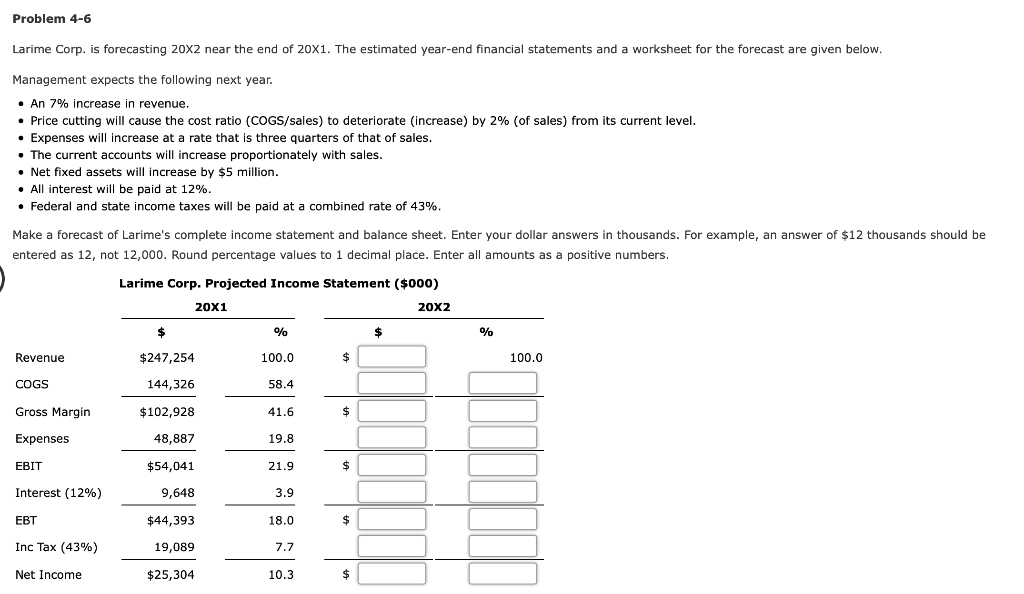

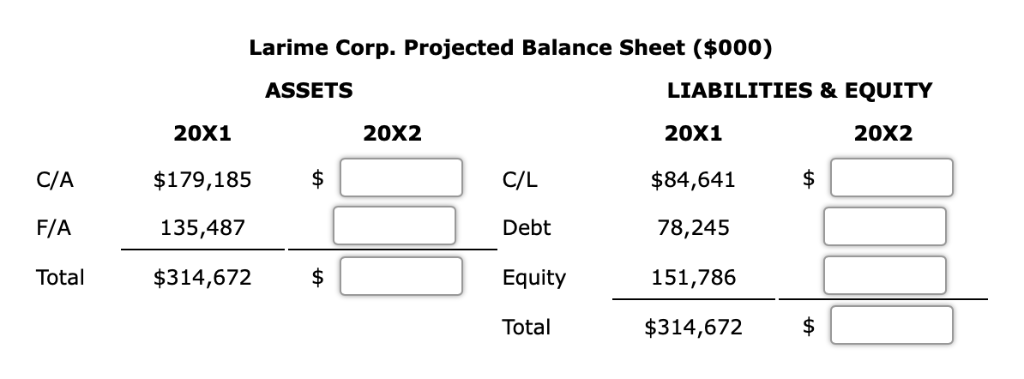

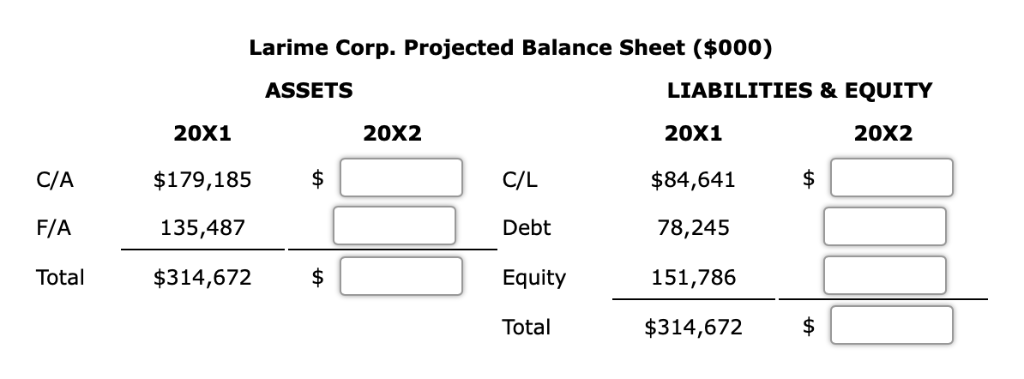

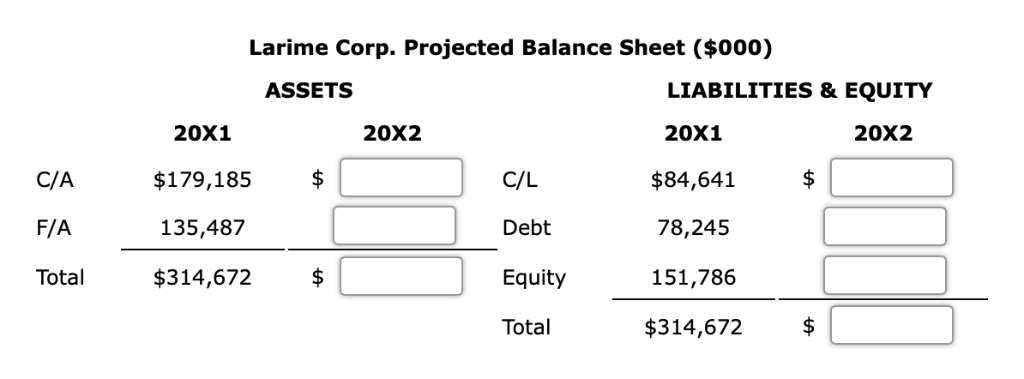

Problem 4-6 Larime Corp. is forecasting 20X2 near the end of 20X1. The estimated year-end financial statements and a worksheet for the forecast are given below Management expects the following next year An 7% increase in revenue . Price cutting will cause the cost ratio (COGS/sales) to deteriorate (increase) by 2% (of sales) from its current level . Expenses will increase at a rate that is three quarters of that of sales . The current accounts will increase proportionately with sales . Net fixed assets will increase by $5 million . All interest will be paid at 12% Federal and state income taxes will be paid at a combined rate of 43% Make a forecast of Larime's complete income statement and balance sheet. Enter your dollar answers in thousands. For example, an answer of $12 thousands should be entered as 12, not 12,000. Round percentage values to 1 decimal place. Enter all amounts as a positive numbers Larime Corp. Projected Income Statement ($000) 20X1 20X2 Revenue COGS Gross Margin Expenses EBIT Interest (12%) EBT Inc Tax (43%) Net Income $247,254 144,326 $102,928 48,887 $54,041 9,648 $44,393 19,089 $25,304 100.0 58.4 41.6 19.8 21.9 3.9 18.0 7.7 10.3 100.0 Larime Corp. Projected Balance Sheet ($000) ASSETS 20X1 $179,185 135,487 LIABILITIES & EQUITY 20X1 $84,641 78,245 151,786 20X2 20X2 C/A F/A Total $314,672$ C/L Debt Equity Total $314,672$ Larime Corp. Projected Balance Sheet ($000) ASSETS 20X1 $179,185 135,487 LIABILITIES & EQUITY 20X1 $84,641 