Answered step by step

Verified Expert Solution

Question

1 Approved Answer

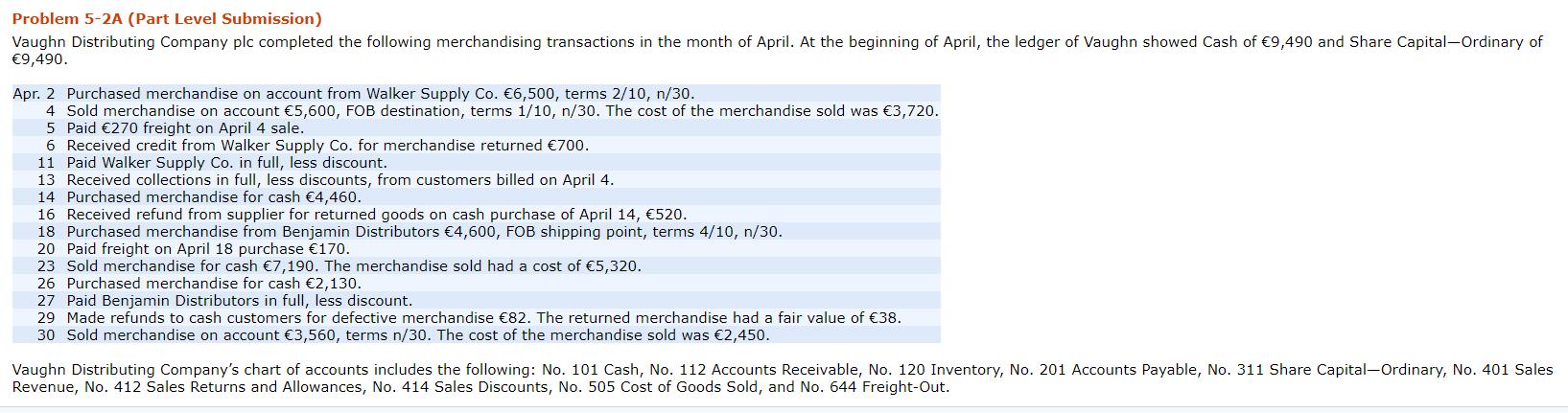

Problem 5-2A (Part Level Submission) Vaughn Distributing Company plc completed the following merchandising transactions in the month of April. At the beginning of April,

