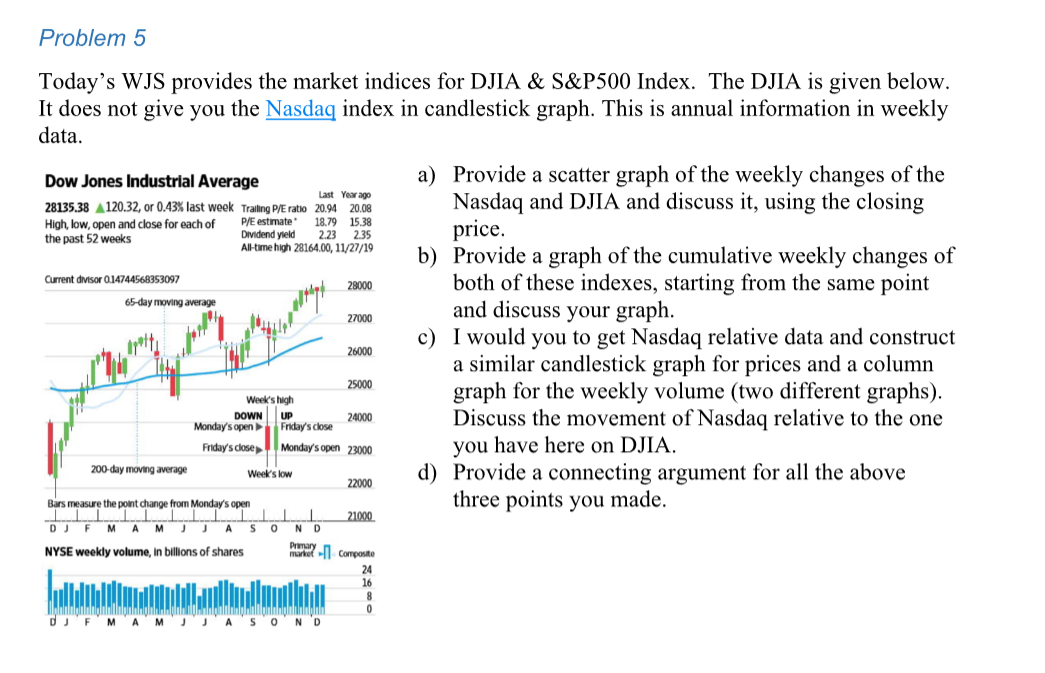

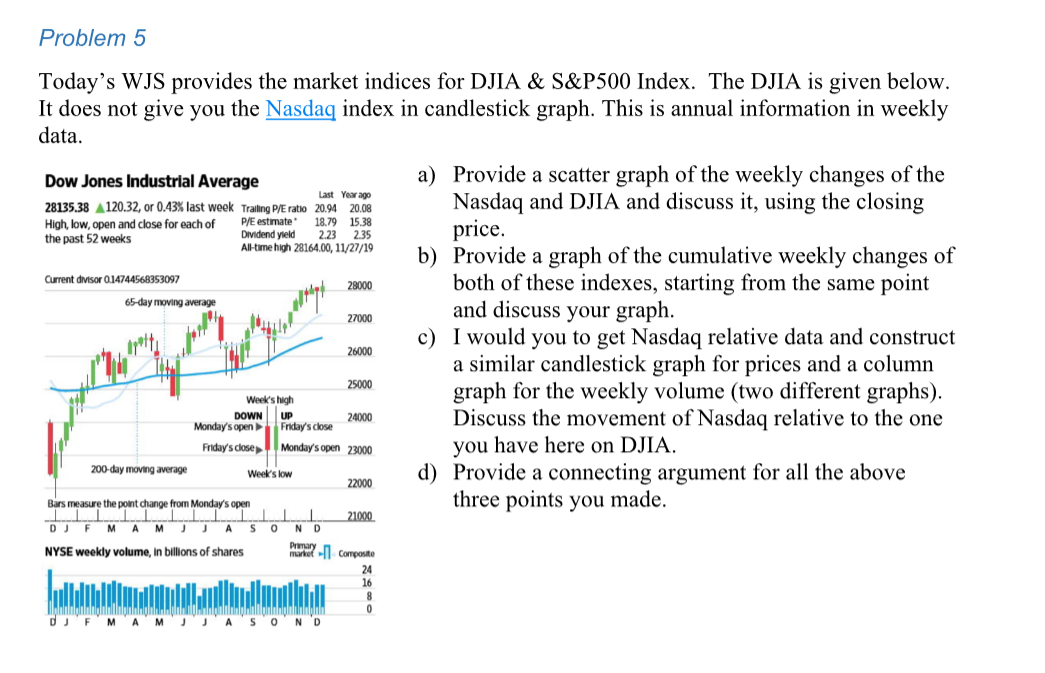

Problem 5 Last Year ago 65-day moving average Today's WJS provides the market indices for DJIA & S&P500 Index. The DJIA is given below. It does not give you the Nasdaq index in candlestick graph. This is annual information in weekly data. Dow Jones Industrial Average a) Provide a scatter graph of the weekly changes of the 28135.38 120.32, or 0.43% last week Trailing P/E ratio 20.94 20.08 Nasdaq and DJIA and discuss it, using the closing High, low, open and close for each of P/E estimate* 18.79 15.38 the past 52 weeks Dividend yield 2.23 price. 2.35 All-time high 28164.00, 11/27/19 b) Provide a graph of the cumulative weekly changes of Current divisor 0.14744568353097 28000 both of these indexes, starting from the same point and discuss your graph. 27000 c) I would you to get Nasdaq relative data and construct 26000 a similar candlestick graph for prices and a column 25000 graph for the weekly volume (two different graphs). DOWN UP 24000 Discuss the movement of Nasdaq relative to the one Monday's open Friday's close Monday's open 23000 you have here on DJIA. 200-day moving average d) Provide a connecting argument for all the above 22000 three points you made. IIIIIII 21000 DJ F M A M J J A S O N D NYSE weekly volume, in billions of shares marke? - Composite Week's high Week's low Bars measure the point change from Monday's open DJ F M A M J J A S O N D Problem 2 You borrow from the car dealer to finance a care you decided to purchase. The price of the car and the annual rate of the loan should be provided. You have a loan with monthly payments for four years, with the payments at the end of each month. After the 23th month, you like to pay the remaining of the loan to the bank and sell your car. How do you do your calculations and what is