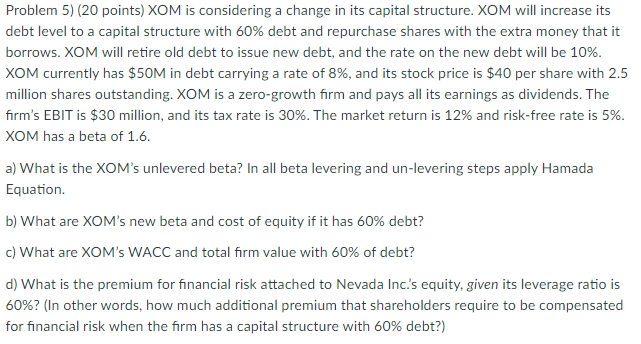

Problem 5) (20 points) XOM is considering a change in its capital structure. XOM will increase its debt level to a capital structure with 60% debt and repurchase shares with the extra money that it borrows. XOM will retire old debt to issue new debt, and the rate on the new debt will be 10%. XOM currently has $50M in debt carrying a rate of 8%, and its stock price is $40 per share with 2.5 million shares outstanding. XOM is a zero-growth firm and pays all its earnings as dividends. The firm's EBIT is $30 million, and its tax rate is 30%. The market return is 12% and risk-free rate is 5%. XOM has a beta of 1.6. a) What is the XOM's unlevered beta? In all beta levering and un-levering steps apply Hamada Equation. b) What are XOM's new beta and cost of equity if it has 60% debt? c) What are XOM's WACC and total firm value with 60% of debt? d) What is the premium for financial risk attached to Nevada Inc.'s equity, given its leverage ratio is 60%? (In other words, how much additional premium that shareholders require to be compensated for financial risk when the firm has a capital structure with 60% debt?) Problem 5) (20 points) XOM is considering a change in its capital structure. XOM will increase its debt level to a capital structure with 60% debt and repurchase shares with the extra money that it borrows. XOM will retire old debt to issue new debt, and the rate on the new debt will be 10%. XOM currently has $50M in debt carrying a rate of 8%, and its stock price is $40 per share with 2.5 million shares outstanding. XOM is a zero-growth firm and pays all its earnings as dividends. The firm's EBIT is $30 million, and its tax rate is 30%. The market return is 12% and risk-free rate is 5%. XOM has a beta of 1.6. a) What is the XOM's unlevered beta? In all beta levering and un-levering steps apply Hamada Equation. b) What are XOM's new beta and cost of equity if it has 60% debt? c) What are XOM's WACC and total firm value with 60% of debt? d) What is the premium for financial risk attached to Nevada Inc.'s equity, given its leverage ratio is 60%? (In other words, how much additional premium that shareholders require to be compensated for financial risk when the firm has a capital structure with 60% debt?)