Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5: True or False questions. 1. Basic financial statements consist of government-wide financial statements, the fund financial statements, notes to financial statements, and

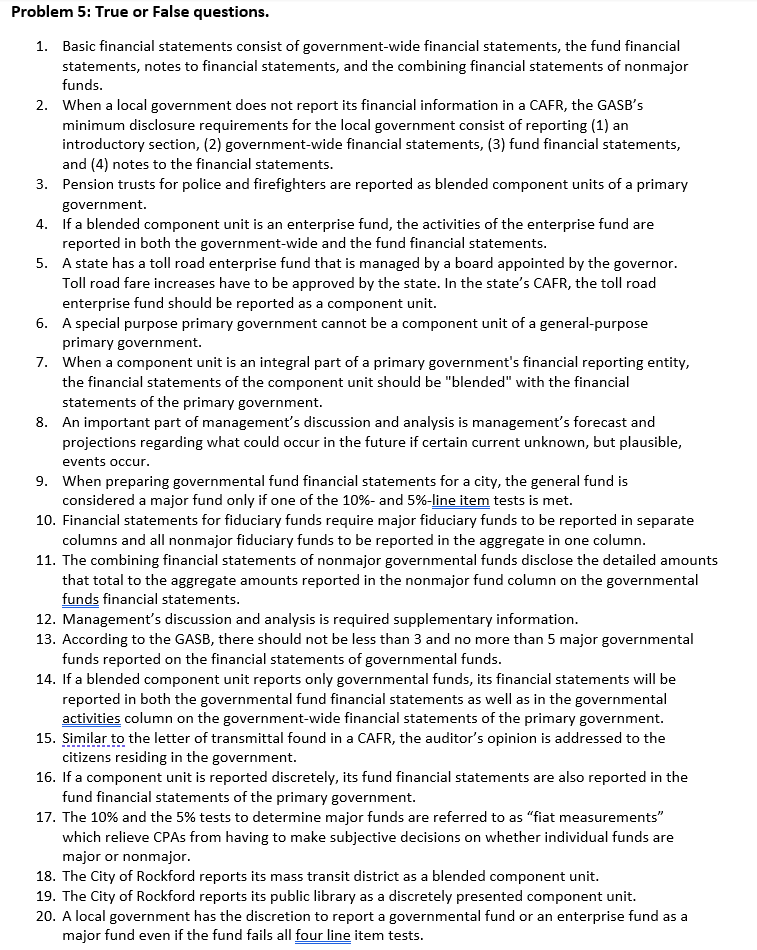

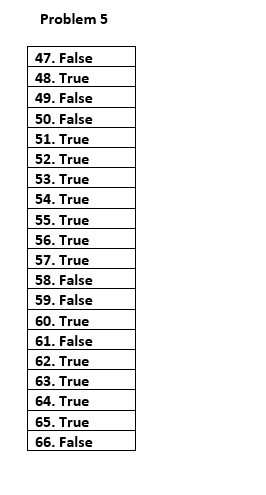

Problem 5: True or False questions. 1. Basic financial statements consist of government-wide financial statements, the fund financial statements, notes to financial statements, and the combining financial statements of nonmajor funds. 2. When a local government does not report its financial information in a CAFR, the GASB's minimum disclosure requirements for the local government consist of reporting (1) an introductory section, (2) government-wide financial statements, (3) fund financial statements, and (4) notes to the financial statements. 3. Pension trusts for police and firefighters are reported as blended component units of a primary government. 4. If a blended component unit is an enterprise fund, the activities of the enterprise fund are reported in both the government-wide and the fund financial statements. 5. A state has a toll road enterprise fund that is managed by a board appointed by the governor. Toll road fare increases have to be approved by the state. In the state's CAFR, the toll road enterprise fund should be reported as a component unit. 6. A special purpose primary government cannot be a component unit of a general-purpose primary government. 7. When a component unit is an integral part of a primary government's financial reporting entity, the financial statements of the component unit should be "blended" with the financial statements of the primary government. 8. An important part of management's discussion and analysis is management's forecast and projections regarding what could occur in the future if certain current unknown, but plausible, events occur. 9. When preparing governmental fund financial statements for a city, the general fund is considered a major fund only if one of the 10%- and 5%-line item tests is met. 10. Financial statements for fiduciary funds require major fiduciary funds to be reported in separate columns and all nonmajor fiduciary funds to be reported in the aggregate in one column. 11. The combining financial statements of nonmajor governmental funds disclose the detailed amounts that total to the aggregate amounts reported in the nonmajor fund column on the governmental funds financial statements. 12. Management's discussion and analysis is required supplementary information. 13. According to the GASB, there should not be less than 3 and no more than 5 major governmental funds reported on the financial statements of governmental funds. 14. If a blended component unit reports only governmental funds, its financial statements will be reported in both the governmental fund financial statements as well as in the governmental activities column on the government-wide financial statements of the primary government. 15. Similar to the letter of transmittal found in a CAFR, the auditor's opinion is addressed to the citizens residing in the government. 16. If a component unit is reported discretely, its fund financial statements are also reported in the fund financial statements of the primary government. 17. The 10% and the 5% tests to determine major funds are referred to as "fiat measurements" which relieve CPAs from having to make subjective decisions on whether individual funds are major or nonmajor. 18. The City of Rockford reports its mass transit district as a blended component unit. 19. The City of Rockford reports its public library as a discretely presented component unit. 20. A local government has the discretion to report a governmental fund or an enterprise fund as a major fund even if the fund fails all four line item tests.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started