Problem 5.28

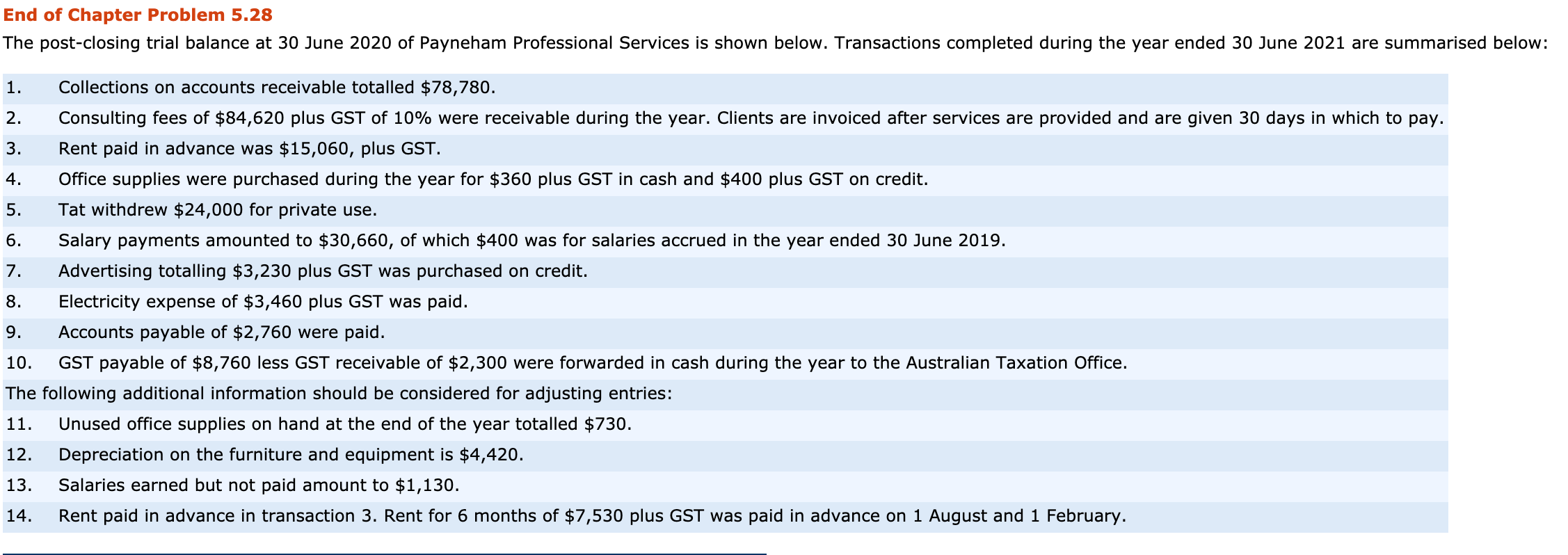

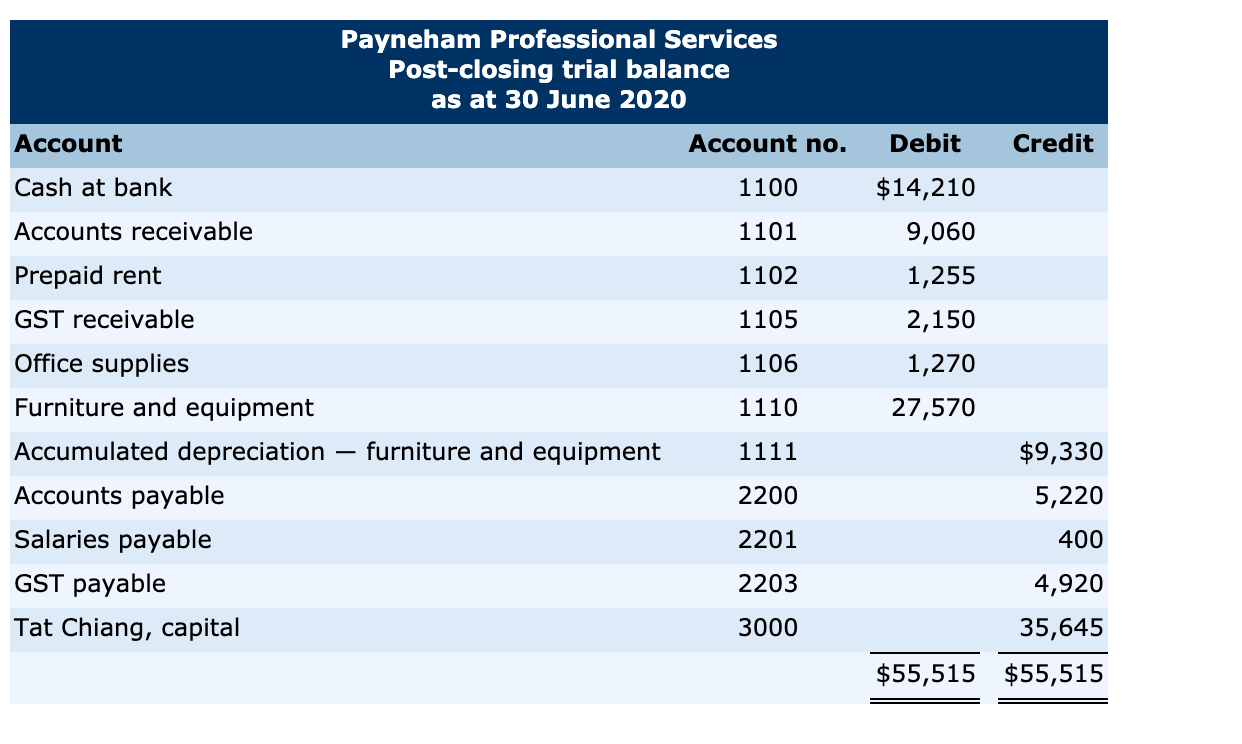

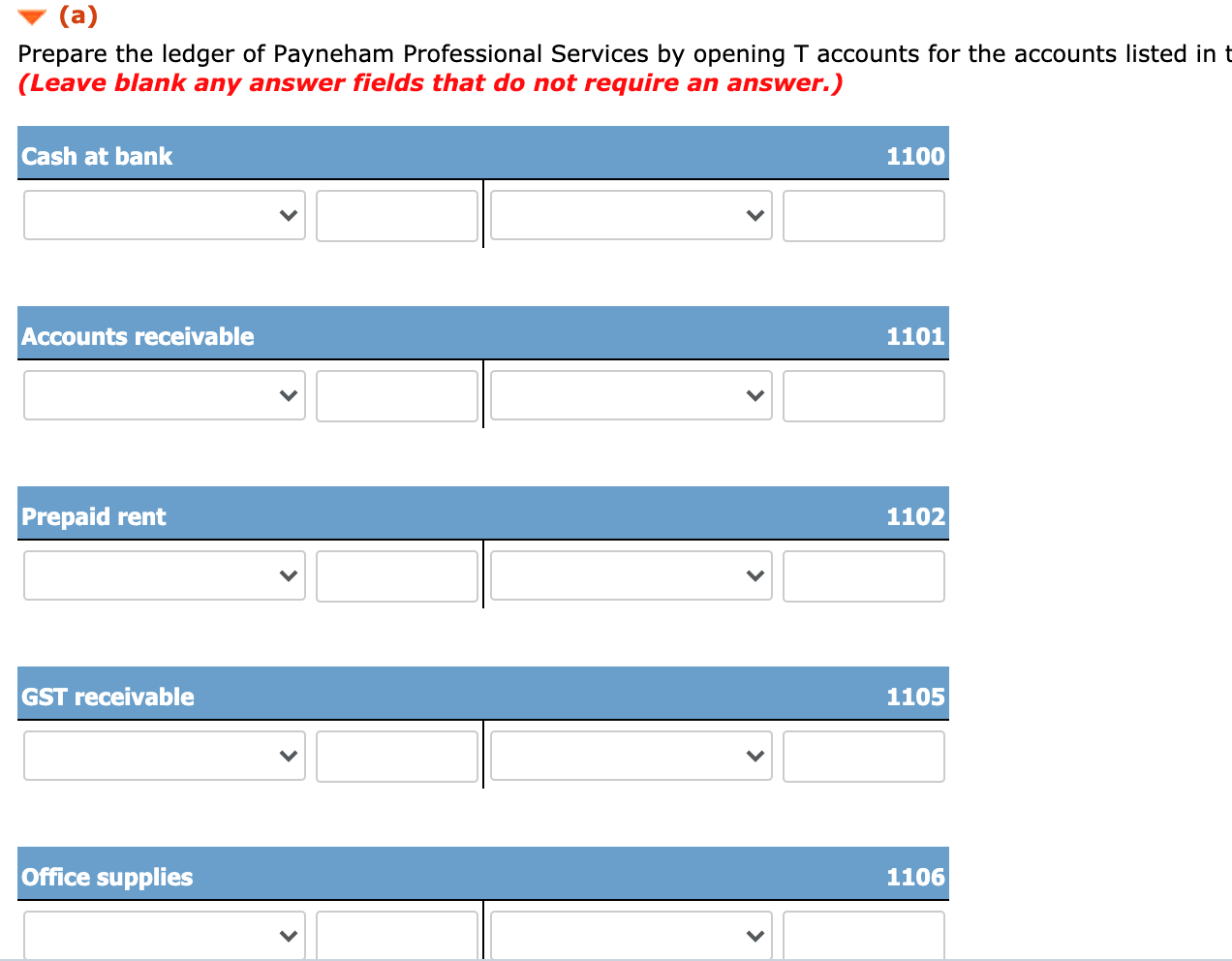

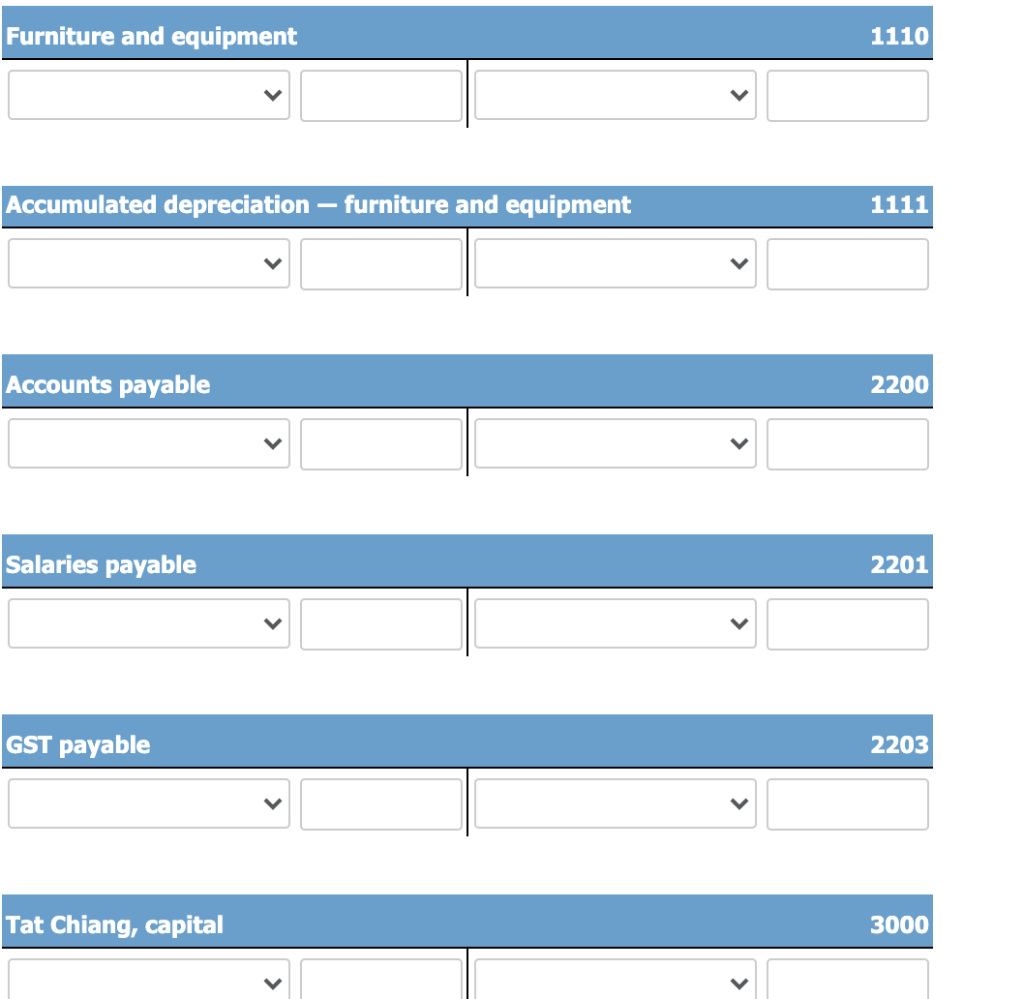

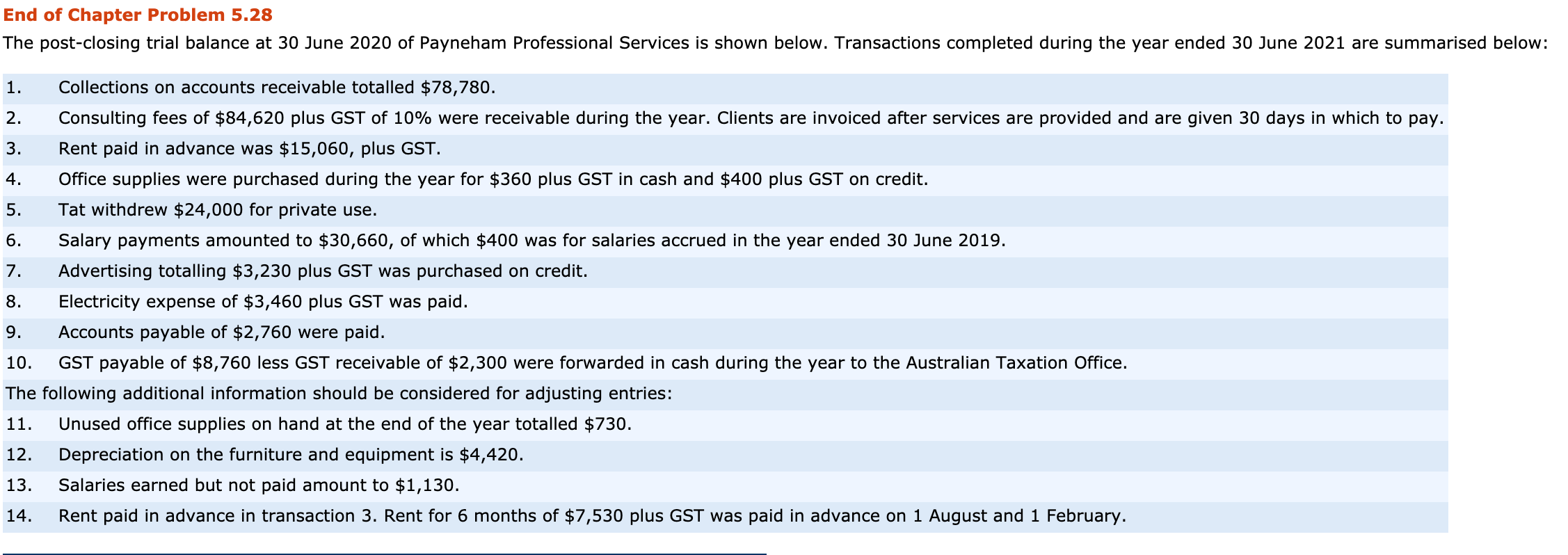

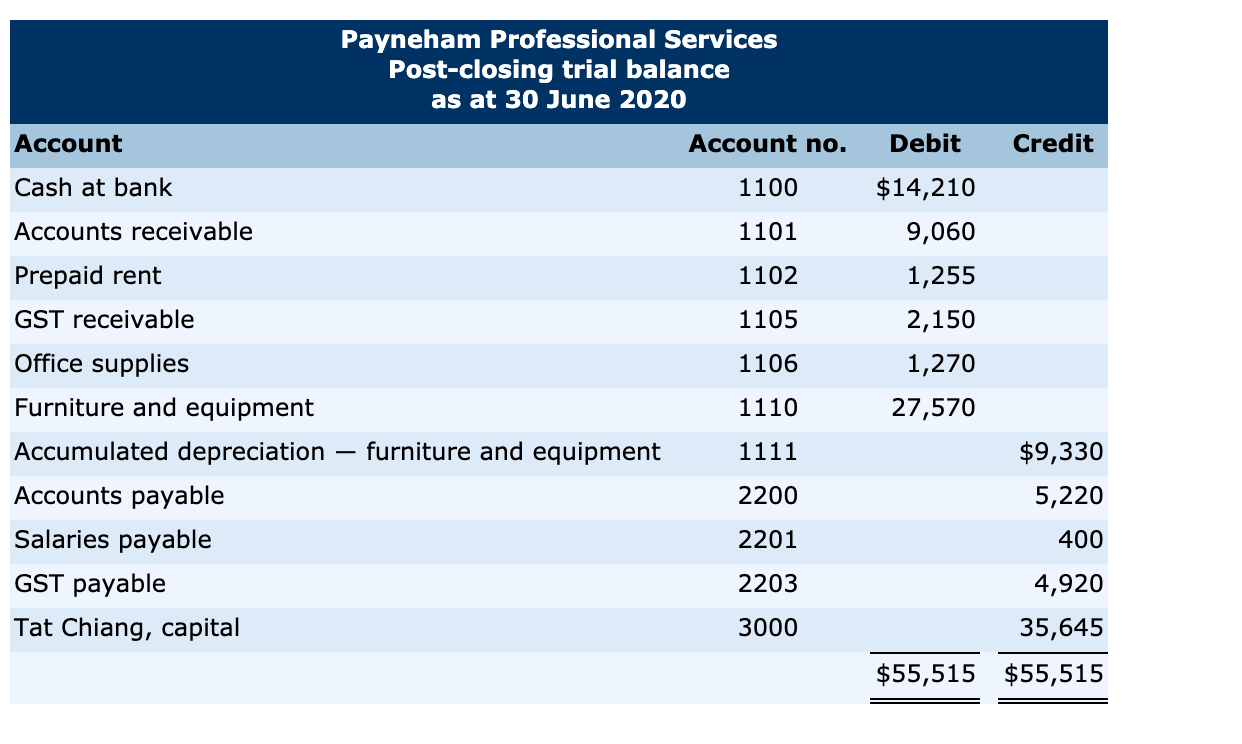

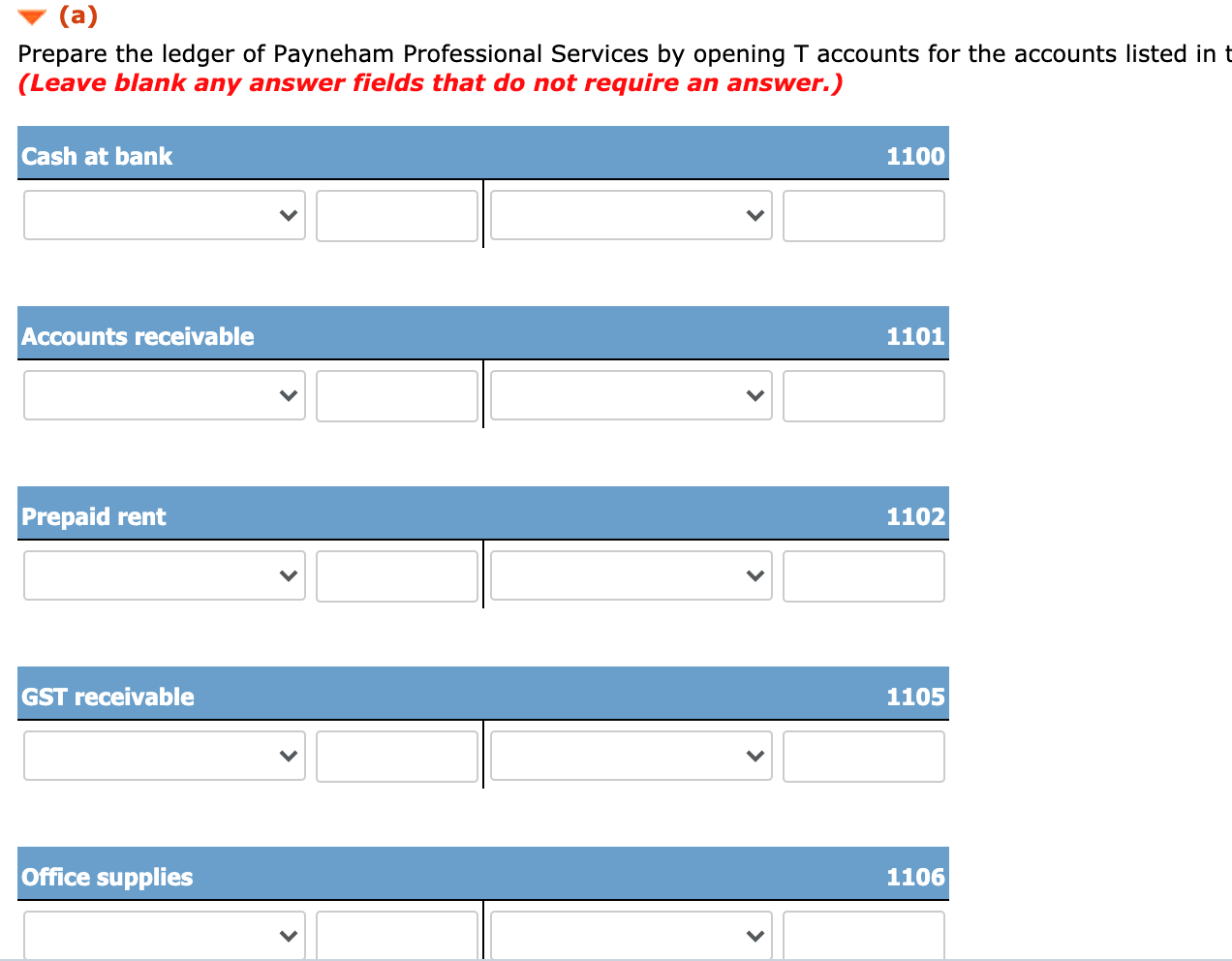

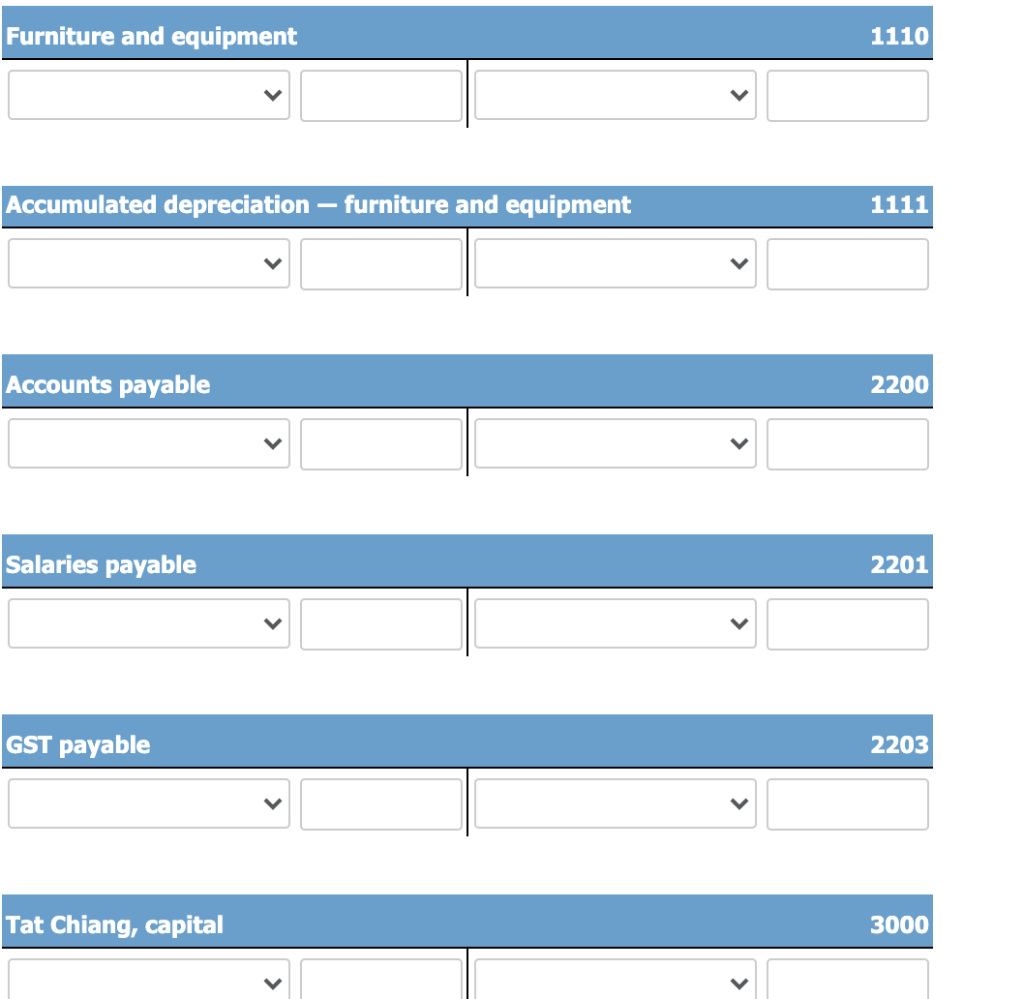