the amount you pay to the bank at that time? Problem 5 Last Year ago 65-day moving average Today's WJS provides the market indices for DJIA & S&P500 Index. The DJIA is given below. It does not give you the Nasdaq index in candlestick graph. This is annual information in weekly data. Dow Jones Industrial Average a) Provide a scatter graph of the weekly changes of the 28135.38 120.32, or 0.43% last week Trailing P/E ratio 20.94 20.08 Nasdaq and DJIA and discuss it, using the closing High, low, open and close for each of P/E estimate* 18.79 15.38 the past 52 weeks Dividend yield 2.23 price. 2.35 All-time high 28164.00, 11/27/19 b) Provide a graph of the cumulative weekly changes of Current divisor 0.14744568353097 28000 both of these indexes, starting from the same point and discuss your graph. 27000 c) I would you to get Nasdaq relative data and construct 26000 a similar candlestick graph for prices and a column 25000 graph for the weekly volume (two different graphs). DOWN UP 24000 Discuss the movement of Nasdaq relative to the one Monday's open Friday's close Monday's open 23000 you have here on DJIA. 200-day moving average d) Provide a connecting argument for all the above 22000 three points you made. IIIIIII 21000 DJ F M A M J J A S O N D NYSE weekly volume, in billions of shares marke? - Composite Week's high Week's low Bars measure the point change from Monday's open DJ F M A M J J A S O N D Problem 2 You borrow from the car dealer to finance a care you decided to purchase. The price of the car and the annual rate of the loan should be provided. You have a loan with monthly payments for four years, with the payments at the end of each month. After the 23th month, you like to pay the remaining of the loan to the bank and sell your car. How do you do your calculations and what is the amount you pay to the bank at that time