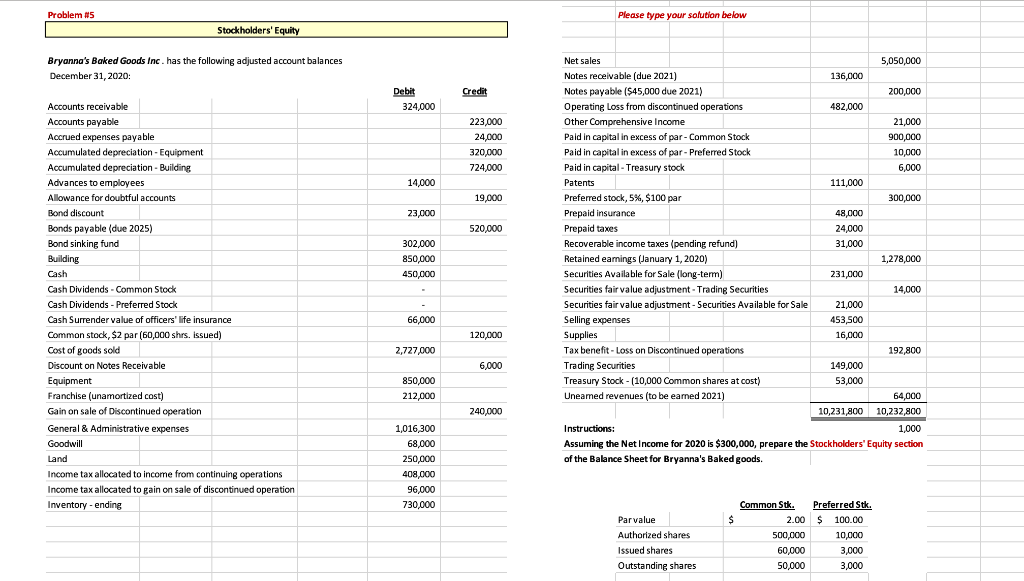

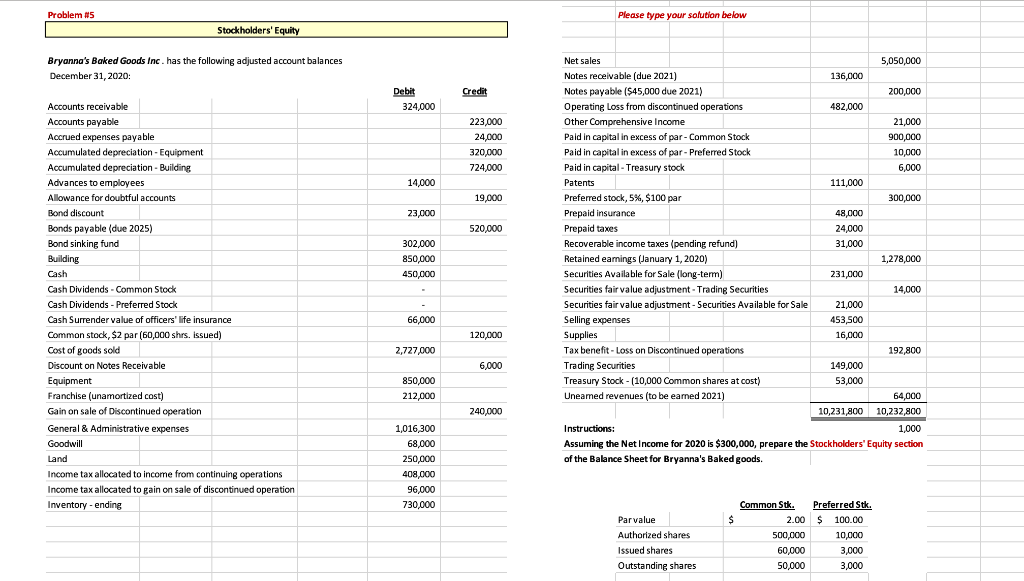

Problem #5 Please type your solution below Stockholders' Equity Bryanna's Baked Goods Inc. has the following adjusted account balances December 31, 2020: Credit Debit 324,000 223,000 24,000 320,000 724,000 14,000 19.000 23,000 520,000 302.000 850,000 450,000 Accounts receivable Accounts payable Accrued expenses payable Accumulated depreciation - Equipment Accumulated depreciation - Building Advances to employees Allowance for doubtful accounts Bond discount Bonds payable (due 2025) Bond sinking fund Building Cash Cash Dividends - Common Stock Cash Dividends - Preferred Stock Cash Surrender value of officers' life insurance Common stock, $2 par (60,000 shrs, issued) Cost of goods sold Discount on Notes Receivable Equipment Franchise (unamortized cost) Gain on sale of Discontinued operation ace General & Administrative expenses Goodwill Land Income tax allocated to income from continuing operations Income tax allocated to gain on sale of discontinued operation Inventory - ending Net sales 5,050,000 Notes receivable (due 2021) 136.000 Notes payable ($45,000 due 2021) 200,000 Operating Loss from discontinued operations 482,000 Other Comprehensive Income 21,000 Paid in capital in excess of par-Common Stock 900,000 Paid in capital in excess of par-Preferred Stock 10,000 Paid in capital - Treasury stock 6,000 Patents Fatens 111,000 Preferred stock, 5%, $100 par 300,000 Prepaid insurance 48,000 Prepaid taxes 24,000 Recoverable income taxes (pending refund) 31 000 Retained earnings (January 1, 2020) 1,278,000 Securities Available for Sale (long-term) 231,000 Securities fair value adjustment - Trading Securities 14,000 Securities fair value adjustment - Securities Available for Sale 21,000 Selling expenses 453,500 Supplies 16.000 Tax benefit - Loss on Discontinued operations 192,800 Trading Securities 149.000 Treasury Stock - (10,000 Common shares at cost) 53,000 Uneamed revenues (to be eamed 2021) ) 64,000 10,231,800 10,232,800 Instructions: 1,000 Assuming the Net Income for 2020 is $300,000, prepare the Stockholders' Equity section of the Balance Sheet for Bryanna's Baked goods. 