Answered step by step

Verified Expert Solution

Question

1 Approved Answer

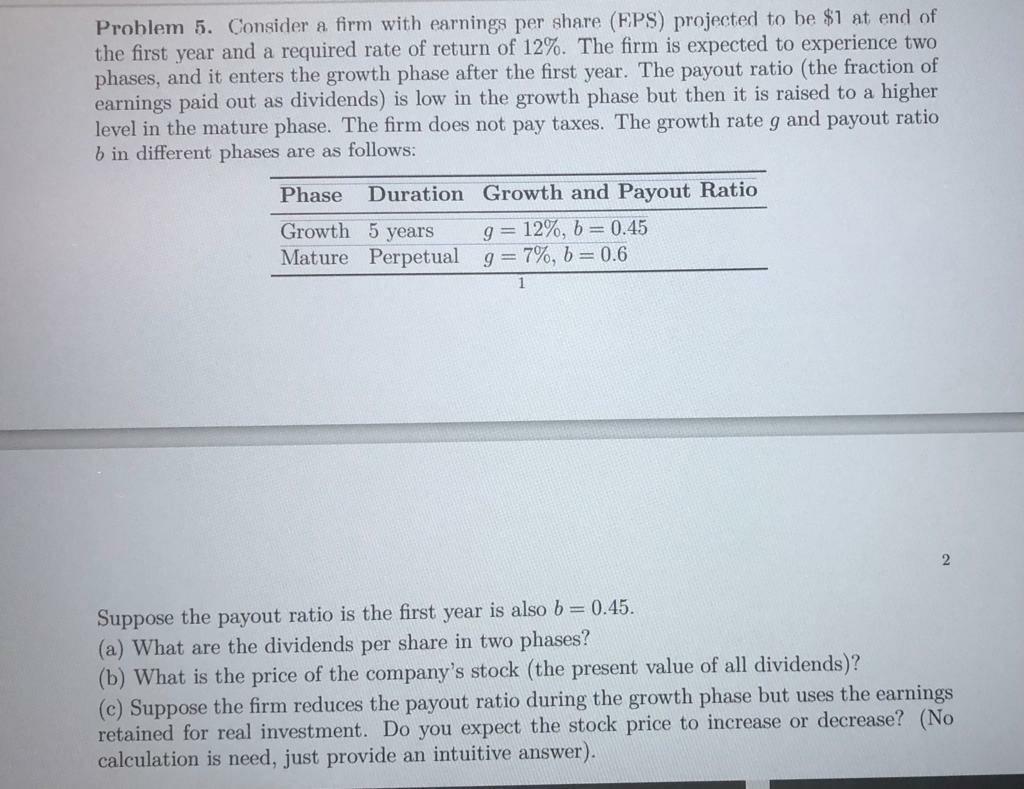

Problem 5. Consider a firm with earnings per share (FPS) projected to be $1 at end of the first year and a required rate of

Problem 5. Consider a firm with earnings per share (FPS) projected to be $1 at end of the first year and a required rate of return of 12%. The firm is expected to experience two phases, and it enters the growth phase after the first year. The payout ratio (the fraction of earnings paid out as dividends) is low in the growth phase but then it is raised to a higher level in the mature phase. The firm does not pay taxes. The growth rate g and payout ratio b in different phases are as follows: Phase Duration Growth and Payout Ratio Growth 5 years 9 = 12%, b = 0.45 Mature Perpetual g = 7%, b = 0.6 1 2 Suppose the payout ratio is the first year is also b = 0.45. (a) What are the dividends per share in two phases? (b) What is the price of the company's stock (the present value of all dividends)? (c) Suppose the firm reduces the payout ratio during the growth phase but uses the earnings retained for real investment. Do you expect the stock price to increase or decrease? (No calculation is need, just provide an intuitive answer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started