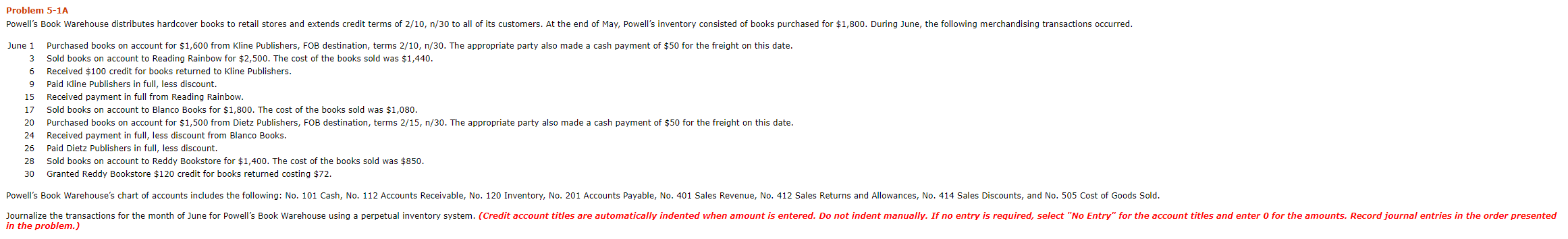

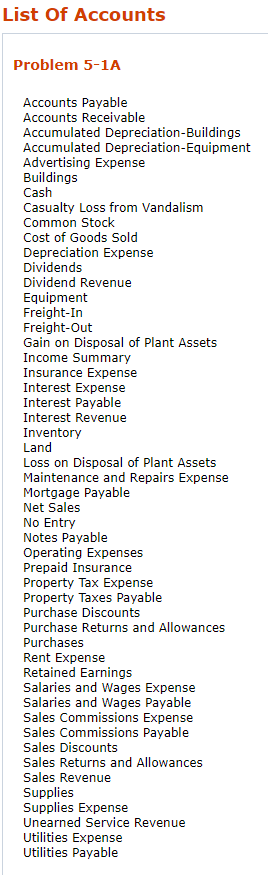

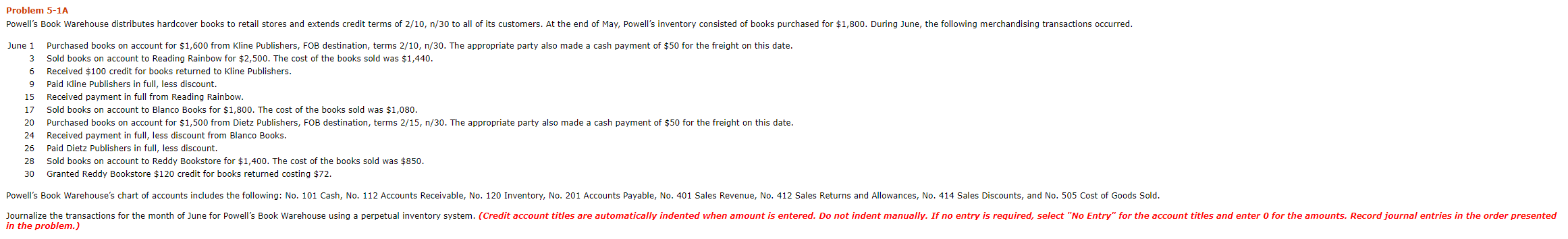

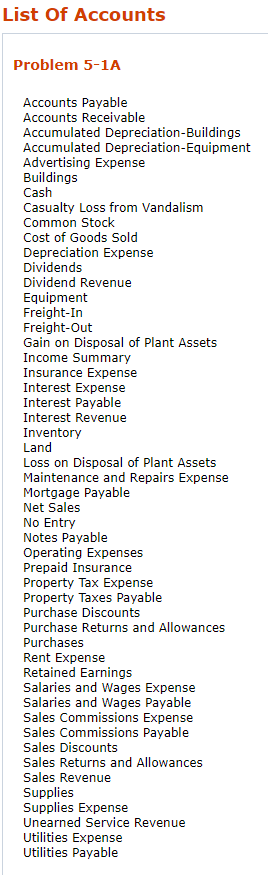

Problem 5-1A Powell's Book Warehouse distributes hardcover books to retail stores and extends credit terms of 2/10, n/30 to all of its customers. At the end of May, Powell's inventory consisted of books purchased for $1,800. During June, the following merchandising transactions occurred. June 1 3 6 9 15 17 20 24 26 28 30 Purchased books on account for $1,600 from Kline Publishers, FOB destination, terms 2/10, n/30. The appropriate party also made a cash payment of $50 for the freight on this date. Sold books on account to Reading Rainbow for $2,500. The cost of the books sold was $1,440. Received $100 credit for books returned to Kline Publishers. Paid Kline Publishers in full, less discount. Received payment in full from Reading Rainbow. Sold books on account to Blanco Books for $1,800. The cost of the books sold was $1,080. Purchased books on account for $1,500 from Dietz Publishers, FOB destination, terms 2/15, n/30. The appropriate party also made a cash payment of $50 for the freight on this date. Received payment in full, less discount from Blanco Books. Paid Dietz Publishers in full, less discount. Sold books on account to Reddy Bookstore for $1,400. The cost of the books sold was $850. Granted Reddy Bookstore $120 credit for books returned costing $72. Powell's Book Warehouse's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Payable, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold. Journalize the transactions for the month of June for Powell's Book Warehouse using a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) List of Accounts Problem 5-1A Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Buildings Cash Casualty Loss from Vandalism Common Stock Cost of Goods Sold Depreciation Expense Dividends Dividend Revenue Equipment Freight-In Freight-Out Gain on Disposal of Plant Assets Income Summary Insurance Expense Interest Expense Interest Payable Interest Revenue Inventory Land Loss on Disposal of Plant Assets Maintenance and Repairs Expense Mortgage Payable Net Sales No Entry Notes Payable Operating Expenses Prepaid Insurance Property Tax Expense Property Taxes Payable Purchase Discounts Purchase Returns and Allowances Purchases Rent Expense Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Commissions Expense Sales Commissions Payable Sales Discounts Sales Returns and Allowances Sales Revenue Supplies Supplies Expense Unearned Service Revenue Utilities Expense Utilities Payable