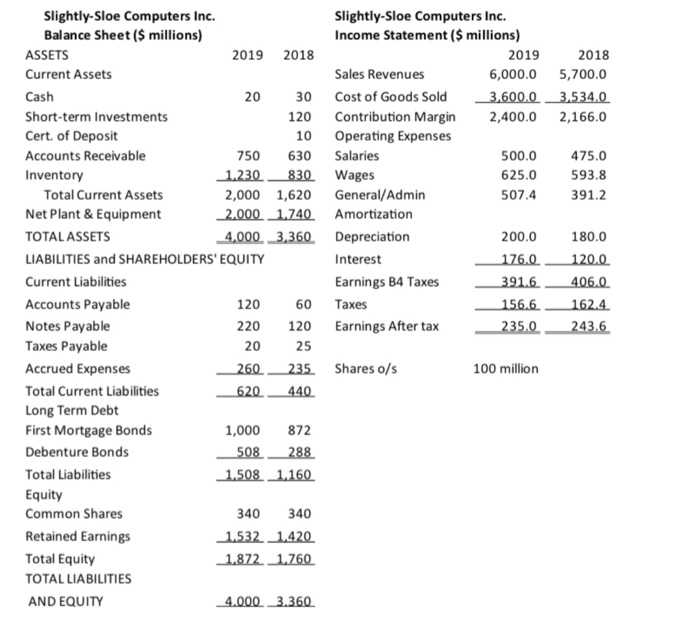

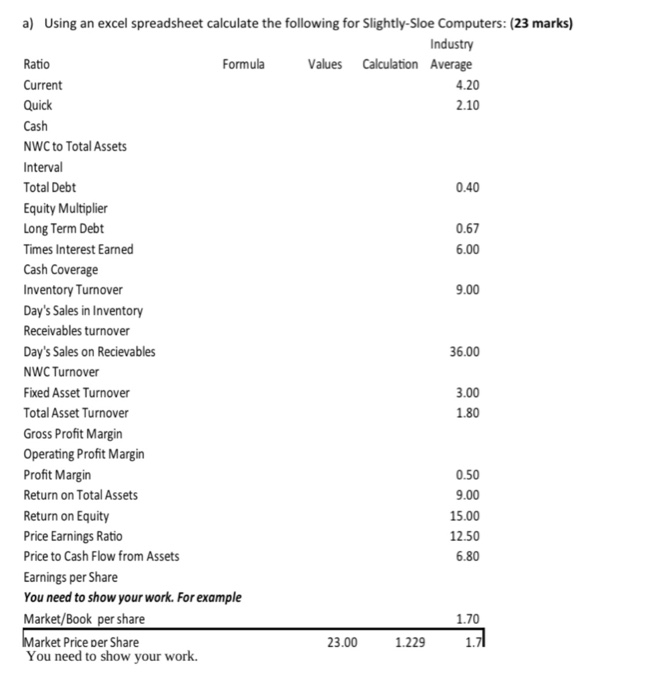

Problem 5 Your friend is in the finance department of Slightly-Sloe Computers and they have heard that you are taking a business course in finance. In order to let you prove your abilities and maybe an employment opportunity, they have provided the following financial statements for Slightly- Sloe Computers. Slightly-Sloe Computers Inc. Slightly-Sloe Computers Inc. Balance Sheet ($ millions) Income Statement ($ millions) ASSETS 2019 2018 2019 2018 Current Assets Sales Revenues 6,000.0 5,700.0 Cash 20 30 Cost of Goods Sold 3,600.0 3,534.0 Short-term Investments 120 Contribution Margin 2,400.0 2,166.0 Cert. of Deposit 10 Operating Expenses Accounts Receivable 750 630 Salaries 500.0 475.0 Inventory 1.230 830 Wages 625.0 593.8 Total Current Assets 2,000 1,620 General/Admin 507.4 391.2 Net Plant & Equipment 2.000 1.740 Amortization TOTAL ASSETS 4,000 3,360 Depreciation 200.0 180.0 LIABILITIES and SHAREHOLDERS' EQUITY Interest 176.0 120.0 Current Liabilities Earnings B4 Taxes 391.6 406.0 Accounts Payable 120 60 Taxes 156.6 162.4 Notes Payable 220 120 Earnings After tax 235.0 243.6 Taxes Payable 20 25 Accrued Expenses 260 235 Shares o/s 100 million Total Current Liabilities 620 440 Long Term Debt First Mortgage Bonds 1,000 872 Debenture Bonds 508 288 Total Liabilities 1.508 1.160 Equity Common Shares 340 340 Retained Earnings 1.532 1,420 Total Equity 1.872 1.760 TOTAL LIABILITIES AND EQUITY 4.000 3.360 a) Using an excel spreadsheet calculate the following for Slightly-Sloe Computers: (23 marks) Industry Ratio Formula Values Calculation Average Current 4.20 Quick 2.10 Cash NWC to Total Assets Interval Total Debt 0.40 Equity Multiplier Long Term Debt 0.67 Times Interest Earned 6.00 Cash Coverage Inventory Turnover 9.00 Day's Sales in Inventory Receivables turnover Day's Sales on Recievables 36.00 NWC Turnover Fixed Asset Turnover 3.00 Total Asset Turnover 1.80 Gross Profit Margin Operating Profit Margin Profit Margin 0.50 Return on Total Assets 9.00 Return on Equity 15.00 Price Earnings Ratio 12.50 Price to Cash Flow from Assets 6.80 Earnings per Share You need to show your work. For example Market/Book per share 1.70 Market Price per Share 23.00 1.229 1.71 You need to show your work. b. Using this excel spreadsheet, prepare the common size statement for Slightly-Sloe Computers. (10 marks) Slightly-Sloe Computers Inc. Slightly-Sloe Computers Inc. Balance Sheet ($ millions) Income Statement ($ millions)