Answered step by step

Verified Expert Solution

Question

1 Approved Answer

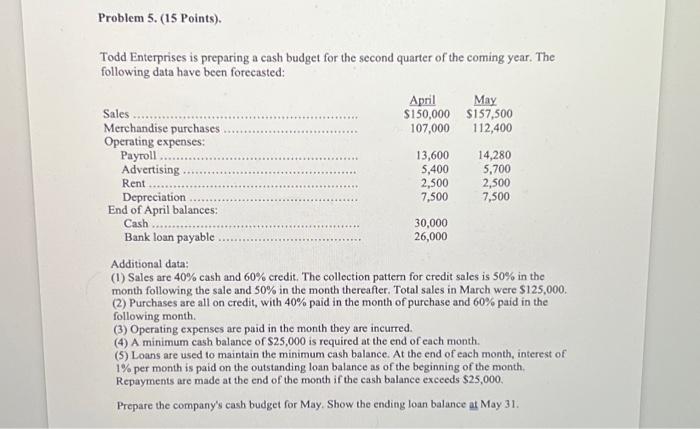

Problem 5. (15 Points). Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Problem 5. (15 Points). Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted: Sales Merchandise purchases Operating expenses: Payroll Advertising Rent Depreciation End of April balances: Cash Bank loan payable May April $150,000 $157,500 107,000 112,400 13,600 5,400 2,500 7,500 30,000 26,000 14,280 5,700 2,500 7,500 Additional data: (1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000. (2) Purchases are all on credit, with 40% paid in the month of purchase and 60% paid in the following month. (3) Operating expenses are paid in the month they are incurred. (4) A minimum cash balance of $25,000 is required at the end of each month. (5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made at the end of the month if the cash balance exceeds $25,000. Prepare the company's cash budget for May. Show the ending loan balance at May 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started