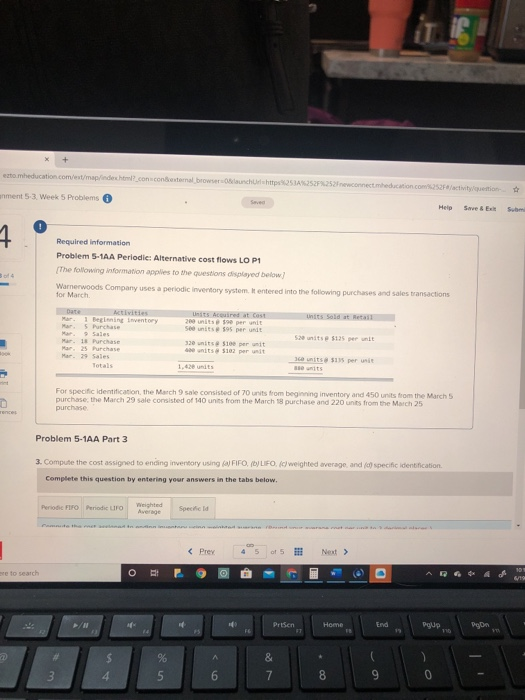

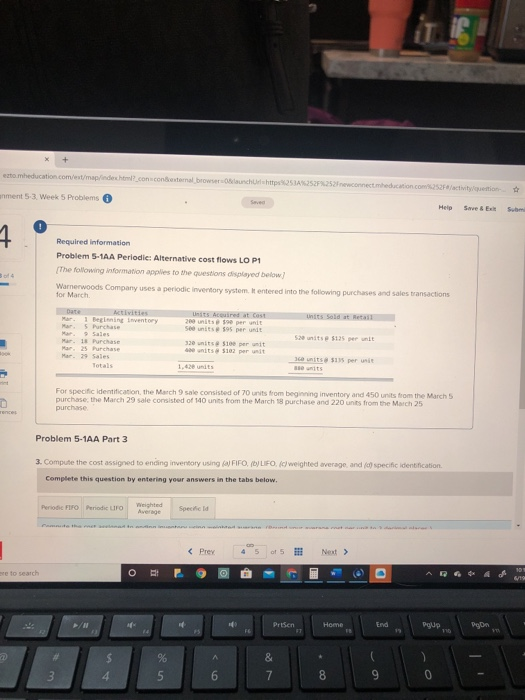

problem 5-1 AA periodic: Alternative cost flows LO p1

problem 5-1AA part 3

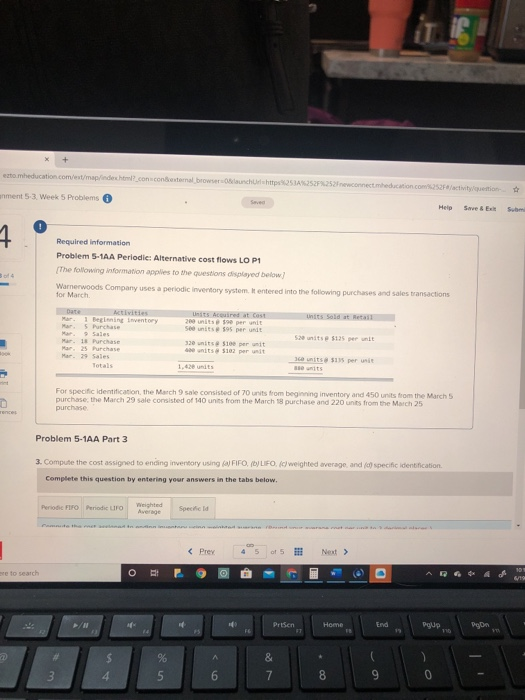

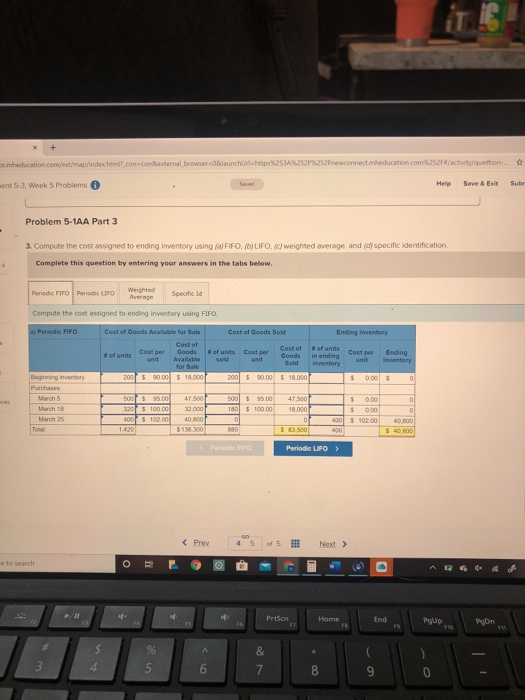

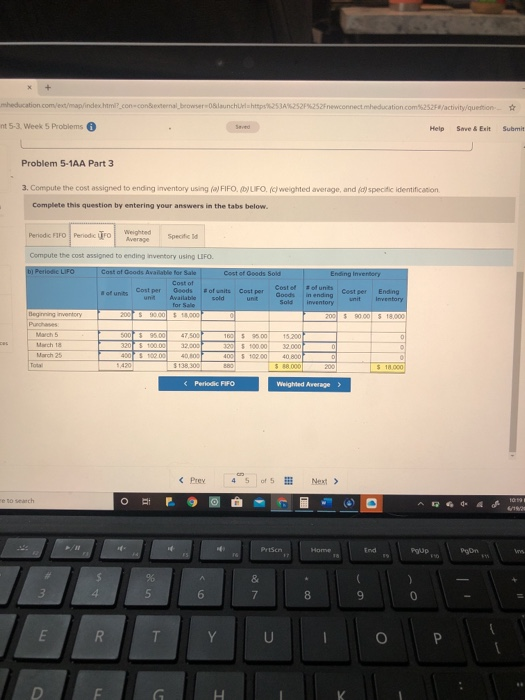

3 ezto meducation.com/est/map/index.html?con conexternal browser launchrh51A%252F%252Fww.connectmeducation.com 252Fd/activitetin anment 5-3. Week 5 Problems Seved Help Sweet 4 Required information Problem 5-1AA Periodie: Alternative cost flows LO P1 [The following information applies to the questions displayed below! Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March Activities Units Accuired at Cost Units sold at Retail 1 Beeling Inventory 200 units per unit Mr. Purchase See units $95 per unit 5.20 unitse $135 per unit r. 18 Purchase 320 units 5100 per unit Mar 25 Purchase seits 5102 per unit Mar 29 Sales 3 units 135 per it Totals 1,420 units se units For specific identification, the March 9 sale consisted of 70 units from beginning inventory and 450 units from the March purchase, the March 29 sale consisted of 140 units from the March 18 purchase and 220 unts from the March 25 purchase Problem 5-1AA Part 3 3. Compute the cost assigned to ending inventory using FIFO, LIFO / weighted average, and () specific identification Complete this question by entering your answers in the tabs below. Pero Periodic UFO Weighted Average Specific 90 se to search Prisen Home Erd Poup Dgn FE 110 A & $ 4 % 5 3 6 7 8 9 0 comheducation.com/ext/map/index.con conexternal_browserBlaunchurahttps2S1A252F%252Fwconnectmeducation.com%252F/activity question went 5-3 Week 5 Problems Help Save & Exit Sube Problem 5-1AA Part 3 3. Compute the cost assigned to ending inventory using (@FIFO, (bLIFO. (c) weighted average, and (d) specific identification Complete this question by entering your answers in the tabs below. 