78,245 151,786 20X2 20X2 C/A F/A Total $314,672$ C/L Debt Equity Total $314,672$ Problem 4-6 Larime Corp. is forecasting 20X2 near the end of 20X1. The estimated year-end financial statements and a worksheet for the forecast are given below Management expects the following next year An 7% increase in revenue . Price cutting will cause the cost ratio (COGS/sales) to deteriorate (increase) by 2% (of sales) from its current level . Expenses will increase at a rate that is three quarters of that of sales . The current accounts will increase proportionately with sales . Net fixed assets will increase by $5 million . All interest will be paid at 12% Federal and state income taxes will be paid at a combined rate of 43% Make a forecast of Larime's complete income statement and balance sheet. Enter your dollar answers in thousands. For example, an answer of $12 thousands should be entered as 12, not 12,000. Round percentage values to 1 decimal place. Enter all amounts as a positive numbers Larime Corp. Projected Income Statement ($000) 20X1 20X2 Revenue COGS Gross Margin Expenses EBIT Interest (12%) EBT Inc Tax (43%) Net Income $247,254 144,326 $102,928 48,887 $54,041 9,648 $44,393 19,089 $25,304 100.0 58.4 41.6 19.8 21.9 3.9 18.0 7.7 10.3 100.0 Larime Corp. Projected Balance Sheet ($000) ASSETS 20X1 $179,185 135,487 LIABILITIES & EQUITY 20X1 $84,641 78,245 151,786 20X2 20X2 C/A F/A Total $314,672$ C/L Debt Equity Total $314,672$ Larime Corp. Projected Balance Sheet ($000) ASSETS 20X1 $179,185 135,487 LIABILITIES & EQUITY 20X1 $84,641 78,245 151,786 20X2 20X2 C/A F/A Total $314,672$ C/L Debt Equity Total $314,672$