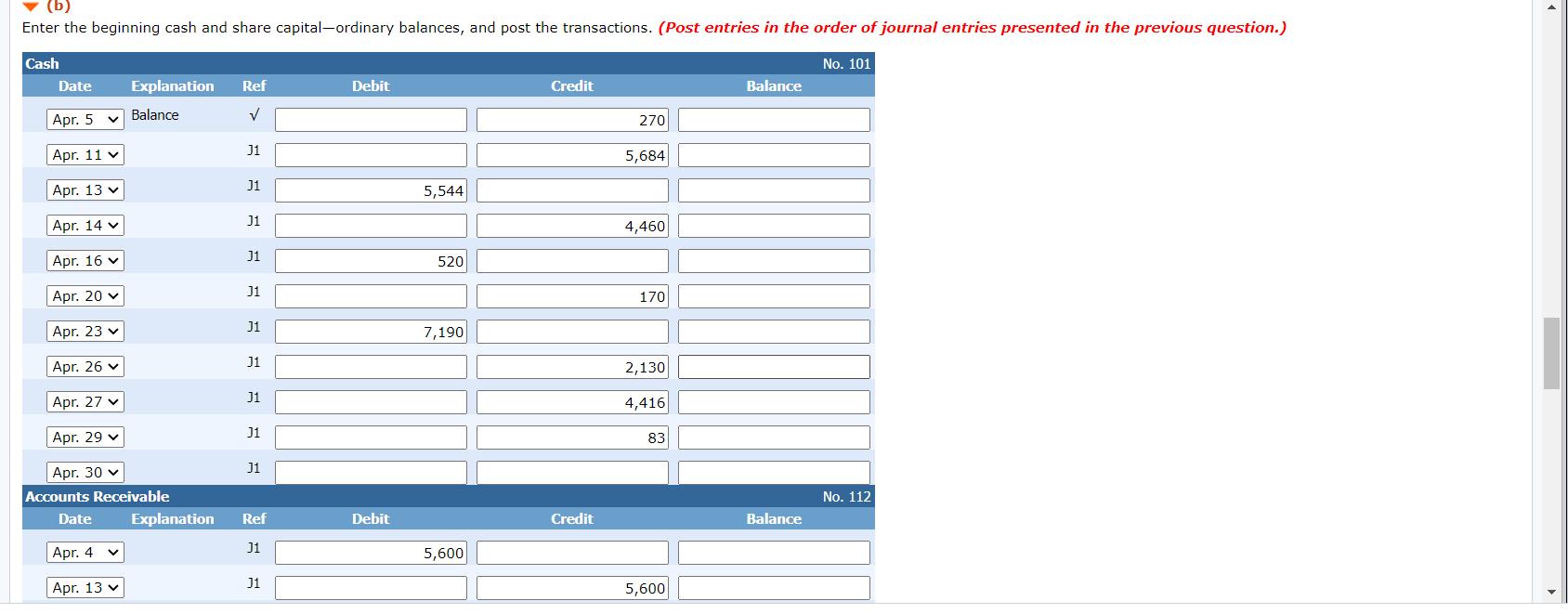

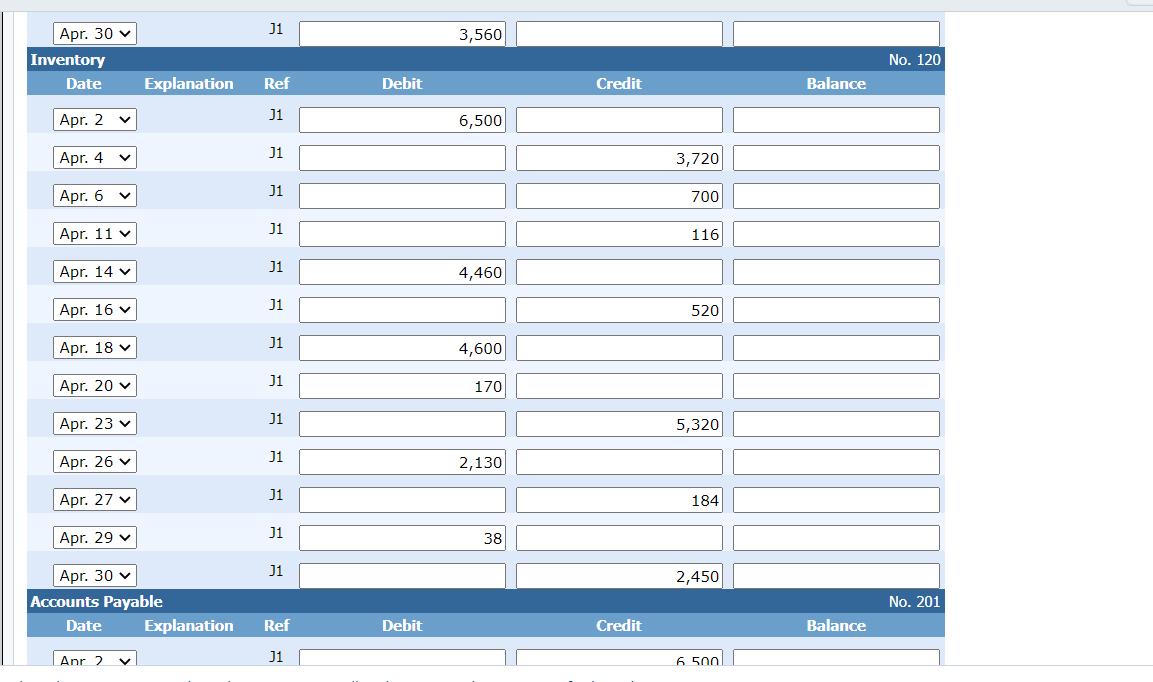

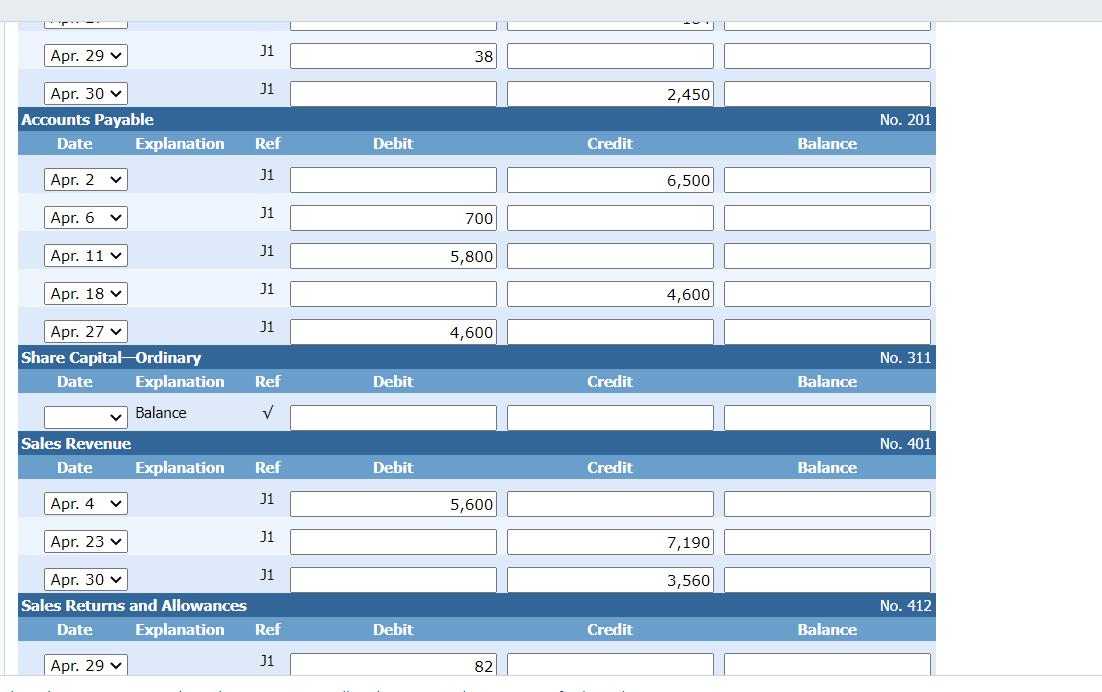

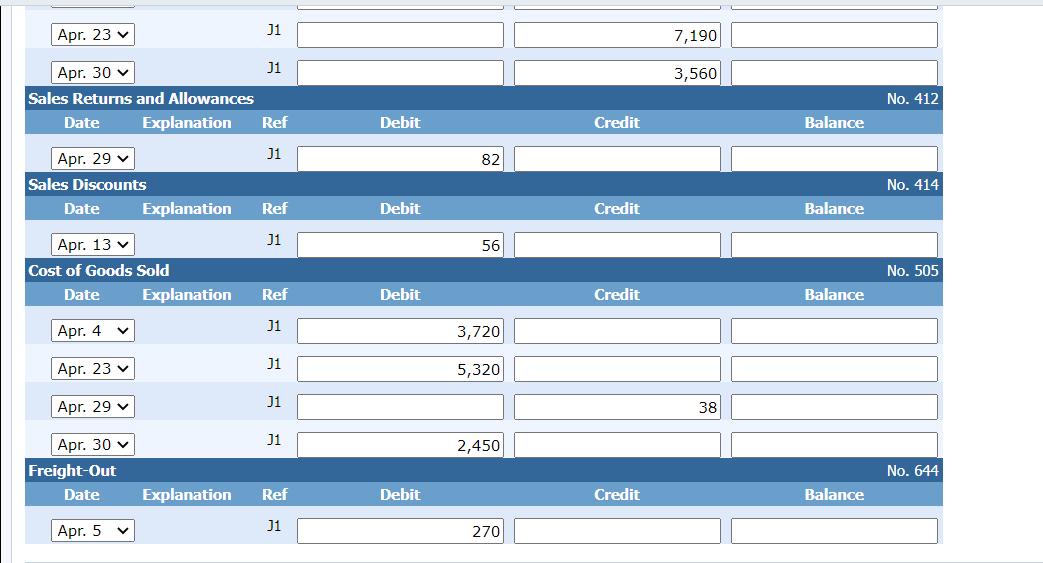

Problem 5-2A (Part Level Submission) Vaughn Distributing Company plc completed the following merchandising transactions in the month of April. At the beginning of April, the ledger of Vaughn showed Cash of 9,490 and Share Capital-Ordinary of 9,490. Apr. 2 Purchased merchandise on account from Walker Supply Co. 6,500, terms 2/10, n/30. 4 Sold merchandise on account 5,600, FOB destination, terms 1/10, n/30. The cost of the merchandise sold was 3,720. 5 Paid 270 freight on April 4 sale. 6 Received credit from Walker Supply Co. for merchandise returned 700. 11 Paid Walker Supply Co. in full, less discount. 13 Received collections in full, less discounts, from customers billed on April 4. 14 Purchased merchandise for cash 4,460. 16 Received refund from supplier for returned goods on cash purchase of April 14, 520. 18 Purchased merchandise from Benjamin Distributors 4,600, FOB shipping point, terms 4/10, n/30. 20 Paid freight on April 18 purchase 170. 23 Sold merchandise for cash 7,190. The merchandise sold had a cost of 5,320. 26 Purchased merchandise for cash 2,130. 27 Paid Benjamin Distributors in full, less discount. 