For each of the following trusts settled by Mrs. A explain: The tax consequences of the transfer of property by Mrs. A to the

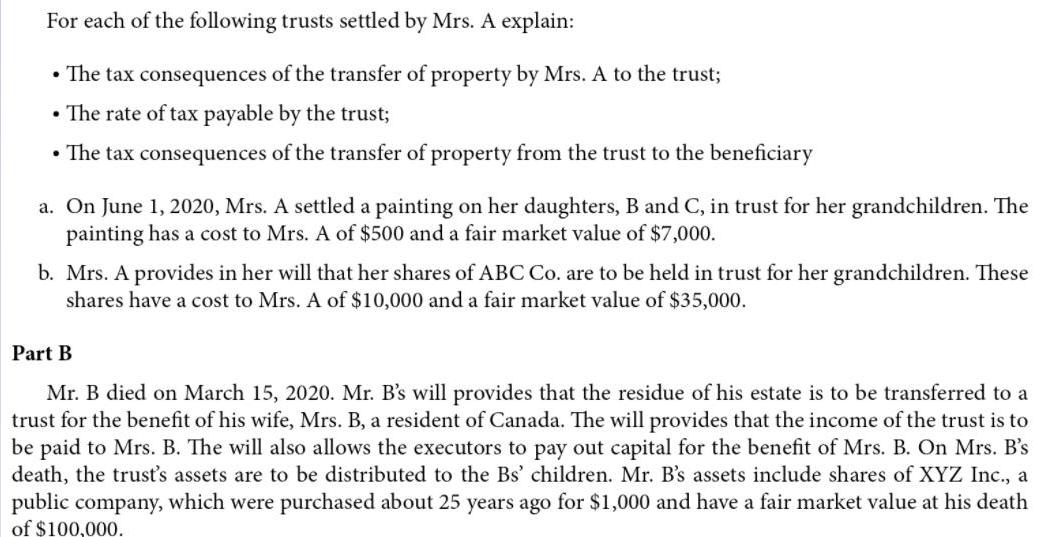

For each of the following trusts settled by Mrs. A explain: The tax consequences of the transfer of property by Mrs. A to the trust; The rate of tax payable by the trust; The tax consequences of the transfer of property from the trust to the beneficiary a. On June 1, 2020, Mrs. A settled a painting on her daughters, B and C, in trust for her grandchildren. The painting has a cost to Mrs. A of $500 and a fair market value of $7,000. b. Mrs. A provides in her will that her shares of ABC Co. are to be held in trust for her grandchildren. These shares have a cost to Mrs. A of $10,000 and a fair market value of $35,000. Part B Mr. B died on March 15, 2020. Mr. B's will provides that the residue of his estate is to be transferred to a trust for the benefit of his wife, Mrs. B, a resident of Canada. The will provides that the income of the trust is to be paid to Mrs. B. The will also allows the executors to pay out capital for the benefit of Mrs. B. On Mrs. B's death, the trus's assets are to be distributed to the Bs' children. Mr. B's assets include shares of XYZ Inc., a public company, which were purchased about 25 years ago for $1,000 and have a fair market value at his death of $100,000. (A) Explain the tax consequences to Mr. B arising out of the transfer of the ABC Inc. shares to the trust for Mrs. B. (B) Explain the tax consequences to the trust of holding the shares and earning dividend income. (C) Explain the tax consequences if the shares are transferred to Mrs. B. (D) Explain the tax consequences if the shares are still held by the trust at the time Mrs. B dies. (E) Explain how your answer to (A) would be different if Mr. B's will provided the trustees with the power to encroach on capital for the benefit of the Bs' children. Part C Ms. C, a lawyer, died on June 1, 2020. Ms. C was divorced at the time of her death. Under the terms of her will, her estate is to be distributed equally to her 2 adult children. At the time of death, Ms. C owned investments in publicly traded securities, RRSPS, a house and cottage, artwork and personal properties as well as an interest in her professional partnership. The executor of her estate is her longtime partner Ms J. You have agreed to advise the executor as follows: (A) Explain the tax consequences to Ms. C at the time of her death related to the properties she owned at that time. (B) Explain the tax treatment of the estate arising on Ms. C's death. (C) Explain the tax consequences of the distribution of properties from Ms. C's estate to her children.

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

According to the CRA the tax ACT regards the body of the trustee as a separate taxable body The Canadian federal income tax is a system of administration undertaken by the Canadian Revenue Agency were ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started