End of Chapter Problem 5.28 The post-closing trial balance at 30 June 2020 of Payneham Professional Services is shown below. Transactions completed during the year ended 30 June 2021 are summarised below: 1. Collections on accounts receivable totalled $78,780. 2. Consulting fees of $84,620 plus GST of 10% were receivable during the year. Clients are invoiced after services are provided and are given 30 days in which to pay. 3. Rent paid in advance was $15,060, plus GST. 4. Office supplies were purchased during the year for $360 plus GST in cash and $400 plus GST on credit. 5. Tat withdrew $24,000 for private use. 6. Salary payments amounted to $30,660, of which $400 was for salaries accrued in the year ended 30 June 2019. 7. Advertising totalling $3,230 plus GST was purchased on credit. 8. Electricity expense of $3,460 plus GST was paid. 9. Accounts payable of $2,760 were paid. 10. GST payable of $8,760 less GST receivable of $2,300 were forwarded in cash during the year to the Australian Taxation Office. The following additional information should be considered for adjusting entries: 11. Unused office supplies on hand at the end of the year totalled $730. 12. Depreciation on the furniture and equipment is $4,420. 13. Salaries earned but not paid amount to $1,130. 14. Rent paid in advance in transaction 3. Rent for 6 months of $7,530 plus GST was paid in advance on 1 August and 1 February. Payneham Professional Services Post-closing trial balance as at 30 June 2020 Account Account no. Debit Credit Cash at bank 1100 Accounts receivable 1101 Prepaid rent 1102 $14,210 9,060 1,255 2,150 1,270 27,570 GST receivable 1105 1106 1110 furniture and equipment 1111 Office supplies Furniture and equipment Accumulated depreciation Accounts payable Salaries payable GST payable Tat Chiang, capital $9,330 5,220 2200 2201 400 2203 3000 4,920 35,645 $55,515 $55,515 (a) Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in t (Leave blank any answer fields that do not require an answer.) Cash at bank 1100 Accounts receivable 1101 Prepaid rent 1102 GST receivable 1105 Office supplies 1106 Furniture and equipment 1110 Accumulated depreciation - furniture and equipment 1111