Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5 A perpetual option is one that never expires. Such an option must be of American style. (a) Show that the value of

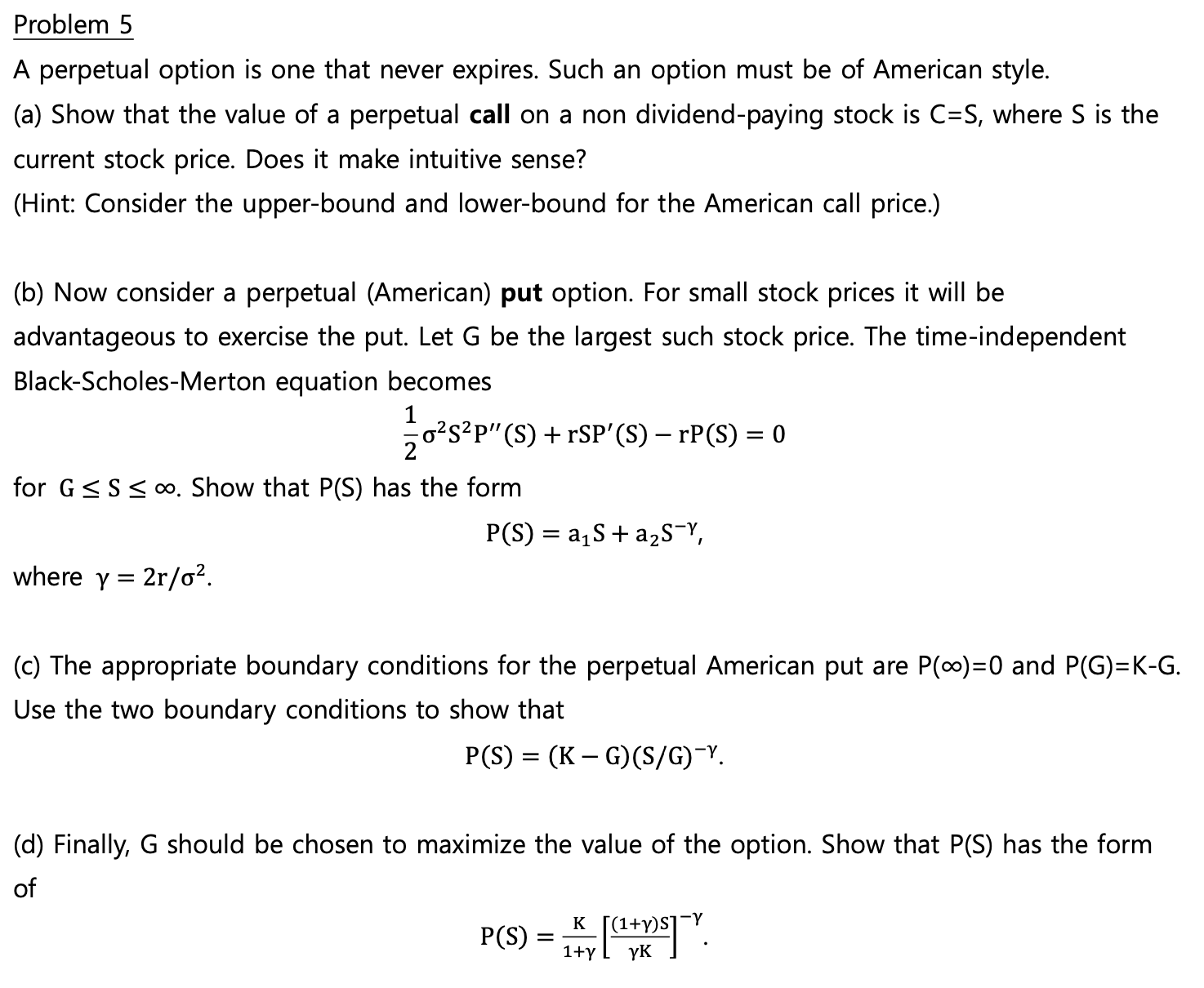

Problem 5 A perpetual option is one that never expires. Such an option must be of American style. (a) Show that the value of a perpetual call on a non dividend-paying stock is C=S, where S is the current stock price. Does it make intuitive sense? (Hint: Consider the upper-bound and lower-bound for the American call price.) (b) Now consider a perpetual (American) put option. For small stock prices it will be advantageous to exercise the put. Let G be the largest such stock price. The time-independent Black-Scholes-Merton equation becomes 1 ==o sp" (S) + rSP'(S) rP(S) = 0 2 for GS. Show that P(S) has the form where y = 2r/o. - P(S) = aS+ aSY, (c) The appropriate boundary conditions for the perpetual American put are P()=0 and P(G)=K-G. Use the two boundary conditions to show that P(S) = (KG)(S/G)-Y. (d) Finally, G should be chosen to maximize the value of the option. Show that P(S) has the form of K -Y P(S) = k [(1+r)]\ 1+Y YK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started