29 Made refunds to cash customers for defective merchandise 82. The returned merchandise had a fair value of 38. 30 Sold merchandise on account 3,560, terms n/30. The cost of the merchandise sold was 2,450. Vaughn Distributing Company's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Payable, No. 311 Share Capital-Ordinary, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, No. 505 Cost of Goods Sold, and No. 644 Freight-Out. v (b) Enter the beginning cash and share capital-ordinary balances, and post the transactions. (Post entries in the order of journal entries presented in the previous question.) Cash No. 101 Date Explanation Ref Debit Credit Balance Apr. 5 Balance 270 J1 Apr. 11 v 5,684 J1 Apr. 13 v 5,544 J1 Apr. 14 v 4,460 Apr. 16 v J1 520 J1 Apr. 20 v 170 J1 Apr. 23 v 7,190 Ji Apr. 26 v 2,130 J1 Apr. 27 v 4,416 J1 Apr. 29 v 83 J1 Apr. 30 v Accounts Receivable No. 112 Date Explanation Ref Debit Credit Balance J1 Apr. 4 v 5,600 Apr. 13 v J1 5,600 J1 Apr. 30 v 3,560 Inventory No. 120 Date Explanation Ref Debit Credit Balance J1 Apr. 2 v 6,500 J1 Apr. 4 v 3,720 J1 Apr. 6 700 J1 Apr. 11 v 116 J1 Apr. 14 v 4,460 J1 Apr. 16 v 520 J1 Apr. 18 v 4,600 J1 Apr. 20 v 170 J1 Apr. 23 v 5,320 J1 Apr. 26 v 2,130 J1 Apr. 27 v 184 J1 Apr. 29 v 38 J1 Apr. 30 v 