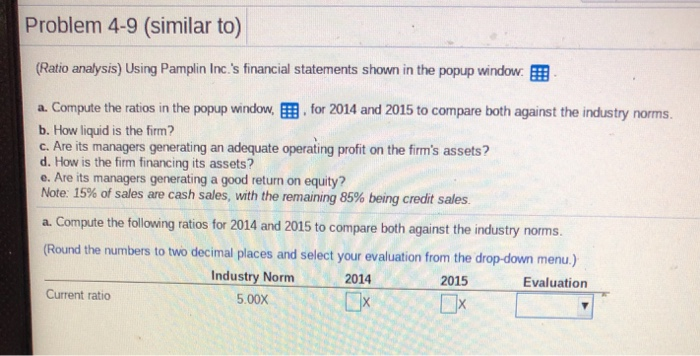

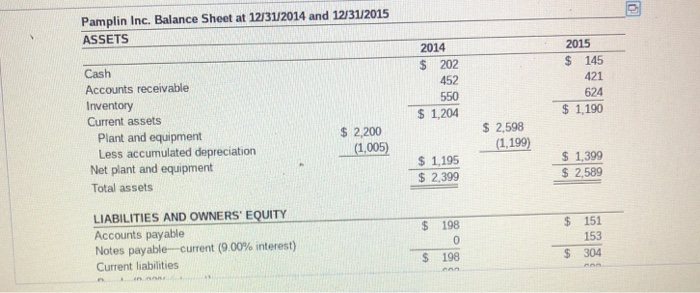

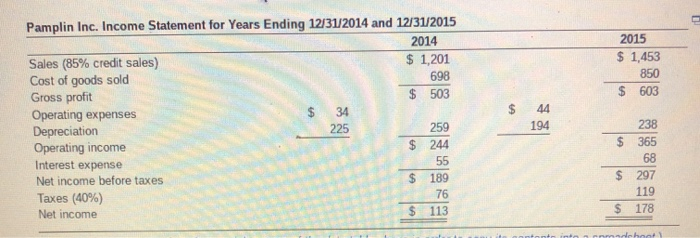

Problem 4-9 (similar to) (Ratio analysis) Using Pamplin Inc.'s financial statements shown in the popup window a. Compute the ratios in the popup window, for 2014 and 2015 to compare both against the industry norms b. How liquid is the firm? c. Are its managers generating an adequate operating profit on the firm's assets? d. How is the firm financing its assets? e. Are its managers generating a good return on equity? Note: 15% of sales are cash sales, with the remaining 85% being credit sales. a. Compute the following ratios for 2014 and 2015 to compare both against the industry norms. (Round the numbers to two decimal places and select your evaluation from the drop-down menu.) Industry Norm 2014 2015 Evaluation Current ratio 5.00X x Pamplin Inc. Balance Sheet at 12/31/2014 and 12/31/2015 ASSETS 2014 $ 202 452 550 $ 1,204 2015 $ 145 421 624 $ 1.190 Cash Accounts receivable Inventory Current assets Plant and equipment Less accumulated depreciation Net plant and equipment Total assets $ 2,200 (1,005) $ 2,598 (1,199) $ 1,195 $ 2,399 $ 1,399 $ 2,589 $ $ LIABILITIES AND OWNERS' EQUITY Accounts payable Notes payable current (9.00% interest) Current liabilities 198 0 198 151 153 304 $ 2015 $ 1,453 850 $ 603 698 Pamplin Inc. Income Statement for Years Ending 12/31/2014 and 12/31/2015 2014 Sales (85% credit sales) $ 1,201 Cost of goods sold Gross profit 503 Operating expenses $ 34 Depreciation 225 Operating income Interest expense Net income before taxes Taxes (40%) Net income 238 365 297 119 178 Problem 4-9 (similar to) (Ratio analysis) Using Pamplin Inc.'s financial statements shown in the popup window a. Compute the ratios in the popup window, for 2014 and 2015 to compare both against the industry norms b. How liquid is the firm? c. Are its managers generating an adequate operating profit on the firm's assets? d. How is the firm financing its assets? e. Are its managers generating a good return on equity? Note: 15% of sales are cash sales, with the remaining 85% being credit sales. a. Compute the following ratios for 2014 and 2015 to compare both against the industry norms. (Round the numbers to two decimal places and select your evaluation from the drop-down menu.) Industry Norm 2014 2015 Evaluation Current ratio 5.00X x Pamplin Inc. Balance Sheet at 12/31/2014 and 12/31/2015 ASSETS 2014 $ 202 452 550 $ 1,204 2015 $ 145 421 624 $ 1.190 Cash Accounts receivable Inventory Current assets Plant and equipment Less accumulated depreciation Net plant and equipment Total assets $ 2,200 (1,005) $ 2,598 (1,199) $ 1,195 $ 2,399 $ 1,399 $ 2,589 $ $ LIABILITIES AND OWNERS' EQUITY Accounts payable Notes payable current (9.00% interest) Current liabilities 198 0 198 151 153 304 $ 2015 $ 1,453 850 $ 603 698 Pamplin Inc. Income Statement for Years Ending 12/31/2014 and 12/31/2015 2014 Sales (85% credit sales) $ 1,201 Cost of goods sold Gross profit 503 Operating expenses $ 34 Depreciation 225 Operating income Interest expense Net income before taxes Taxes (40%) Net income 238 365 297 119 178