66,000 120.000 2,727,000 6,000 850,000 212.000 240,000 1,016,300 68,000 250,000 408.000 96,000 730,000 $ Par value Authorized shares Issued shares Outstanding shares Common Stk. Preferred Stk. 2.00 $ 100.00 500,000 10,000 60,000 3,000 50,000 3,000 Problem #5 Please type your solution below Stockholders' Equity Bryanna's Baked Goods Inc. has the following adjusted account balances December 31, 2020: Credit Debit 324,000 223,000 24,000 320,000 724,000 14,000 19.000 23,000 520,000 302.000 850,000 450,000 Accounts receivable Accounts payable Accrued expenses payable Accumulated depreciation - Equipment Accumulated depreciation - Building Advances to employees Allowance for doubtful accounts Bond discount Bonds payable (due 2025) Bond sinking fund Building Cash Cash Dividends - Common Stock Cash Dividends - Preferred Stock Cash Surrender value of officers' life insurance Common stock, $2 par (60,000 shrs, issued) Cost of goods sold Discount on Notes Receivable Equipment Franchise (unamortized cost) Gain on sale of Discontinued operation ace General & Administrative expenses Goodwill Land Income tax allocated to income from continuing operations Income tax allocated to gain on sale of discontinued operation Inventory - ending Net sales 5,050,000 Notes receivable (due 2021) 136.000 Notes payable ($45,000 due 2021) 200,000 Operating Loss from discontinued operations 482,000 Other Comprehensive Income 21,000 Paid in capital in excess of par-Common Stock 900,000 Paid in capital in excess of par-Preferred Stock 10,000 Paid in capital - Treasury stock 6,000 Patents Fatens 111,000 Preferred stock, 5%, $100 par 300,000 Prepaid insurance 48,000 Prepaid taxes 24,000 Recoverable income taxes (pending refund) 31 000 Retained earnings (January 1, 2020) 1,278,000 Securities Available for Sale (long-term) 231,000 Securities fair value adjustment - Trading Securities 14,000 Securities fair value adjustment - Securities Available for Sale 21,000 Selling expenses 453,500 Supplies 16.000 Tax benefit - Loss on Discontinued operations 192,800 Trading Securities 149.000 Treasury Stock - (10,000 Common shares at cost) 53,000 Uneamed revenues (to be eamed 2021) ) 64,000 10,231,800 10,232,800 Instructions: 1,000 Assuming the Net Income for 2020 is $300,000, prepare the Stockholders' Equity section of the Balance Sheet for Bryanna's Baked goods. 66,000 120.000 2,727,000 6,000 850,000 212.000 240,000 1,016,300 68,000 250,000 408.000 96,000 730,000 $ Par value Authorized shares Issued shares Outstanding shares Common Stk. Preferred Stk. 2.00 $ 100.00 500,000 10,000 60,000 3,000 50,000 3,000