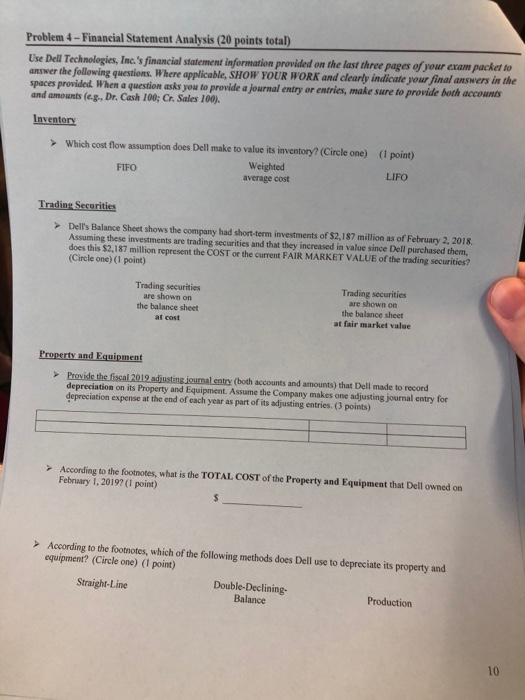

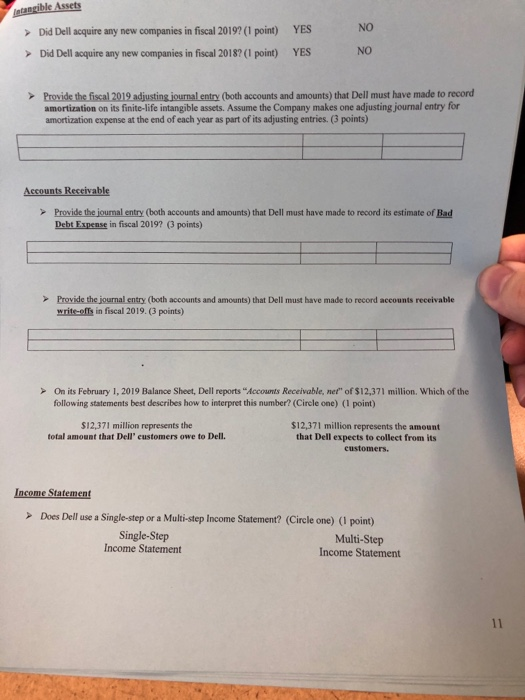

Problem 4-Financial Statement Analysis (20 points total) Use Dell Technologies, Inc.'s financial statement information provided on the last three pages of your exam packet to answer the following questions. Where applicable, SHOW YOUR WORK and clearly indicate your final answers in the spaces provided. When a question asks you to provide a journal entry or entries, make sure to provide both accounts and amounts (e.g, Dr. Cash 100; Cr. Sales 100). Inventory >Which cost flow assumption does Dell make to value its inventory? (Circle one) ( point) Weighted FIFO LIFO average cost Trading Securities Dell's Balance Sheet shows the company had short-term investments of $2,187 million as of February 2, 2018 Assuming these investments are trading securities and that they increased in value since Dell purchased them, does this $2,187 million represent the COST or the current FAIR MARKET VALUE of the trading securities? (Circle one) (1 point) Trading securities are shown on the balance sheet Trading securities are shown on the balance sheet at fair market value at cost Property and Equipment Provide the fiscal 2019 adjusting journal entry (both accounts and amounts) that Dell made to record depreciation on its Property and Equipment. Assume the Company makes one adjusting journal entry for depreciation expense at the end of each year as part of its adjusting entries. (3 points) According to the footnotes, what is the TOTAL COST of the Property and Equipment that Dell owned on February 1, 20192 (I point) According to the footnotes, which of the following methods does Dell use to depreciate its property and equipment? (Circle one) (1 point) Double-Declining- Balance Straight-Line Production 10 ntangible Assets NO YES Did Dell acquire any new companies in fiscal 2019? (1 point) NO YES Did Dell acquire any new companies in fiscal 2018? (1 point) Provide the fiscal 2019 adjusting journal entry (both accounts and amounts) that Dell must have made to record amortization on its finite-life intangible assets. Assume the Company makes one adjusting journal entry for amortization expense at the end of each year as part of its adjusting entries. (3 points) Accounts Receivable Provide the journal entry (both accounts and amounts) that Dell must have made to record its estimate of Bad Debt Expense in fiscal 2019? (3 points) Provide the journal entry (both accounts and amounts) that Dell must have made to record accounts receivable write-offs in fiscal 2019. (3 points) On its February 1, 2019 Balance Sheet, Dell reports "Accounts Receivable, net" of $12,371 million. Which of the following statements best describes how to interpret this number? (Circle one) (1 point) $12,371 million represents the $12,371 million represents the amount that Dell expects to collect from its total amount that Dell' customers owe to Dell. customers. Income Statement Does Dell use a Single-step or a Multi-step Income Statement? (Circle one) (1 point) Single-Step Income Statement Multi-Step Income Statement 11 Problem 4-Financial Statement Analysis (20 points total) Use Dell Technologies, Inc.'s financial statement information provided on the last three pages of your exam packet to answer the following questions. Where applicable, SHOW YOUR WORK and clearly indicate your final answers in the spaces provided. When a question asks you to provide a journal entry or entries, make sure to provide both accounts and amounts (e.g, Dr. Cash 100; Cr. Sales 100). Inventory >Which cost flow assumption does Dell make to value its inventory? (Circle one) ( point) Weighted FIFO LIFO average cost Trading Securities Dell's Balance Sheet shows the company had short-term investments of $2,187 million as of February 2, 2018 Assuming these investments are trading securities and that they increased in value since Dell purchased them, does this $2,187 million represent the COST or the current FAIR MARKET VALUE of the trading securities? (Circle one) (1 point) Trading securities are shown on the balance sheet Trading securities are shown on the balance sheet at fair market value at cost Property and Equipment Provide the fiscal 2019 adjusting journal entry (both accounts and amounts) that Dell made to record depreciation on its Property and Equipment. Assume the Company makes one adjusting journal entry for depreciation expense at the end of each year as part of its adjusting entries. (3 points) According to the footnotes, what is the TOTAL COST of the Property and Equipment that Dell owned on February 1, 20192 (I point) According to the footnotes, which of the following methods does Dell use to depreciate its property and equipment? (Circle one) (1 point) Double-Declining- Balance Straight-Line Production 10 ntangible Assets NO YES Did Dell acquire any new companies in fiscal 2019? (1 point) NO YES Did Dell acquire any new companies in fiscal 2018? (1 point) Provide the fiscal 2019 adjusting journal entry (both accounts and amounts) that Dell must have made to record amortization on its finite-life intangible assets. Assume the Company makes one adjusting journal entry for amortization expense at the end of each year as part of its adjusting entries. (3 points) Accounts Receivable Provide the journal entry (both accounts and amounts) that Dell must have made to record its estimate of Bad Debt Expense in fiscal 2019? (3 points) Provide the journal entry (both accounts and amounts) that Dell must have made to record accounts receivable write-offs in fiscal 2019. (3 points) On its February 1, 2019 Balance Sheet, Dell reports "Accounts Receivable, net" of $12,371 million. Which of the following statements best describes how to interpret this number? (Circle one) (1 point) $12,371 million represents the $12,371 million represents the amount that Dell expects to collect from its total amount that Dell' customers owe to Dell. customers. Income Statement Does Dell use a Single-step or a Multi-step Income Statement? (Circle one) (1 point) Single-Step Income Statement Multi-Step Income Statement 11