4 Ending Inventory of units in ending Cost per Periodic Fro Periodic UFO Weighted Avenge Specified Compute the cost assigned to ending inventory using FIFO. Periodic FIFO Cost of Goods Able for Sale Cost of Goods Sold Cost of Cost of of units Cost per Goods of units Couper Goods Available sold for Sale Sold Beginning inventory 200 59000 5 18,000 200 $ $0.00 $ 18,000 Purchase March 5 500 $95.00 47.500 500 47 500 March 18 320 S 10000 30.000 180 $ 100.00 18.000 March 25 400 5 102.00 40 400 0 0 Tonal 1.420 5134.300 880 $ 3.500 Ending Inventory $ 0.00 $ 0 5 0.00 0.00 400 S 902.00 400 o 0 40.800 S40,300 Periodic UFO > e to search o Prison Home 18 Ind Pgup 410 PgOn 59 A $ 4 % 5 & 7 6 8 meducation.com/ext/map/index.html?con conexternal browserslaunchMhA%252F%252Fnewconnect education.com/2528/activity/question nt 5-3. Week 5 Problems Hele Serve & Exit Submit Problem 5-1AA Part 3 3. Compute the cost assigned to ending inventory using () FIFO. CLIFO. (c) weighted average, and (d) specific identification Complete this question by entering your answers in the tabs below. Periodic Fifo Periodic TFO Weighted Specific to Goods Compute the cost assigned to ending inventory using LIFO. b) Periodic LIFO Cast of Goods Avaliable for Sale Cost of Goods Sold Ending Inventory Cost of Cost of units of units Cost per of units Cost per Ending unt Cost per Available sold unit Goods in ending unit for Sale Sold inventory Inventory Beginning inventory 2007 530.00 18.000 200 $90.00 $ 18.000 Purchases March 5 5001 s 9500 47.500 160 595.00 15.2001 March 18 320 100.00 32.000 320 5 100.00 32.000 0 March 25 4001 s 100.00 40.00 400 $ 109,00 40.800 ol Total 5420 $138 300 $ 8.000 200 $ 1 000 et sech OP 1011 a HP Prisen Home End Pgup pain $ A 96 5 & 7 3 6 8 9 0 E R T Y U D G