2,450 Accounts Payable No. 201 Date Explanation Ref Debit Credit Balance Anr 2 v J1 6.500 J1 Apr. 29 v 38 J1 Apr. 30 v 2,450 Accounts Payable No. 201 Date Explanation Ref Debit Credit Balance Apr. 2 v J1 6,500 J1 Apr. 6 v 700 J1 Apr. 11 v 5,800 J1 Apr. 18 v 4,600 J1 Apr. 27 v 4,600 Share Capital Ordinary No. 311 Date Explanation Ref Debit Credit Balance Balance Sales Revenue No. 401 Date Explanation Ref Debit Credit Balance J1 Apr. 4 5,600 J1 Apr. 23 v 7,190 J1 Apr. 30 v 3,560 Sales Returns and Allowances No. 412 Date Explanation Ref Debit Credit Balance J1 Apr. 29 v 82 J1 Apr. 23 v 7,190 J1 Apr. 30 v Sales Returns and Allowances 3,560 No. 412 Date Explanation Ref Debit Credit Balance Apr. 29 v Sales Discounts J1 82 No. 414 Date Explanation Ref Debit Credit Balance Apr. 13 v J1 56 Cost of Goods Sold No. 505 Date Explanation Ref Debit Credit Balance J1 Apr. 4 v 3,720 J1 Apr. 23 v 5,320 J1 Apr. 29 v 38 J1 Apr. 30 v 2,450 Freight-Out No. 644 Date Explanation Ref Debit Credit Balance J1 Apr. 5 v 270

Step by Step Solution

There are 3 Steps involved in it

Step: 1

General journal Date Particular Ref Dr Cr Apr 2 Merchandise inventory 6500 Account payable 6500 Apr 4 Account Receivable 5600 Sales 5600 Cost of good ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started